The cryptocurrency market is risky, ultra-volatile, and unregulated. It is a cutthroat market, where most new investors fly in blind and end up paying a heavy price for their risk-taking. As an illustration, in late October 2021, a digital currency that harnessed the Squid Game TV series zeitgeist popped up in the market overnight.

Riding high on the popularity of the Netflix series that it was unaffiliated with, it enjoyed a meteoric rise that pushed it from lows of $0.016 per SQUID on 26th October to highs of $523 a week later. The Squid Game token then plunged to lows of $0.003 on 1st November.

In a typical crypto rug pull scam, the team behind the utility token that should have supported a play-to-earn game drained its liquidity pool, leaving scores of investors high and dry. Were there tell-tale signs that this token’s quick rise was too good to be true?

Yes, and had SQUID’s buyers carried out a crypto fundamental analysis on this project, they would have noticed the red flags a mile off. Crypto investors do not have to invest blindly when there already is a clear and rational value investing model for cryptocurrencies via crypto fundamental analysis.

What is Crypto Fundamental Analysis?

Crypto fundamental analysis takes an in-depth look at a cryptocurrency project’s data to locate its actual value. This intense scrutiny of the financial value of an asset is a throwback to the legacy financial asset investment sector’s fundamental analysis.

Investors such as Warren Buffet, the king of the stock market’s value investing movement, use fundamental analysis to establish the intrinsic value of the asset they wish to invest in. Then, they will study a variety of the asset’s external and internal factors and only spend their money on undervalued stocks.

History of Fundamental Analysis

History recognizes Benjamin Graham as the father of the fundamental analysis method of trading. Graham, also known as a proponent of value investing, began using fundamental analysis techniques to gauge the value of Depression Era stocks amid plunging markets.

He wrote a book on this topic, ‘Security Analysis, in 1934. His work on fundamental analysis captivated young Warren Buffet, who studied at Columbia University to learn the securities profession under Graham’s tutelage.

Buffet’s genius at fundamental analysis turned around the Berkshire Hathaway fortunes, turning it from textile to a holding company. Warren summarises his FA methodology with the phrase that “there are no called strikes in investing.”

He says strikes only occur when you swing and miss. When you leverage fundamental analysis, you do not swing at every pitch. Therefore, you do not need to have an opinion on every new and shiny token as well.

The Oracle of Omaha says that investors that perform intensive background checks when planning their investment strategy will only take a couple of dozen pitches in their lifetime. Those few swings will become hits.

Benefits of Crypto Fundamental Analysis

As per coinopsy data, over 2,345 digital currencies released in the last decade have failed and faded from existence, taking along with them investor capital. Still, there are over 10,000 digital currencies left in the market, and new ones such as SQUID and the defunct Robinhood (RHD) pop up every other day.

Traders that perform crypto fundamental analysis and figure out a token’s intrinsic value will enjoy fruitful long-term investments. That said, value investing using fundamental analysis might be a contrarian approach in the #tothemoon and FOMO driven sector, but value investments consistently outperform index returns on the equity markets.

This is especially true of bitcoin. Despite all the hue and cry over its volatility, bitcoin is the best performing investment asset of the last decade. Its annualised return eclipses those of other financial assets by a factor of ten.

Crypto fundamental analysis will ensure that you only invest in assets whose value will rise steadily over time. Of course, this does not imply that these assets will not have short-term price shocks and disappointments. However, these price dips will only have a short-term negative effect on the long-term outlook of healthy assets.

Like bitcoin, the undervalued crypto assets’ mean will revert over time, reversing disastrous falls and showing strong fundamentals for slow but sure profit growth. Fundamental analysis also keeps investors from irrational or emotional investing driven by greed and fear.

These emotions translate to poor investment decisions amongst most investors, and especially so in the tech scene. However, the fundamental analysis-driven value investor will remain dispassionate, harnessing opportunities when the investor driven by human nature is panicking.

