Green lending is a term used to refer to a type of lending that is reliant on environmental principles for the planned use of the funds. It forms a part of sustainable lending aiming to reduce the effect of new lending activities on the environment.

A green loan, therefore, is a kind of personal loan meant for covering the cost of eco-related expenses including greywater treatment systems and rooftop solar panel installations.

When you talk about p2p green lending, it is an arrangement where investors lend directly to creditworthy borrowers who are looking to install or buy an approved ‘green’ product. In this process, investors are allowed to specify the amount of money they want to invest as well as the interest rate they are willing to accept.

How green lending works

Green lending aims to increase the level of financial flows from investors to sustainable development priorities. The main goal of this type of lending is to manage better social and environmental risks while taking up opportunities that are capable of bringing both a decent and constant rate of return and environmental benefit along with delivering greater accountability.

Green lending can be an attractive investment, and even normal p2p lending loans can be made green.

They tend to come with cheaper interest rates with some variants. But what makes a loan green is its purpose.

If the borrower intends on spending the funds on environmentally-friendly, resource-saving, or climate-friendly activities, then it is considered a green loan.

With sustainable p2p lending, investors don’t need to wait for government bonds to go green with their funds.

Green lending platforms allow investors of all scale, from small investors with $10 to spare to major institutional investors, to lend their funds to creditworthy businesses or individuals looking to fund energy efficiency, low emissions, and renewable energy.

Green crowdfunding works just like traditional p2p lending, except that your funds go to sustainable development activities.

By choosing p2p green lending, you can be directly involved in the creation of a renewable energy source with higher annual returns.

The benefits of green loans make them highly popular. First, they are backed by tangible assets, thus you can easily track and recover your capital. And if you need your capital back early, you can just sell the loan (full or parts) to other investors willing to buy them.

Case Study: Green lending investment

CEFC is a major green investment company in Australia aiming to play a major role in increasing investment in the country’s transition to lower emissions.

The company invests in order to lead the market, operating with commercial rigor in addressing Australia’s hardest emission challenges in energy generation and storage, agriculture, transport and waste, infrastructure, and property.

CEFC has $10 billion funds to invest in green loans on the behalf of the Australian government, and below is a case study of their green lending.

Case Study #1: Manufacturing Property; Category: Energy Efficiency, Low Emissions; Location Western Australia.

In this project, three companies – Hesperia, Fiveight, and Gibb Group – are setting up a 56-hectare carbon-neutral Roe Highway Logistics Park (PHLP) in Kwinana using low carbon concrete, solar PV as well as industry-leading sustainability measures to create the greenest industrial estate in Perth, Australia.

Comprising five warehouses, the developers will use entirely low carbon construction materials, thus reducing emissions by around 42 percent compared to standard concrete.

The energy investment is supported by a number of other sustainability initiatives like on-site water recycling as well as a state of the art stormwater management system, the usage of materials like specialist insulation and double glazing to enhance heating control and reduce energy use.

The CEFC has invested $95 million in this project to help curb embodied carbon in property construction.

Case Study #2: Property; Category: Renewable Energy

The CEFC has also provided funds to the Frasers Property, which is trying to extend the benefits of clean energy to industrial tenants by offering them green power and clean water for no additional costs at two new industrial estates in New South Wales and Victoria.

The new estates will comprise energy-efficient design as well as renewable technology. Innovative distributed energy generation models are expected to be installed at The Horsley Park Estate in New South Wales and Rubix Connect in Victoria to provide carbon-neutral energy through onsite solar, biodiesel generator, and battery storage.

Frasers Property energy retailer Real Utilities will be tasked to provide Climate Active approved carbon neutral electricity to the tenants and common areas.

The project is linked to up to $300 million green crowdfunding loans, with CEFC investing $75 million.

A comprehensive range of sustainability features will be employed to help curb the operating emissions to zero, including LED lighting with modern controls, passive design, solar PV, energy monitoring, building electrification, battery storage, and biodiesel generation among others.

RateSetter, a UK-based p2p lending opened its offices in Australia a few years ago, and recently they opened the green lending option, backed by $20 million financing from CEFC (Clean Energy Finance Corporation).

