The question, “why is crypto dropping in Q2 2022?” has become commonplace on crypto social media. Crypto resets are traumatic and can confuse investors, especially if it is their first market-wide plunge. As per a Grayscale Investments study, many crypto investors joined the market during its 2021 boom.

55% of BTC investors, for instance, made their first purchase in 2021. This new group of crypto users brought over $30 billion in liquidity to the nascent sector. India had over 20 million new crypto investors in this period.

Over 5.1 million South Korean millennials opened their first crypto addresses and accounts between January and March 2021, as per Statista data. On the other hand, new US investors pumped $7 billion into the crypto space.

Most of these investors got into the market for its high-yielding assets and speculation. They are not knowledgeable about the market’s risks, volatility and historical trends. Therefore, they may not know that this is not the first crypto bear run, nor will it be the last.

To answer why crypto is dropping, the crypto sector has had its fair share of resets since its inception in 2009. The first significant crash occurred in 2014, after the Mt. Gox hack. The infamous exchange handled over 70% of all BTC transactions at the peak of its popularity. Consequently, investors lost 740,000 BTC worth close to half-billion dollars to the exploit.

Two years following that fiasco, another hacking attempt brought the market to the brink. The Ethereum DAO attack led to the loss of $60 million worth of user investment, springing the second crypto reset. However, the market quickly recovered after the Ethereum network hard fork.

This development led the market to the 2017 ICO season, whose bubble popped, wiping out over $700 million worth of investors’ liquidity in the form of worthless tokens.

A crypto winter set in, crashing the bitcoin price by 65% by February 2018. Then, the market recovered, only to plunge alongside the stock market in March 2020 over pandemic driven FUD (fear, uncertainty and doubt). So, the crypto market is dropping because it is undergoing one of its reset periods,

The most popular answer to the question “why is crypto dropping?” is the ongoing Terra Luna debacle. However, it is not the only reason why crypto prices are plunging in mid-2022.

The crash of the Terra Luna ecosystem was indeed elemental to the perfect crypto storm. That event plunged bitcoin prices to their lowest since 2020. Moreover, the crypto events that led to the stablecoin crash wiped over $300 billion worth of liquidity from the market in hours.

Investors that had enjoyed months of asset increases helplessly watched as their gains vanished overnight. The massive market panic has instigated a reset that could rival the 2018 crypto winter when bitcoin lost most of its value.

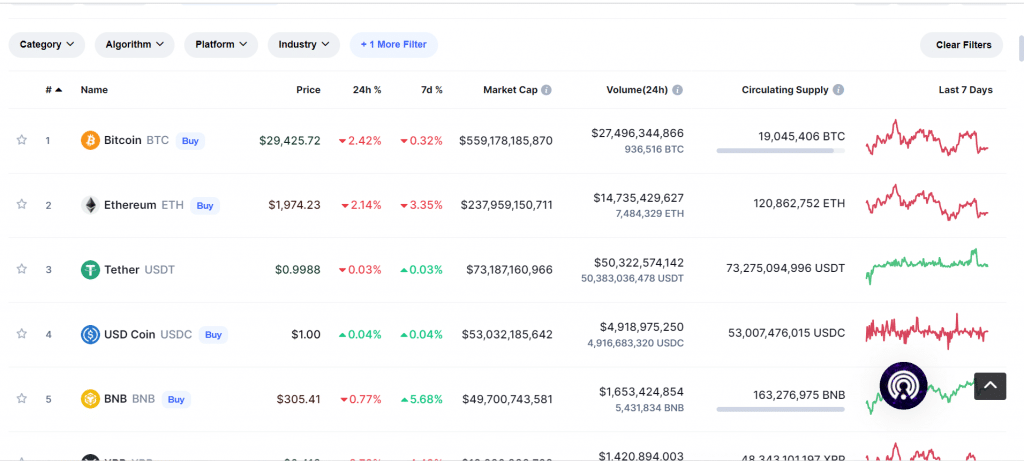

Figure: Crypto price plunge (source: coinmarketcap.com)

Why is crypto dropping? The perfect crypto storm

However, the Terra ecosystem crash is not to blame for all the market’s woes. The crypto market was already undergoing a broader pullback in 2022. External events such as rising interest rates, geographical risks from the Russia Ukraine invasion and inflation had significantly depressed the stock and crypto market valuations by May 2022.

