There are few sectors in the world of business as volatile as the cryptocurrency industry. Tumultuous, yes, but full of potential. New stories, flows and capital pour into the sector every new day. The business savvy can leverage this vitality and create a cryptocurrency that may change the world as the Ethereum or Bitcoin networks have.

Some benefits of creating a cryptocurrency include access to new customer demographic groups. As per Deloitte research, 40% of customers who make cryptocurrency payments are new to a business. Additionally, the crypto payment customer’s purchase is twice as large as that of the credit card user.

Then, did you know that the crypto sector is the only investment paradigm with more young adults participating in its activities than the old? While only 8% of adults 50 years and above own digital assets, 31% of young adults in the 18 to 29 age segment have interacted with cryptocurrencies.

The crypto superuser is the millennial and Gen Z. This young generation is ascending in the workforce and taking over most leadership positions in the corporate sector. Young adults now constitute 38% of the workforce and will dominate it by 58% by the decade.

Consequently, create a cryptocurrency and position your business in the blockchain industry as its golden age dawns. Some potential use cases for cryptocurrency are enabling payments and improving data access.

Blockchain technology creates smart supply chains and improves insurance sector efficiency. Its applications are limitless, ranging from the mainstream uses above to the quirky. There are, for instance, unusual crypto applications such as PotCoin, the cannabis industry digital currency payment network.

Unobtanium (UN), aka “the platinum to Bitcoin’s gold’s” main use case, is its rarity compared to bitcoin. There are over 18,000 cryptocurrencies today and over 300 million users globally. But unfortunately, at least half of these crypto coins are inactive or dead.

So how can you create a cryptocurrency that outlasts the sector’s rather short coin life span?

How to create a cryptocurrency

1. Identify a robust use case

Do you know that a team created a cryptocurrency to halt Elon Musk’s influence on the cryptocurrency world? Yes, $STOPELON is a meme coin that seeks to bring down billionaire influencers’ “irresponsible manipulation of the digital currency market.

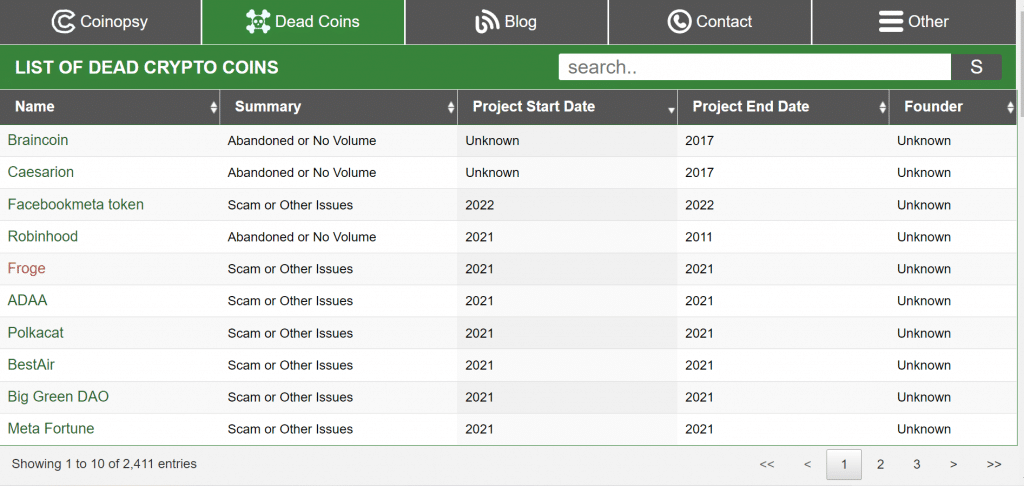

As you can see, you can create a cryptocurrency for just about any use case. But there are thousands of other failed projects for every successful crypto coin in the market. As per Coinopsy, a crypto project biopsy site, over 60% of all new tokens die at the ICO stage.

Then, 95% of all joke tokens such as $STOPELON go on a death spiral due to a lack of development oversight. On top of that, dishonest teams have released thousands of scams and abandoned coins that die at first breath.

The most significant impediment to a successful crypto project is the lack of research on the use case. Therefore, if you are going to build a crypto project, you first need to make a thorough business plan.

A business plan will clarify your decision-making processes on the target audience, project use case, resources, opportunities and risks.

Your use case should be sound and ethical as well. To illustrate this point, the recently crashed Terra stablecoin network had an exceptional use case. Unfortunately, it has been offering its community a pure algorithmic stablecoin that maintains its peg through arbitrage.

Many stablecoin projects have warned that stablecoins that lack asset backing are unstable and unreliable. As an illustration, in January 2022, Rune Christensen, DAI stablecoin co-founder, warned Terra UST users that they were at risk of massive losses.

“Look, UST and MIM are solid Ponzis, and I respect that. You can make good money off them for sure. But they are not built for resilience, and they are going to 0 once the market turns for real. Now stop trying to scam users looking for actual stability into being your exit liquidity”, Rune said.

