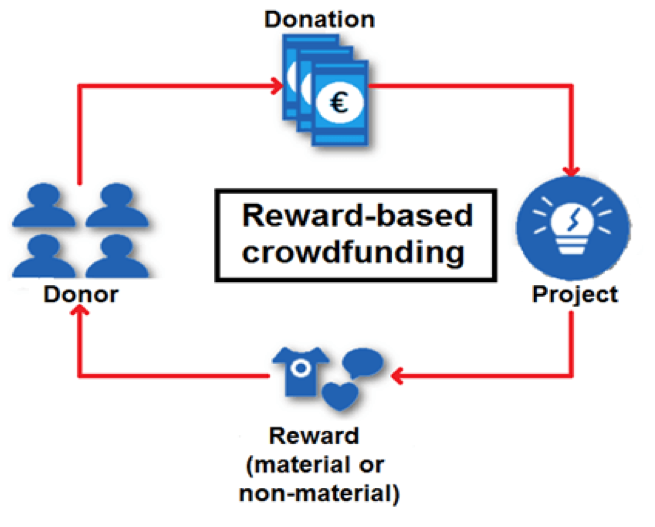

What is Rewards-based crowdfunding?

Rewards-based crowdfunding is the sourcing of money from a crowd of people to a project. The owner of the project presents its worth to the crowd of people and if they like it, they provide money to work on the idea to completion. In return, the crowd of people get an incentive (or reward) based on criteria that the owner of the idea has decided upon.

Figure: What is Rewards-based Crowdfunding

This kind of crowdfunding is good for small business, mostly startups, which are pursuing funding for an invention which serves a specific purpose and is likely to have a large market up-take due to the need it satisfies. Furthermore, it supports an upcoming inventor who would otherwise be bothered by the burden of a bank business loan to actualize a brilliant idea.

How it works

Below are basic steps along the way to a successful rewards-based crowdfunding process:

- A willing investor looks for a reputable crowdfunding platform.

- A project owner convincingly describes their idea on the crowdfunding platform.

- The funders provide funds to actualize the idea.

- Investors donate funds to run the idea.

- After successful completion, the project owner rewards the funders who funded the idea. As an example, consider an idea where a project owner recycles wooden pallets to make outdoor furniture. The funders get a piece of furniture as a reward.

With more project owners actualizing their brilliant ideas this way, there are more success stories from rewards-based crowdfunding platforms that increase the likelihood of getting valuable rewards from investing in it.

Source: NerdWaller

A typical rewards-based crowdfunding project goes through the following stages from inception to delivery:

Idea Conception and Organization

- A project owner determines an idea that they are passionate about and which satisfies a real need in society.

- The project owner designs a model of the product on paper and/or in real life.

- The next step is to draw up a budget of the raw materials and tools, labor, and any other attendant costs needed to make a complete product. The number of products to be made is also determined at this stage.

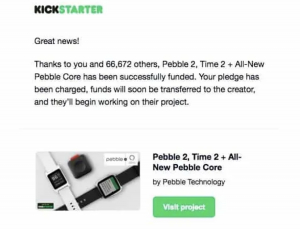

Figure: The Pebble Time smartwatch. It received $1 million in funding within one hour of the project launch.

Preparation

The project owner carries out in-depth research to determine the best rewards-based crowdfunding platform. This is a very important step for the project owner to ensure the idea is not stolen by scammers, and to ensure the least amount of energy is wasted in convincing a more willing crowdfunding audience.

Presentation

Most successful presentations of a crowdfunding project contain a balanced mix of video, slideshows, and models of the product or service. A good solid presentation will draw sufficient funding to carry the idea to fruition. A project owner carries out research and includes other people with mastery of the product to back up their presentation.

Funding

This stage comes after a successful presentation. Many interested funders will donate to the idea at this point, while others may need more coaxing. The project owner responds by being available to elaborate on inquiries regarding the product, which leads to more donations.

Production and Delivery (includes personal Wrap-up report)

After getting funds, the project owner goes back to the product blueprint and creates a complete and ready-to-use product. Any equipment needed to support continuous production is purchased at this point, and so are additional workers to satisfy the labor requirements including delivery to the funders.

As a matter of good planning and to make successful crowdfunding requests in the future, it is very important for the project owner to write a Wrap-up report with details of how the entire project happened. Anyone who approaches this project owner for information about rewards-based crowdfunding will be potential customers of the product.

Case study: Rewards-based Crowdfunding investment

We cannot discuss rewards-based crowdfunding without mentioning the Pebble Time smartwatch project. It is one of the most successful rewards-based crowdfunding investments in history raking in a whopping $20.4million from 78,741 crowd funders or backers as they are known on the crowdfunding platform “Kickstarter”.