As an illustration, the S&P 500 has had an 18% decline in the last few months. On the other hand, Bitcoin’s price had lost 40% of its value from its August 2021 highs of $67,000 before the Terra Luna scandal threw a spanner in the works.

Then, ETH and BTC prices plunged in March 2020, when the pandemic’s effects began to throttle the global markets. By mid-March 2020, the world’s most popular cryptocurrency lost 57% of its initial gains, falling to $3,867 from its February 2020 highs of $10,000 per BTC.

These cryptocurrencies would fully recover and hit their all-time highs in 2021’s post-pandemic recovery season. Bitcoin prices rose to $67,000 by mid-year, while ether rose to $4,800. As you can see, cryptocurrency asset prices take a tumble alongside global stock market asset prices due to external market forces. Some of these forces include;

External reasons why crypto is falling

Risk-off conditions

Cryptocurrencies are risk-on assets. Investors will turn to growth-sensitive risk-on assets such as equity markets and digital currencies when their economies are booming. These assets offer a higher return on investment than risk-off assets such as currencies and bonds.

The cryptocurrency market’s quick price appreciation and volatility promise high rewards, making them the perfect risk-on assets. Demand heightens during risk-on market settings, further increasing crypto prices.

But investors will exit the sector when market events turn. As an illustration, the cryptocurrency sector prices plunged in April 2022, when the Bureau of Labour Statistics reported an 8.3% jump in consumer prices.

Investors sold off on-risk assets such as cryptocurrencies, showing a significant correlation between the Nasdaq Composite, the S&P 500 and the digital currency market. Instead, they settled for risk-off assets such as government backed treasury bills.

Figure: BTC price plunge (source: coinmarketcap.com)

Interest rate hikes

As mentioned above, cryptocurrency prices will rise during times of economic expansion. This is because investors will allocate more wealth to risk-on assets for higher returns on investment (ROI). In contrast, looming recessions will tighten spending and lower the demand for cryptocurrencies. But how does inflation affect cryptocurrency prices?

Inflation is the rate of increase in prices of goods and services over some time. It is a broad measure that considers factors such as an increase in the cost of living, food, services or certain goods.

Extreme inflation can plunge society into instability. For this reason, most central banks keep a keen eye on inflation. These inflation hawks, however, are losing the battle. As per WeForum, the global consumer price index has had an 8.3% increase.

The consumer price index collates the average price of goods and services and effectively measures the cost of living. The Geneva-based international non-governmental organisation also says that inflation in the US is at a 40-year high.

Oil prices have soared to over $110 a barrel due to the international sanctions levied against Russia. Investors often react to inflation by betting against it. They will invest in deflationary assets such as bitcoin or gold, hedging inflation. These assets rise in value when cash continues to lose its purchasing power.

So why is crypto dropping if inflation is rising? Cryptocurrencies prices are falling due to central banks’ attempts to mitigate full blown inflation. The Federal Reserve is, for instance, tapering its Treasury securities purchases and hiking interest rates to combat historical inflation.

The central bank will hike interest rates several times in 2022 to temper inflation. A tightening monetary policy leads to a pullback in speculative markets.

As an illustration, the Standard & Poor’s 500 Index ended 2021 at its all-time highs but is currently on a downward trend. So are the Nasdaq composite and the Dow Jones Industrial Average. It follows then that assets that gain the most from low-interest-rate environments experience a pullback in price when high-interest rate phases commence.

For instance, both bitcoin and ether have had a 44% and 42% loss in value from their all-time highs in November 2021. Rising interest rates are unfavourable to high-octane growth assets such as cryptocurrencies because they offer higher returns to lenders and safe asset investors.

This setting increases competition for capital, dooming the performance of speculative assets such as tech stocks. However, the crypto sector is holding up much better than speculative tech stocks due to investor optimism about blockchain technology.

Figure: ETH price plunge (source: coinmarketcap.com)

Internal crypto events

Besides external events, domestic crypto events also significantly influence the price of cryptocurrencies. Below are native crypto events that can answer the question, “why is crypto dropping in Q2 2022”?