Green lending market size, growth, and forecast

Market Size

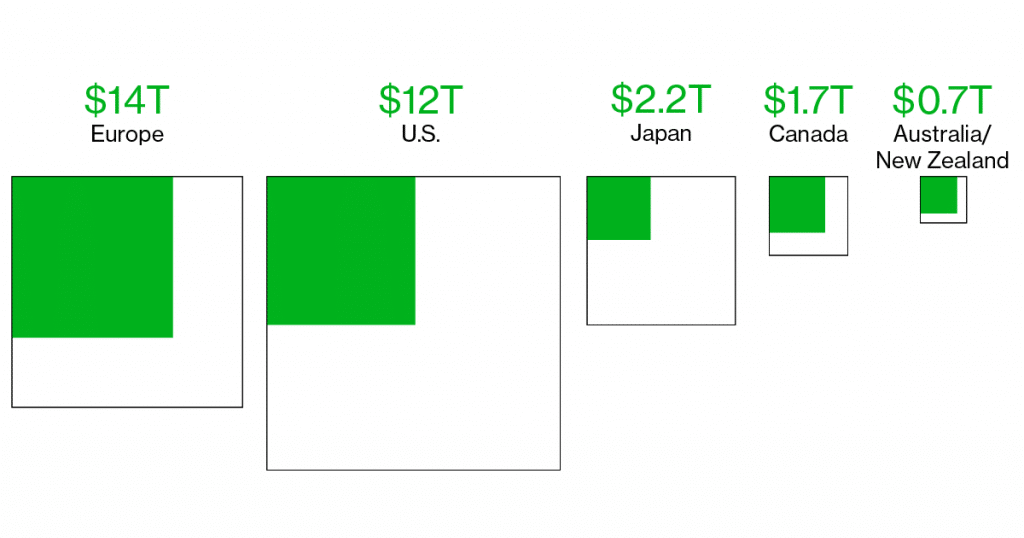

Green lending is now a $31 trillion industry according to Bloomberg Finance and is expected to grow further.

According to the report, despite climate change taking center stage in politics, it is the investors who are decisive.

At least $30.7 trillion of funds is being held in green lending investments, which is a 34% increase from 2016 as per the Global Sustainable Investment Alliance, a group of companies that track green investments around the world.

As the public sector lags behind, the private sector is taking the matter of climate change very seriously.

Renewable developers are now attracting investors to back their sustainable projects by offering security with steady returns backed by contracts to sell electricity.

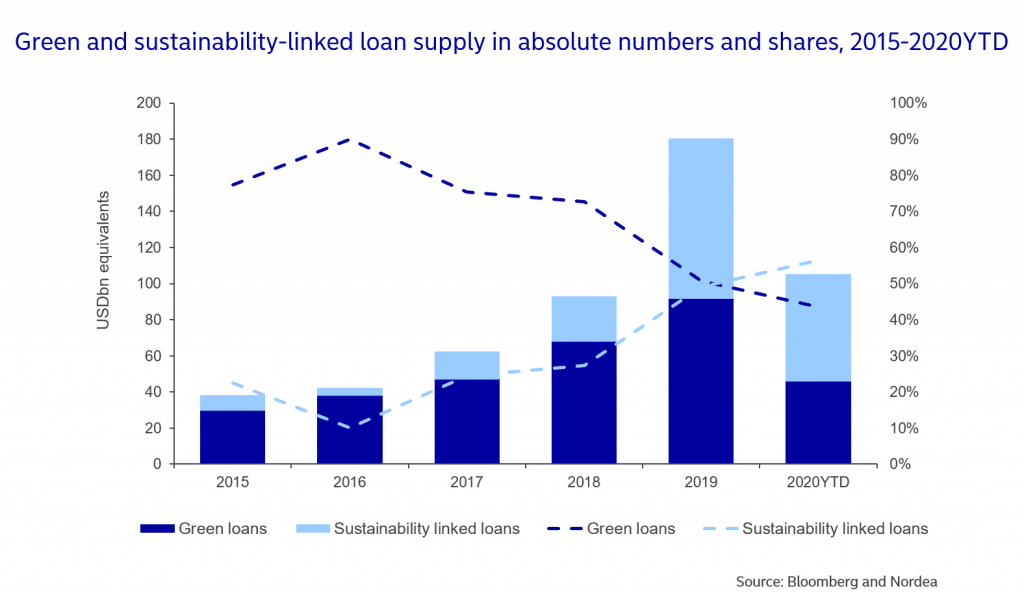

Green lending offers steady predictable cash flows, and as you can see from the graph below it is one of the most popular sustainable debt instruments.