Unfortunately, the Terra Luna community and team turned a deaf ear to all positive criticism. Instead, they prioritised returns over stability, causing a blood bath of never-before-seen proportions in the crypto sector.

2. Build community support

An ardent bitcoin evangelist, Jack Dorsey, says that what endears the controversial asset is its resilience and “the community driving it.” Saying that the bitcoin community bears a semblance to the early internet, the billionaire businessman says that bitcoin is all about “the network and the community.”

The most significant difference between cryptocurrency projects and traditional businesses is community support. Traditional businesses will first build a working product and then sell it to the market.

The crypto space has an unorthodox approach to new product rollout. A crypto project team will first develop a use case and then directly approach retail investors for support. The strength, size and commitment of your community will determine your success.

A robust community will double up as users of your cryptocurrency. They will also support your crowdfunding initiatives by purchasing your tokens on the issue, giving them a stake in your success.

Afterwards, they will become the fabric that holds your project together during high and low times. Your community will also help spread the word about your project. Every successful crypto project has a resilient and bullish community of users as its epicentre.

A crypto community also enhances decentralisation, supporting the development of a flat governance structure through governance token holdings. To build a robust community, spread word about your project and its use on various communication channels.

Use social media to approach crypto enthusiasts and technology fans eager to learn about the blockchain space.

Create a content strategy that centres your community discussions on your project’s technical roadmap and developments. Then create diverse content that builds community interactivity and cohesion.

3. Choose your consensus algorithm.

Cryptocurrencies support the virtual transmission of value. First, they use cryptography to secure their records. Afterwards, blockchain technology distributes these records to various nodes in disparate geographic locations to further enhance data security, censorship resistance, immutability and transparency.

A digital currency functions much like a traditional currency but can work without the interference of third-party institutions such as banks. Blockchain consensus algorithms achieve agreement of data value in distributed networks. Common consensus protocols include the proof of work (PoW) and proof of stake (PoS) algorithms.

The bitcoin blockchain leverages the Proof of Work mining algorithm to prevent double-spending, 51% attacks and promote a flat data governance structure. In addition, its robust consensus protocol assures users of transaction data veritably and maintains its supply at 21 million BTC.

4. Choose a blockchain platform.

Now choose a blockchain code base that corresponds to your consensus algorithm. If you, for instance, have chosen a PoW algorithm, you can build your cryptocurrency using the open-source Bitcoin codebase.

Create a cryptocurrency ‘hard fork’ by downloading the code from its official Github. As an illustration, the Ethereum blockchain repository is available on the github.com/Ethereum page. Downloading a code base and modifying it to suit your needs is easier, faster and cheaper than building a codebase.

Alternatively, use a digital currency toolbox such as the control.app or createmytoken.com to hard fork a code base and build a simple cryptocurrency project in minutes.

That said, creating a unique codebase from scratch has its advantages. First, it controls the total number of coins and block size. If you do not have blockchain technical experience, hire an experienced developer for this step.

Tip 1

Where do cryptocurrencies derive their value from?

These digital systems procure value from the security of their blockchains. As an illustration, BTC is the most valuable cryptocurrency globally because it has utility, is scarce and is a store of value.

Nevertheless, BTC’s most significant source of value is that its base code has never been hacked. Then its robust consensus algorithm assures its holders no one entity will dilute the value of their tokens through double-spending or duplication of BTC coins.