Crypto Fundamental Analysis Challenges

The legacy investment industry has a wide range of data sources for easy and quick fundamental analysis. It has tons of historical, public, and grapevine data supporting robust fundamental analysis and research. In addition, there are diverse qualitative and quantitative fundamental analysis data such as management decisions and corporate financial statements.

These data sources are not as easy to come by in the new cryptocurrency scene. Most cryptocurrencies are decentralized and function like commodities since they do not generate cash flows. Therefore, they do not have historical data.

Since they are run by community governance, they also do not have quantitative and qualitative management decisions and financial statements databases. Consequently, crypto fundamental analysis utilizes other forms of data for analysis. These include project, on-chain, and financial metrics. Below are factors to consider when performing analysis.

Factors to Consider in Crypto Fundamental Analysis

On-chain Metrics

A cryptocurrency’s on-chain metrics can provide a wealth of information. This data can offer adoption, unique price signals, address growth, total transaction values, and exchange flow insights. Public on-chain data is open and easy to access on crypto investment data websites such as CoinMarketCap, Messari, CoinGecko, Glassnode, and CryptoCompare. So, which are the must-have on-chain fundamental analysis metrics?

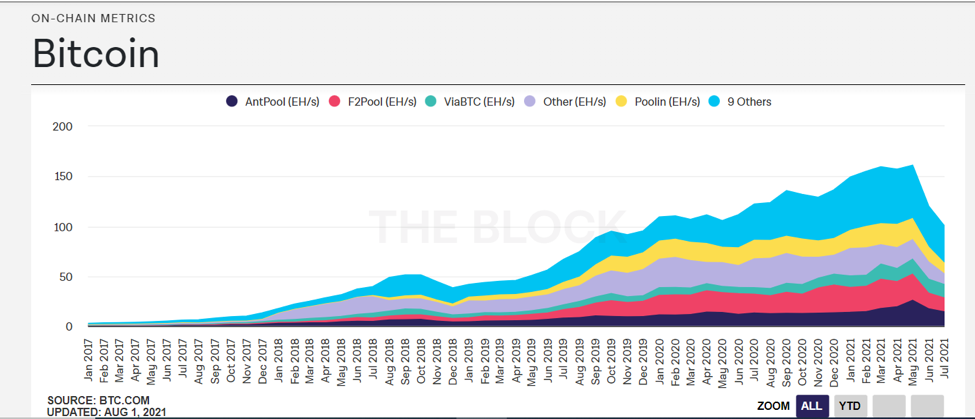

Hash Rate

Some investors believe that Bitcoin does not have value. However, there is a good reason why BTC is outperforming gold as a safe haven asset and a store of value. Its value as digital gold has outpaced that of the shiny yellow yearly, going up by 133%. Gold year-to-date values have dropped by 4%.

Bitcoin’s value lies in its finite 21 million cap supply and its unbreakable blockchain security enhanced by its high hash power. A hash rate is a unit that measures the computing power of a Proof of Work blockchain node. Nodes or data validators use high-end computers to solve complex mathematical equations when verifying and validating blocks.

A high hash rate implies that network nodes are busy mining or validating block data. Consequently, the network is secure. Should the Bitcoin blockchain’s hash power plunge, then it would be vulnerable to 51% attacks.

Such attacks could lead to a duplication of BTC, making the digital currency worthless. In Proof of Stake blockchain networks, the metric highlighting network security is the number of governance tokens staked in its governance protocol.