The Pebble Time is a smartwatch developed by Pebble Technology and assembled by Foxlink, released on 14 May 2015. This is the first smartwatch to introduce a color e-paper display, as well as a microphone, a new charging cable, and a new Pebble Time-optimized operating system. (Wikipedia)

Within the first hour of its launch, the project received $1million from backers.

The backers got a minimum of one customized Pebble Time smart watch at 20% of the retail price. The more the amount donated, the more the rewards. Some funders got:

- more Pebble Time smart watches

- choice of three colors for the smart watch

- personal choice of color of the Pebble Time smart watch

- personal choice of color of the smart watch, and matching leather strap and metal strap

- Some backers

Source: Wikipedia and Kickstarter

Figure: A screenshot of the confirmation of funding for the Pebble Time smart watch.

Market size, growth, and forecast

According to the Global crowdfunding market size, status and forecast 2021 – 2027 report, the global Crowdfunding market size is projected to reach USD 23.2 trillion by 2026, from USD 12.3 trillion in 2019, at a CAGR of 11.2% during the forecast period 2021-2026.

Out of the above amounts, rewards-based crowdfunding accounts for 74% of the total. With the total growth expected in 2020 standing at USD 13.78 trillion, rewards-based crowdfunding is expected to be 10.2 trillion in the same year.

Source: Valuates Reports

Rewards-based crowdfunding is a shrewd investment and funding for a pre-business incubation environment. Many crowdfunded ideas turn out to be huge companies, with their investors becoming profitable shareholders.

Furthermore, forecasters expect rewards-based crowdfunding to grow due to the current pandemic which has slowed business.

Pros & cons for investors

Pros

- It is a smart way to invest and earn without having to organize the work for the project owner.

- Flexible to invest as it does not require a huge initial amount, yet has good returns

- No investment management or knowledge required

- Diversified investment portfolio. Reward-based crowdfunding is the nursery of many profit-making inventions.

- Rewards-based crowdfunding does not require a formal structure like traditional stock markets and other investment programs.

- An investor can directly make a difference in the community, because the simplicity of rewards-based crowdfunding makes it permeate every level of society while remaining a structured means of generating funding for an idea.

- Free marketing of an investor’s influence, due to all the publicity raised on social media by the project owners and investors alike.

Cons

- Uncertainty of returns, especially if the project does not reach its goals.

- The tangible reward may not match the value donated.

- No influence on the progress of the investment.

Risks

As with any investment, rewards-based crowdfunding does have real risks to contend with. Some are discussed below to cushion a wary investor against making a bad decision or to prepare one for the outcome of such investments.

