Warren Buffet once said that “If you don’t find a way to make money while you sleep, you will work until you die.” He is right. Every person should own an asset that generates a passive income while sleeping. Passive income is the wealth that you earn without spending too much effort. Thus in this article we want to talk to you about the different solutions on the market to earn passive income from crypto..

In the past, passive income generation was a reserve of the moneyed few. Most investors earned passive income from limited partnerships as silent investors, savings accounts, or rental property. Then bitcoin came and changed all that.

At first, all cryptocurrency investors could do was HODL “hold on for dear life” or hold on to their assets through excessive volatility to allow value increase before cashing out. There was no crypto on and off-ramps, and the market was very small and closed.

Then came decentralized finance (DeFi). DeFi applications have lowered the barrier of entry to passive income generation. Decentralized finance functions as a separate entity from the legacy traditional finance system.

To this end, it is more efficient, affordable, accessible, and transparent. You do not need a bank account to generate passive income from cryptocurrencies. You can earn passive income from crypto while you sleep by simply purchasing your crypto assets and deploying them in the vast decentralized finance field.

How to start your passive income crypto journey

You can generate passive income from the cryptocurrency market and future proof your savings by investing directly in crypto. Own some crypto assets and place them in the robust staking, lending, or yield farming protocols.

To partake of the vast crypto passive income generation sector, you, first of all, need cryptocurrencies in your wallet. Most digital currencies can generate a passive income, but the most optimal is Ethereum. The reason is, decentralized finance has deep ties with the Ethereum blockchain. To this end, most lending, staking, and yield farming protocols are built on the Ethereum blockchain.

Competitor blockchains such as Terra and the Binance Smart Chain also have upcoming and robust DeFi platforms. As an illustration, Terra has 13 DeFi projects with an $18.2 billion value locked. Top on its list is the Anchor protocol, a savings platform that offers low volatile Terra stablecoin yield rates.

Additionally, Terra hosts Lido, a staking service and liquidity provider. There also is Terraswap, a decentralized exchange that supports smart contracts managed peer-to-peer trades. According to DeFi Prime data, the Binance Smart Chain has over 44 DeFi projects.

The Ethereum network dwarfs this figure with 214 DeFi projects. That said, the BSC hosts PancakeSwap, DeFi’s most prolific automated market maker (AMM) platform. It is also home to the DRIP Network, trading, staking, liquidity farming service, and the automated yield optimizer platform, AutoShark Finance.

The Binance Smart Chain and the Ethereum network supports the largest number of passive income crypto projects, so holding Ethereum’s native currency Ether or BSCs BNB will make it easier for you to invest in the complex DeFi ecosystem.

To generate an income from your crypto holdings, first;

- Please choose a network of choice and turn your fiat into its native tokens. Fortunately, most DeFi networks are MetaMask wallet compatible so that you can access your crypto assets directly on your browser. A compatible wallet will interact with your network and DeFi application easing your cryptocurrency passive income generation process.

- Purchase your network’s or DeFi applications native currency. Blockchain utility tokens support the payment of transaction fees. Alternatively, turn your crypto assets into popular stablecoins assets such as DAI or USDT accepted in a wide range of protocols. You can purchase these assets on a decentralized or centralized exchange.

- Move them to your wallet for ease of use.

- If you want to generate a passive income from Bitcoin, you can purchase tokenized wBTC crypto assets in other networks.

- Connect your wallet to your DeFi protocol of choice.

- Enable the assets in your wallet for use so that the protocol can access them, and voila, you are ready to generate wealth while you sleep from your crypto asset holdings.

Ways to earn passive income from crypto.

Profit Margins | Time | Risk | |

Staking | Moderate | Long Term | Low |

Lending | Moderate | Flexible/ Fixed | Moderate |

Yield Farming | High | Flexible/ Fixed | High |

Mining | High | Long Term | Moderate |

Crypto interest-bearing accounts | Moderate | Flexible | Low |

Decentralized Lending

DeFi lending is one of the most popular passive income generation channels in decentralized finance. So how do you generate revenue from lending? Traditionally, banks and other lending institutions pool together savings from users and lend them to creditors at an interest.