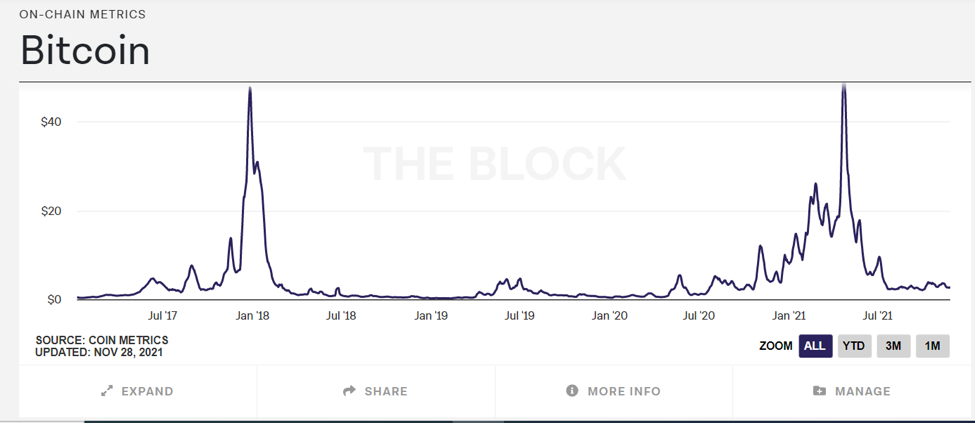

Transaction fees and value

High transaction values can be proof of adoption and circulation. Additionally, the value of fee payments can highlight the blockchain’s security metrics. Blockchain transaction fees will rise as network activity increases.

To illustrate this point, the 2021 Bitcoin network’s monthly transactions fluctuate between 10 million highs and lows of 6.51 million. Its daily transactions rates also fluctuate between highs of 450k to lows of 180k. This is a healthy balance and signifier of healthy user activity.

In contrast, the $SQUID rug pull scheme had a chart that had a constant price rise. There was no moment of fluctuations as there would be with a viable crypto project’s token.

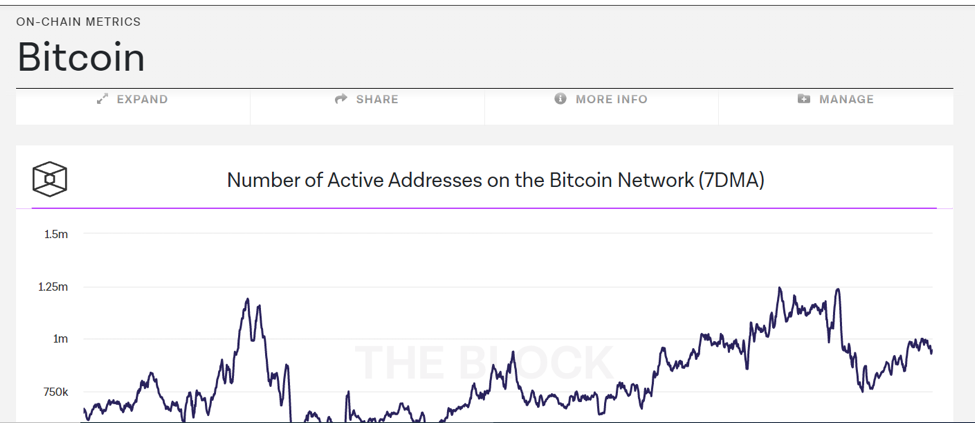

Active addresses

Active and unique addresses are an important crypto fundamental metric. Tally the blockchain’s active addresses over time, and you will have a clear picture of user activity. Growing user activity is a good signifier of adoption or project interest.

To illustrate this point, the Squid Games cryptocurrency had 43,455 addresses before its rug pull act. However, a closer look at the wallet’s status shows that eight of its active addresses held 1% of its 800,000,000 SQUID supply or 8,000,000, a clear sign of a rug pull set up.

One account had 5% of all SQUID’s circulation and initiated the rug pull since it had snatched up a sizable share of tokens in the market. In contrast, BTC has 945k active user addresses, up from lows of 754k in July when BTC demand was low.