Along with broader strategies for green lending, more capital is being divested from fossil fuels as per 350.org, an organization that wants to reduce funding for coal and oil companies.

There is also a change in the equity market. The value of green funds traded on exchanges hit over $41 billion in 2018 according to data from Bloomberg Intelligence.

Market Growth

The growth of green lending is certain to continue growing as more p2p lending platforms are going green.

Sustainable lending is expected to see 55% growth in 2021 according to Credit Agricole Group. The growth will be driven by the increase in the issuance of social bonds as well as the rise in sustainability-linked loans.

In 2020, sustainable finance was driven partly by the Covid-19 pandemic, which revealed the need to develop resilience to shocks and risks including those associated with climate and environmental changes.

The Covid-19 crisis has brought in shaper-focus how much the well-being of the planet very much affects human health, which subsequently affects the way humans live and interact with each other.

These changes in principles and new economic realities mean that investors are now scrutinizing how organizations respond to the public health crisis.

The current momentum in the green, social, and sustainability supply will result in an increase of 55% to up to $726 billion by the end of 2021 according to Credit Agricole CIB.

Moreover, the emergency green p2p lending platforms and social bonds as well as the looming EU Taxonomy directive are expected to be the driving force behind the growth of green lending.

Market Forecast

Currently, the private sector is the driving force behind the growth of green lending, but governments are also entering the market, especially developed countries such as the United States, Canada, and the UK as well as emerging markets like China and India.

Fascinatingly, several educational institutions like MIT and municipalities like the City of Paris and some in the Scandinavian, have begun exploring green lending as an option to finance sustainable projects.

This increase in popularity of green financing is what could see the green financing market double in the coming months.

Pros and Cons of Green Lending

Green crowdlending is a great idea. A growing number of retail and institutional investors want to earn profits while at the same time doing good.

They want their portfolios to include “ESG” that is, to take part in supporting environmental, governance, and social causes.

Pros of green lending

- Allows you to align your investment with your personal values

Green lending is a quite compelling concept for most investors as it allows them to align their funds with their personal values.

Investing in p2p green lending is investing in sustainable projects that help fight things like climate change and social injustice.

- It keeps you in the game for long

One of the major benefits of investing in green loans is that it could keep you in the game for the long haul. This is important particularly if you aim to grow your investments and save for your retirement.

Investing in something that you care about a lot can keep you in the market even when you have the urge to get out.

There is a belief that if an investor can form an attachment to their funds, he or she will stick with the investment even when the markets get messy, which is a good thing for investors with long-term objectives.

Because of that, there is clearly an invaluable behavioral component that green lending brings to the table.

- Sustainable returns

Most of the green loans have enjoyed some great returns and according to the Responsible Investment Benchmark Report in Australia, the funds even outperformed the average large-cap Australian share funds over the long term.

Also, the green loan has the potential to outperform large-cap international share funds on one to three years and matched over ten-year horizons.

- Easy to de-risk your portfolio

Borrowers of green loans understand that sustainability is not just about being green, clean, and ethical, but ensuring that investment’s or business’s long-term survival and abilities to support steady future returns. This means that the risk of your investment is reduced significantly.

Cons of green lending

- Performance isn’t guaranteed

Investing is about getting good returns on your capital, and while p2p lending can perform just as well, if not better, as index funds, exempting particular categories or companies from your portfolio can impact your results.

Also, while this is still a new concept, you may find yourself paying exorbitant fees, which can reduce your earnings significantly.

But this is not to say that all green loans are costly because they are not.

Return on investment

In green lending, assessing non-financial like sustainability is always important, but that does not mean that as an investor, you have to sacrifice your potential returns in order to invest sustainably.

While the loans perform almost the same as traditional p2p lending loans, the factor of being green can affect the asset’s returns.

One of the many speculations about green lending is that returns and values were not compatible, that while it exposes investors to important values, it sacrificed returns.

But that is just not true.

The figure below shows how the “green” factor (Environmental, Social, and Governance – ESG) performs against other factors in comparison with the MSCI World Equities Index.

For this analysis, the “green” factor is proxied by the MSCI ESG KLD 400 Index.

From the figure, we can see that “green” is a strong factor that can affect returns.

How to Invest in Green Lending

Investing in green lending is similar to investing in regular p2p lending loans, but you have to choose sustainable projects.

Some platforms have set aside a section for green loans while others are focus entirely on green lending.

Just find a green crowdlending platform, open an account, and start investing.