The bank will earn a yield on the loan and pay the savings account holder a small percentage of that profit. Unfortunately, global financial challenges have adversely impacted the traditional account’s yield rate.

As per the Federal Deposit Insurance Corporation (FDIC), the APY on the ordinary savings accounts now rests at 0.07%.

Factor in inflation and most savings accounts earn negative interest, not passive income. Decentralized finance is upending the legacy financial system’s foundation by eliminating the intermediary from the financial transaction process.

To this end, crypto assets holders can earn interests when they lend their crypto assets to other crypto token holders. Smart contracts support crypto lending, trustlessly connecting investors through borrowing and lending protocols.

Smart contracts are self-executing codes that lower lending risks and eliminate loan collateral requirements. In addition, peer-to-peer lending platforms connect borrowers and lenders, setting the terms and rates of lending agreements.

In this setting, the cryptocurrency lenders acts as the investors. They will, therefore, earn passive income after loaning their crypto assets to borrowers that qualify for the loan. Cryptocurrency P2P lending is finalized by smart contracts for trustless transactions. To access a loan, the borrower will supply collateral, and the P2P lending platform will lock that collateral as security for the loan via smart contracts.

P2P lending platforms have a predetermined collateral ratio or factor. The collateral ratio is dependent on the value of collateral locked by the platform. This system supports lending without observing traditional barriers to credit access, such as history or creditworthiness.

The lender earns passive income from crypto while the borrower accesses quick loans. In addition, the lender could earn more revenue from platform incentives such as bonus tokens. These rewards attract more lenders to the platforms, positively impacting the growth of the platforms.

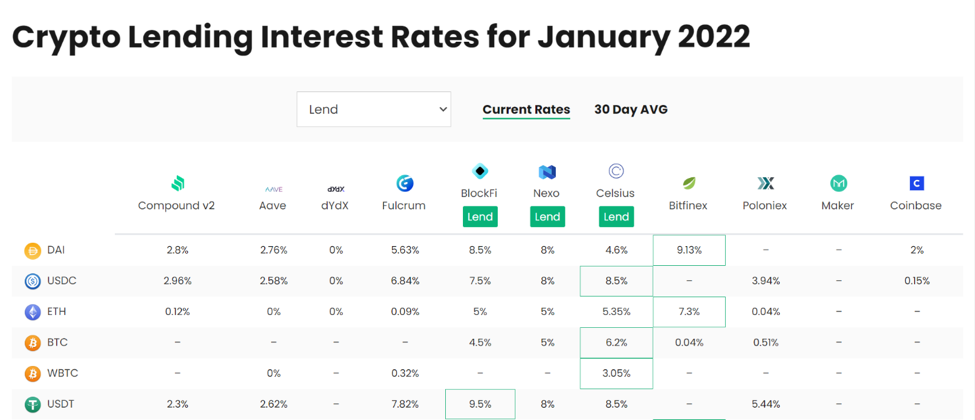

Some of the most popular P2P lending platforms are MakerDAO, Aave and Compound. These platforms run on the Ethereum network. Aave has an average 3% yield rate in DAI and USDC. Borrowers will pay an average of 4% interest on the DAI and USDC collateralized loan on Aave.

MakerDAO, Aave, and Compound are decentralized. They are non-custodial P2P lending platforms that operate without any interference from intermediaries. As a result, you can borrow or lend without undergoing AML or KYC checks and keep your private keys safe in your wallet.

How to earn passive income from P2P lending platforms such as Aave

- Purchase your Ether tokens from an exchange.

- Send your ETH to your wallet.

- Connect your wallet to a P2P lending platform

- Place your funds in the platform’s lending pool. To perform this action on Aave, click the ‘staking’ option on the app’s left side.

- You will begin to earn yield. The P2P platform will lend your crypto assets to borrowers and pay you your interest.

Crypto lending risks

Note that when you deposit your crypto assets into a liquidity pool, you cannot trade them till the platform unstakes them. Consequently, your assets are exposed to risks such as a dramatic drop in price.