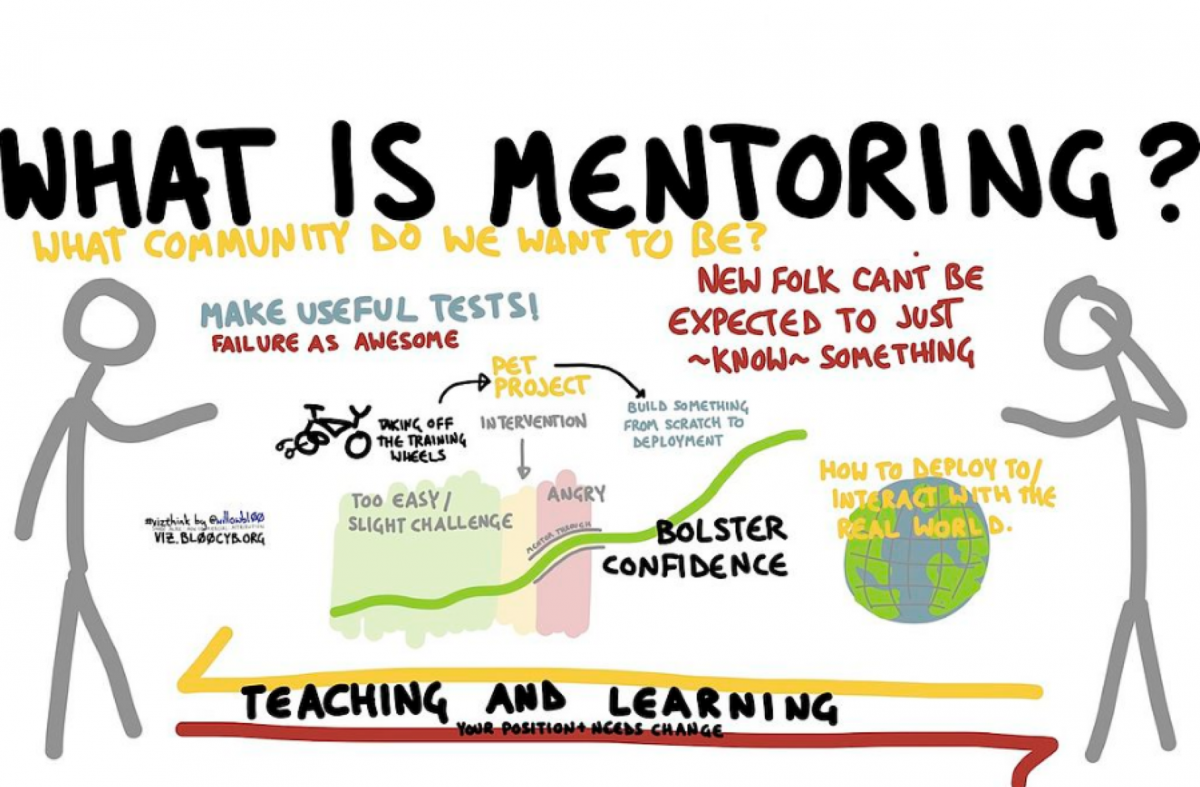

Lack of Tutorage

Many rewards-based crowdfunding projects are usually a brainchild of a proactive inventor who addresses a real-life need. They may have good intentions, but those with purchasing decisions already anticipate the kind of solutions they want. An important consideration for consumers is that the solution is sustainable. For example, a product should have spares availability and after-sales support. That is where the value of business mentors comes in. If a new business idea does not have proper mentorship, it risks being a one-hit-wonder that fizzles into a relic too soon.

Figure: Mentorship provides startups with crucial direction and support that helps their products do well in the real world.

Mentors guide a business newbie through the motions of a good business plan that ensures enduring success for the product and cushions them against market apathy.

Some crowd-funding investing best practices include:

- Invest small amounts at first to gauge the rewards-based crowdfunding platform that an investor chooses to use.

- Inquire more on the idea being funded by the project owner

- Research more on the product being presented and pre-empt likely failures

Source: Investopedia

Scams

Unscrupulous persons may present a project with a solid plan only to disappear after funding has been released. Others may start well but later divert project funds to other purposes. To avoid being scammed, dig deep when carrying out due diligence on the product and the project owner(s).

Low-Quality Products

The result of a successful rewards-based crowdfunding venture is a tangible product or an actual service. However, a project owner could produce lower than usual quality products due to the lack of government or industry regulation on the same. Since there is no way to determine the outcome of a project, an investor should place funds in reputable rewards-based crowd-funding platforms discussed later.

As mentioned earlier, rewards-based crowd funding is a sort of incubation environment for business. As a result, it is difficult to regulate as normal businesses and can lead to proliferation of many products with artificial value. Such products can genuinely of lesser value due to redundancy of use. For example, if many project owners undertook to use recycled materials, but all came up with recycled fences, then it would lead to a market glut of an unneeded product. This kind of scenario comes about from the depth of passion that many project owners have for their products and may be unwilling to let go of them to avoid over-production.

An investor should be prudent and balanced when funding projects, to maintain spiked interest in funding ideas. A good investor spreads out their investments so that they are more likely to get interesting and unique rewards that will remain so for long.

Return on investment (ROI)

Rewards-based crowdfunding offers the most diverse returns ever. The returns will be as diverse as the number of projects. This is because an investor rarely funds a project from which they have no strong gain. They are also likely to get a highly-priced product despite providing low funds.

On the other hand, an investor is likely to get a product that costs lower than the funds they invested. In such a case, the value lies in the beauty of helping out a new business and gaining a special production version of an item.

An intrinsic value in investing in rewards-based crowdfunding is that it acts as a kind of social responsibility towards the community. This is especially so, for funders who receive a special production item, such as one of the first hundred of a handmade product. Other subsequent products may have graduated to factory production. Furthermore, such a funder is very likely to have helped a struggling inventor who lacks access to funds for better education and/or actualization of a useful invention.

Best Rewards-based Crowdfunding platforms

There are several recognized crowd-funding platforms such as:

- Kickstarter

- Indiegogo

- Crowdfunder

- Pozible

- Vision Bakery

- Thunder Fund

- Patreon

A few of the above are discussed below because they are ranked best rewards-based crowdfunding sites by popularity.

Kickstarter

Kickstarter is a creativity funding platform based in the United States of America. As such, it provides rewards-based crowdfunding for creative projects like musicians, filmmakers, comics, publishers, and other creators. It has raised over $2million from more than 10 million funders. It is noteworthy that funds are only released when they reach a defined funding goal on the Kickstarter platform.

Patreon

Many Youtube videos have a link to Patreon where you can donate directly after watching a video. This is because Patreon is popular with video creators, webcomics, and musicians. The main reason Youtube content owners prefer it is because it allows them to get crowdfunding on each view of the content and repeatedly so. This makes for good income and funding at the same time for project owners.

Indiegogo

Indiegogo has a wider audience of project owners as it allows almost everyone with an idea, start-up business, or aid program to request crowdfunding. Though it is based in the USA, it provides crowdfunding throughout the globe. A project owner chooses to receive funding as it comes or when it reaches a particular funding goal on Indiegogo.