Best Green lending platform

Although p2p lending is still slowly going green, there are already a number of platforms offering investors a chance to invest in sustainable loans.

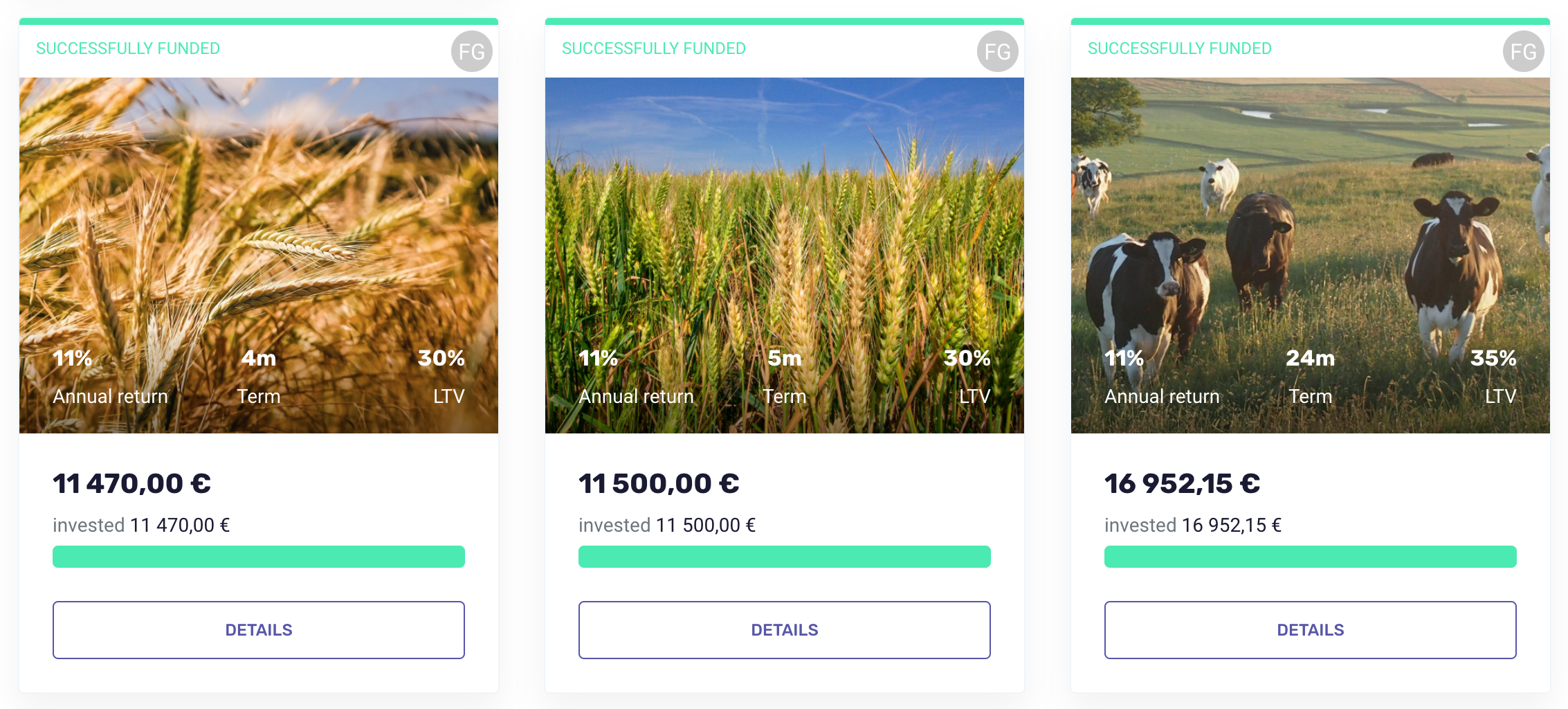

Invest in asset basked agricultural loans with low LTV – LendSecured

If you would like to invest in green lending you can use the button below.

RateSetter has recently launched its Green Loan marketplace to make it easier for investors and borrowers to work together in the field of clean energy by reducing market fragmentation.

The platform brings together borrowers, investors, and sustainable project owners with a shared interest in energy-efficient, low emissions, and renewable energy projects to conclude a deal that benefits every party.

It allows investors to lend their money directly to creditworthy borrowers seeking funds to install or buy certified “green” products.

Investors specify the amount they want to invest as well as the interest rate they are willing to accept. Their request is then matched to approved borrowers.