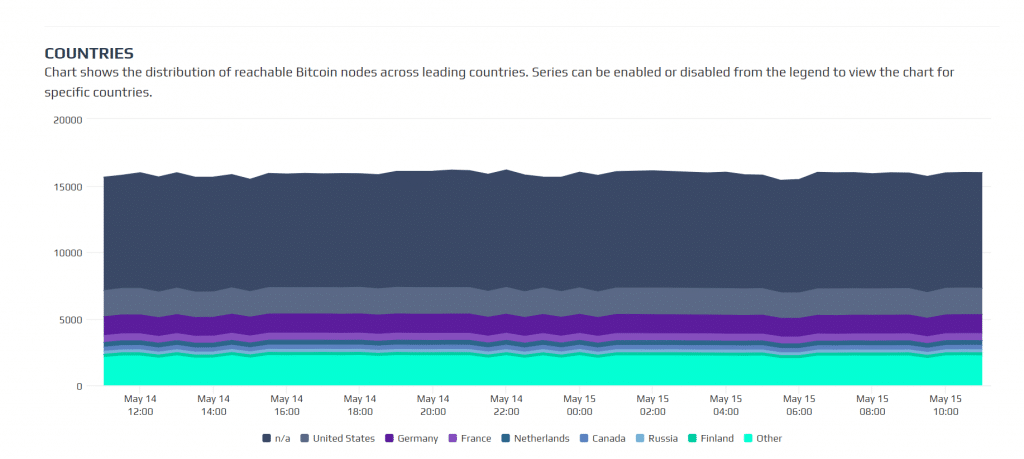

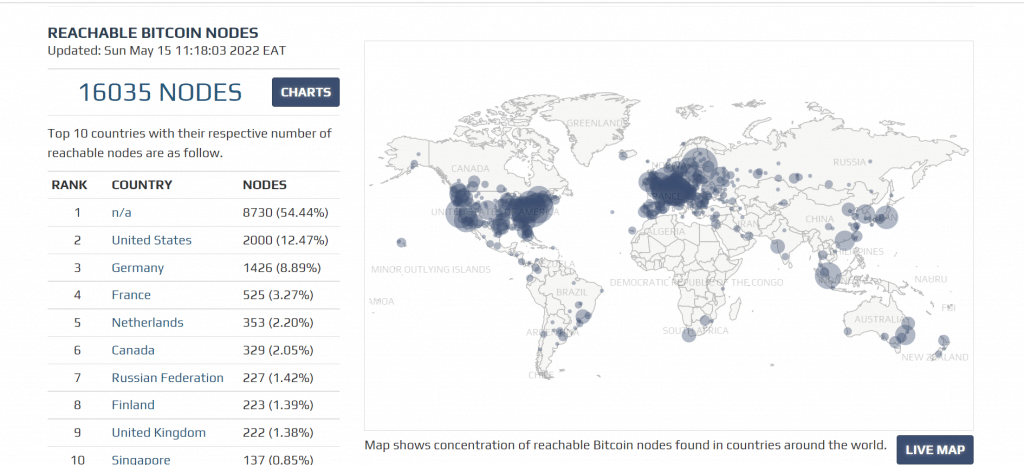

Blockchain networks also derive value from decentralisation. Bitcoin, for instance, has over 16,000 nodes on its network. The bitcoin developer and miner community use off-chain voting to direct and control the undertakings and the future of the blockchain network. Its wide node network averts centralised control of bitcoin processes and ledgers.

Tip 2

Cryptocurrency or token?

There is a vast difference between crypto coins and tokens. Cryptocurrencies are native assets of blockchain networks. BTC and ETH are cryptocurrencies, and their protocols are inbuilt into the structure of their blockchain code.

In contrast, tokens are native to platforms that run atop a blockchain network. Developers can deploy a token’s smart contract logic on a blockchain, leveraging its Layer 1 security, decentralisation, and transparency benefits for their projects. A token’s most prolific use case is decentralised finance (DeFi).

5. Customise your altcoin code

An altcoin, short for an alternative coin, is any cryptocurrency besides bitcoin, the original cryptocurrency. Now that you have an altcoin, it is time to establish its internal architecture. Some protocols that you will need to customise include;

a. Decentralisation protocols

Are you building a blockchain network for business, public or private use? If you create a public blockchain, promote decentralisation through community engagement, education and technological support. Promote your consensus algorithms incentivization process to your community and build a mining or staking node network to assure users of high data security.

If your cryptocurrency is private or hybrid, assign node status to all stakeholders. Key to establishing a node network is determining features such as the on premise or cloud hosting of blockchain data.

Specify your node hardware details and select operating systems compatible with your blockchain protocols.

b. Establish internal architecture protocols

Work with a blockchain developer and establish rules that govern permissions, address and key formats and asset issuance systems. Institute your cryptocurrency network’s key management processes, block mining and size parameters, and native asset rules.

Features such as multi-signatures, block signatures and atomic swaps are also vital internal architecture protocols.

c. Integrate blockchain APIs

An application programming interface (API) simplifies user interactions with software platforms. To this end, a blockchain API integrates a wide variety of applications to blockchain networks, giving them more utility and value.

As an illustration, the Bitcoin Receive Payments API V2 supports BTC payments on websites. Other important APIs include the Coinbase, ChromaWay, Factom Alpha, Gem and Neuroware APIs.

6. Create a cryptocurrency interface

Your cryptocurrency’s robust functionality will go to waste if you do not build a user-friendly navigation process for all features. Build an app that offers an easy to use and frictionless sign-up, onboarding and customer journey experience. Avoid excessive animations and graphics on your interface, and use your UI colours wisely.

7. Legal processes

The world of cryptocurrencies is at a crossroads, and governments are initiating legal processes that govern their operations. To this end, look into regional and international laws on cryptocurrencies to ensure compliance and assess its costs.

As an illustration, when active, the European Council’s Markets in Crypto Assets (MiCA) proposal will expect stablecoin projects to table their white papers before a regulator for approval before project commencement.

The costs of white approval could cost upwards of $87,000. EU-based regulator licences could also rise to $19 million, and there will be repeat compliance costs of at least $28 million to consider. Then, all stablecoin issuers in the EU will require at least $400,000 as capital funds deposits to operate in the region.

Conclusion

A project team with a viable use case and token economics can create a cryptocurrency by creating hard forks of open codebases or developing a new blockchain network. The latter, however, has extensive and demanding API, upgrades and technology needs.

Creating a new cryptocurrency could cost a minimum of $6000 to $10,000 and take weeks to launch. On the other hand, creating a blockchain network from scratch will cost more and take several months of development time.