Supply and demand

The cryptocurrency sector is in its nascent stage of development. To this end, it is highly susceptible to the forces of demand and supply. Cryptocurrencies prices will skyrocket when there is heightened demand for coins.

Bitcoin, for instance, is ultra-volatile because it has a finite supply of 21 million coins. BTC supplies increase by a preset amount after miners verify and validate new data blocks into their distributed ledgers.

Consequently, BTC has low supply and high demand metrics, therefore, high prices per coin. Other factors that increase the demand for a cryptocurrency are public awareness and its use case. Cryptocurrency prices increase when there is mass adoption. As an illustration, increased institutional and retail investor interest spurred the 2021 cryptocurrency market bull.

Unlike the 2017 bull run with retail investors at its core, the 2021 bull run brought in liquidity from professional investment firms. As per a 2020 Fidelity Digital Assets report, over 35% of investment advisors, hedge and pension funds, endowments and family offices had shown interest in crypto investments.

Large investors such as Grayscale brought in much-needed support, mopping up 630,000 BTC on behalf of their institutional accredited investors. In addition, large financial institutions such as JPMorgan Chase & Co., Citibank and Deutsche Bank have also shown public support for the sector.

Crypto funds by investment managers brought in $62.5 billion in assets under management liquidity to the bitcoin market in 2021. In addition, the sector’s investment funds had over $9.3 billion in inflows as institutions launched 37 new investment products.

Broad mainstream recognition gave the asset class a multi-trillion-dollar valuation. Crypto prices are now falling as the Fed raises its lending rate, pushing investors to assets such as treasury bills. A cool-down in demand has adversely affected crypto prices.

As an illustration, the January 2022 crypto sell off lowered crypto exchange spot volumes by 30%. It was the lowest turnover the exchanges have had since 2020. A decline in trading volumes is why crypto is dropping in Q2 2022.

Lower trading action has had a significant impact on exchange revenues that Coinbase has cut back on staff hiring and is rethinking its staffing strategy.

Crypto market whales

Figure: Luna price plunge (source: coinmarketcap.com)

Whales are cryptocurrency wallets that hold at least a billion dollars’ worth of crypto assets. However, since the cryptocurrency market is small and inefficient, the actions of crypto whales can brew crypto events that heighten crypto volatility.

The Terra Luna saga illustrates the significant influence of whales on crypto events. Rumour has it that the Luna and UST crash resulted from a coordinated whale attack. A whale borrowed a hundred thousand BTC and built a $1 billion short position against UST.

The whale then pulled out the liquidity quickly and was the first to cause a slight movement to the TerraUST stablecoin USD peg. Unfortunately, the whale’s actions kicked off panic in the ecosystem, causing a bank run event that brought Terra to its knees.

Whales take up a lot of crypto market liquidity and space and can easily manipulate it. They can, for instance, sell their crypto assets at lower than usual market prices, cause panic and buy more crypto assets at rock bottom prices.

Social media influence

The fear of missing out (FOMO) has a significant impact on crypto events. Influencers such as Elon Musk can influence the price action of cryptocurrencies through their tweets. For example, the billionaire investor’s tweets have positively influenced Dogecoin’s price in the past.

So, why is crypto dropping in Q2 2022? Not out of FOMO but large-scale FUD. The ongoing reset has created fear and panic on social media as investors begin to call out the Terra team for negligence and fraud.

Regulations

The cryptocurrency sector is at a crossroads. As a result, regulators are beginning to show acute interest in the sector’s processes. As an illustration, on March 9th, 2022, the Biden administration issued an Executive Order (EO) to guide his government’s stance on blockchain technology and its assets.

On the other hand, the Eurozone legislators have the Markets in Crypto Assets (MiCA)proposal ready for legislation. A negative regulatory stance could cause crypto events that adversely affect crypto prices.

The cryptocurrency market’s prices are plunging as Janet Yellen, the Treasury Secretary, renews calls for a crypto regulatory framework following the demise of the Terra UST ecosystem.

“In the last couple of days, we’ve had a real-life demonstration of the risks… (stablecoins) present the same kinds of risks that we have known for centuries in connection with bank runs,” Janet says.

Conclusion

Above are external and internal events that reveal why crypto is dropping in Q2 2022. That said, the industry is resilient and will make a recovery in time.