Proof-of-Stake (PoS) staking

Blockchains that leverage the Proof-of-Stake (PoS) consensus algorithm has a unique passive income crypto generation process via crypto staking. The PoS consensus protocol allows network participants or nodes that stake their assets on their networks to partake of the blockchain’s governance proceedings, such as validation of transactions.

The blockchain’s systems will pick validators from participants and reward them with more crypto assets for validating transactions and keeping the network honest. All participants that stake their assets will also earn interest on their funds.

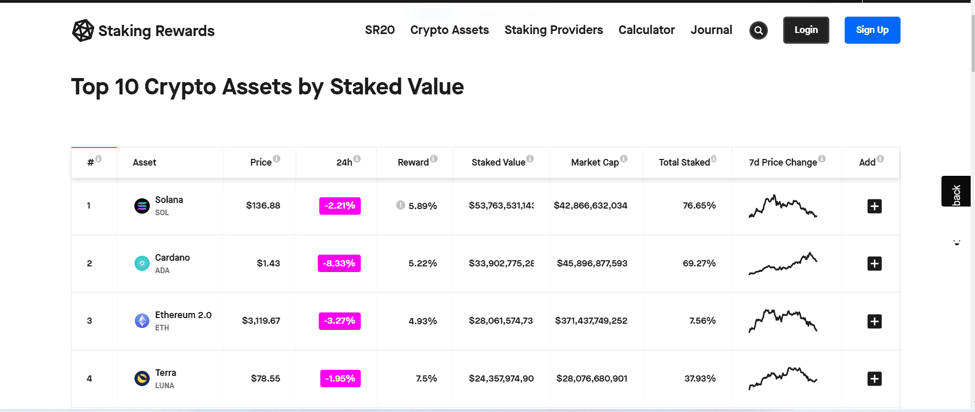

Staking yields can go as high as 5% to 15%. You can also delegate your staked assets to validators and receive more rewards should your validator earn validation incentives. Some of the most popular Proof of stake blockchains include Ethereum 2.0, Solana, Cardano, and Polkadot.

Crypto staking, however, can be complex and challenging to most investors. To run a validator node, you need to meet the crypto threshold required and provide a bond and deposit. As an illustration, to stake ETH as a validator node, you will need to hold 32ETH on your wallet.

An alternative is to earn staking rewards via a staking service. Staking-as-a-service platforms will pool together crypto assets from several users to give them a higher chance of winning validator rewards. You could earn an APY as high as 5% on your crypto assets.

Some popular staking services include Rocketpool, Figment Network, MyCointainer, Stake.Fish, Stakinglab and P2P Validator. Alternatively, stake your assets on Coinbase, Binance, KuCoin, Kraken, and Poloniex.

Crypto staking risks

Staking has certain risks, and it pays to stake your assets in reputable validator nodes. Nodes that perform wrong actions will have their stake burned. To this end, it is safer to stake your assets using well-known exchange pools and staking services.

You will have to commit your assets for extended periods. Consequently, your crypto assets may be exposed to sudden drops in value.

How to stake crypto assets

- To stake your assets on an exchange, visit your exchange of choice and join its staking service.

- First, choose a reputable and established pool service to stake your assets via a staking pool.

- Connect your wallet to a staking as a service platform.

- Earn staking rewards.

Yield farming

Yield farming takes place on decentralized exchanges such as Uniswap and SushiSwap. Yield farmers are also liquidity providers. They provide their liquidity into a decentralized exchange’s liquidity pool.

They will then earn a proportional fraction of trading fees from all the transactions within that pool. Hence yield farming.

To become a yield farmer and earn passive income from crypto;

- Pick a decentralized exchange of choice

- You will need to deposit a preset pair of crypto assets into a liquidity pool per yield farming protocols. As an illustration, SushiSwap has the Circle Snail pool, which is a USDC-ETH pool. Likewise, the Tether Turtle pool accepts USDT-ETH pair. These two pools will pay rewards in Sushi, the DeX’s native token.