Financial Metrics

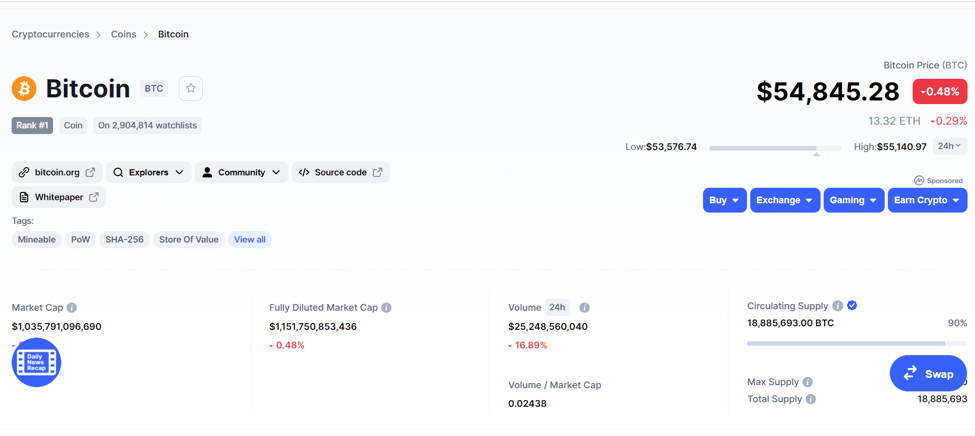

Crypto fundamental analysis can analyze the genuine value of a cryptocurrency by assessing its financial data such as its market capitalization, trading, and liquidity volume, and the circulating supply.

Market cap

A value investor might make one mistake in the crypto market is equating low market capitalisation with possible growth potential. The $SQUID tokens had an attractive 800 million cap and an attractive low initial sale price of $0.016. A crypto fundamental analysis would have revealed that $SQUID valuation was distorted, lacking a robust value proposition.

Some digital currencies may have a high market cap but have room for growth due to stronger on-chain metrics. The market cap is a token’s network value or current price multiplied by supply.

Liquidity

A liquid token is easy to buy and sell. You can trade or swap it in an instance without altering its market value. A token is liquid when buyers and sellers seek it in equal measure. Liquidity translates to a healthy bid-ask spread. On top of that, liquidity is a sign of manageable volatility and sustained momentum.

SQUID’s buyers realized they had been duped when they could not cash out their $SQUID at will. On 1st November, over $3.3 million of investor capital was taken out of the platform’s liquidity pool, cleaning out all $SQUID liquidity. The token’s value plummeted to zero in 10 minutes.

To this end, a healthy cryptocurrency such as BTC or ETH has a liquid market and sells at a fair price. If you have to wait for hours to trade your token or lower your prices to sell, your investment has a poor liquidity profile, low market interest, or fraudulent protocols.

Circulating Supply

Bitcoin bulls are eyeing a new bull run, saying that it could break the $70,000 price range. Its circulating supply metrics show that BTC holding metrics are on a nine-month high lowering its circulating supply. Its circulating supply is at its lowest in three years as the institutional investor accumulation spree gathers momentum.

Project metrics

Studying project metrics such as its whitepaper, team composition, competitors, and tokenomics can reveal crucial data on the use case and value of the project.

The whitepaper

The project’s whitepaper will reveal, amongst other metrics;

- The project’s unique use case

- Features

- Roadmap

- Upgrades

- Partnerships

- Investors

- Team

- Token sale and capital allocation

Project team

The project’s development team’s track records, experience, past successes, or failures could be a pointer to the teams’ ability to meet the project’s milestones. In addition, the health and vibrance of the project developer and user community are also indicators of a project’s use case and marketing prowess.

Use case and competition.

What challenge is the crypto project trying to solve? What is its target use case? Are there other projects that have successfully solved this challenge? Crypto fundamental analytics will help establish weak projects by surveying these metrics.

Tokenomics

When a project has a real use case, then its token could have a utility as well. Healthy token distribution metrics also matter. Development teams that keep a large portion of governance tokens to themselves jeopardize the project’s decentralization structure, hence value.

Road map

A token with a long-term growth strategy and use case will have a timeline that showcases their upgrades and release of new features,

Conclusion

Crypto fundamental analysis provides valuable trading insight that will keep the investor safe in the wild crypto market. Use it to gauge the real value of an asset and then invest for long-term growth.

We also advise you to read our article on crypto technical analysis to complete your knowledge on the analysis of crypto.