- When you deposit your crypto asset pairs or LP tokens into a pool, the platforms’ smart contracts will lock them up. You will then earn interest in the form of yield.

Yield farming risks

Some yield farming risks include impermanent loss. Impermanent loss could lead to loss of value in the tokens that you deposit in a liquidity pool. The yield, however, could offset these losses over time.

There is also the risk of rug pulls and vulnerable smart contract risks that could lead to capital loss. Finally, a liquidity provider also faces liquidation risks, should they pull their liquidity provider from a pool before time.

Centralized crypto interest-bearing accounts

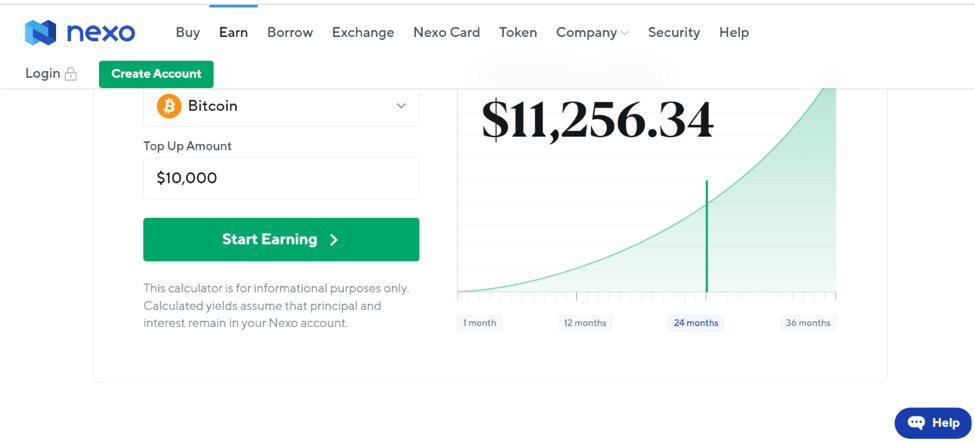

Crypto interest-bearing account platforms such as Nexo, BlockFi and SwissBorg are also excellent methods of earning passive income from crypto. For example, Nexio accounts pay a 17% APR on crypto-assets, while the BlockFi Interest Account (BIA) APY can go as high as 9.5%.

The BlockFi Rewards Visa card pays its holders a 3.5% rebate on BTC purchases, while the Nexo Mastercard pays a 2% instant cashback on every Nexo card crypto purchase.

Crypto interest-bearing accounts risks

Nexo, BlockFi, and SwissBorg are custodial wallet platforms. They are centralized and regulated, and you will have to undergo AML or KYC checks, to borrow or lend assets on their platforms. On top of that, you will have to surrender control of your private keys to their wallet.

As an illustration, to open a Nexo account, you will have to deposit your crypto assets to your Nexo account. Consequently, should Nexo suffer a hacking incident, you could lose your assets.

Crypto interest-bearing account platforms are intermediaries that hold on to your crypto asset’s private keys and invest them on your behalf. Work with reputable, regulated, and established platforms to secure your assets.

Cloud mining

Proof of Work consensus algorithm blockchains such as Bitcoin, leverage crypto mining as its transaction validation process. You can earn passive income from crypto mining by partaking in the mining process. However, BTC mining is a computing resource-intensive process.

To this end, miners pool their computing resources to strengthen their hash rate, which gives them a higher chance of winning a block reward. In addition, small-scale miners looking to generate passive income from mining can rent or purchase mining rigs and join a mining pool such as Antpool, Binance pool, Foundry USA or Slush Pool to earn more crypto assets.

How to join a mining pool

- Choose a reputable pool, to steer clear of scammers

- Input its Stratum V2 URL addresses

- Connect your wallet to the pool

- Configure your mining to the pool

- Receive pool payouts

Industry outlook

DeFi is one of the world’s fastest-growing finance sectors. Over $96B is locked in its platforms and, as per predictions, could grow to an $800 billion industry by 2022’s end. Data shows that crypto-assets locked in DeFi platforms grew in value by 385% in 2021. Investors have raked in massive profits from double-digit yielding platforms like Aave and Compound.