A climate apocalypse, genomic data boom, a moon base, and the dusk of global poverty, welcome to 2030. But, away from the sci-fi bent prophecies, what is the future of cryptocurrency?

Well, predicting the future of money is not an easy task. For example, the luminary inventor of the lightbulb Thomas Edison, disastrously predicted that gold would become useless in the 19th century. Thomas thought that the fictitious promise of the transmutation of metals would change metals to gold.

However, a few people can make spot-on predictions of the future. For example, Edward Bellamy, an 18th-century author, foresaw a cashless society at a time when plastic money was the stuff of dreams.

Bellamy’s credit card dream has its day and is fading as digital currencies take over. Satoshi Nakamoto, Bitcoin’s inventor, also foresaw a bank-less financial system.

Despite high levels of suspicion and scepticism, these digital representations of value that minimise the use of intermediaries could go mainstream in the next decade. Below are some predictions that will shape the future of cryptocurrency and the decentralised finance sector.

Increased crypto adoption

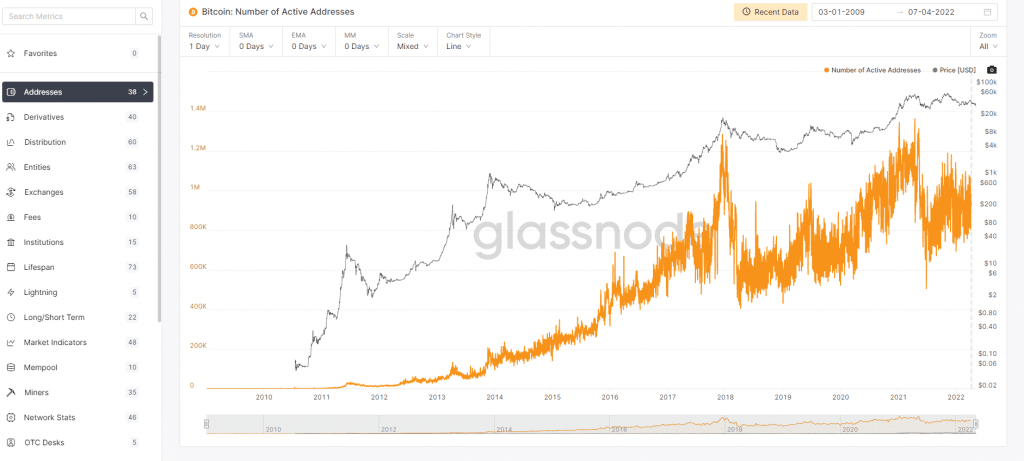

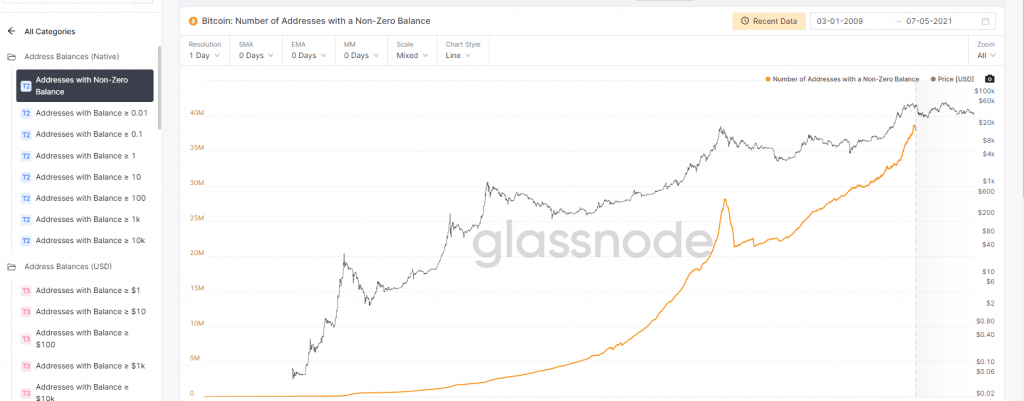

A decade ago, cryptocurrencies were a fringe occupation of the anti-establishment community. However, there are now over 81 million bitcoin wallets as per Statista data and 300 million cryptocurrency users worldwide.

The cryptocurrency market has a $1.58 trillion market capitalization, led by bitcoin’s $655 billion liquidity volume. Digital currency mass adoption will grow exponentially this decade and triple the sector’s liquidity by 2030.

Some pundits say that the digital currency market could rise by 100x value by the end of the decade to a $250 trillion market cap. Its liquidity will rival the global real estate or debt market valuation of $280 trillion and $252 trillion, respectively.

It follows then that cryptocurrencies will enjoy the shortest and fastest growth of the asset class in the new decade. Crypto mass adoption has been buoyed by Fintechs and large institutional investor interest in the sector.

Wall Street, for instance, is lowering its anti-crypto stance as investors seek exposure to the nascent industry. Large financial institutions like Goldman Sachs now show unprecedented openness to an idealistic technology designed to keep them out of the transaction loop.

Their clients have their eyes on BTC’s safe-haven asset status as currency debasement becomes a major investment risk. To this end, Morgan Stanley and JP Morgan Chase have collectively invested over $400 million in the cryptocurrency sector platforms.

Fintechs such as PayPal, Stripe, Mastercard and Visa have also opened their platforms to cryptocurrency payments. In addition, the emergence of easy to use crypto-fiat ramps will enhance crypto adoption.

However, there is no denying that the sector’s payments need to scale to meet global enterprise use. Fortunately, fast and scalable blockchain networks such as Cardano and Solana are rising to meet this challenge.

As an illustration, Cardano, an environmentally friendly proof of stake network, is partnering with the Ethiopian Ministry of Education. They have built a blockchain-based universal student credential system and could integrate Ethiopia’s digital I.D. system in the future.

Increased regulation

The ongoing push and pull between crypto centric platforms and financial regulators is proof that the blockchain sector is going mainstream. For instance, the Biden administration has issued an executive order that will guide “responsible development and use of digital assets.”

So, will government intervention negatively affect the future of cryptocurrency? Some investors believe that a level of government intervention could have a positive outlook on the future of cryptocurrency. Regulation could lower uncertainty, volatility and fraud.

Circle, the issuer of the USDC stablecoin, is all in on regulation. Jeremy Allaire, the Circle CEO, has said that they support the U.S. Treasury Department regulatory proposal to relegate stablecoins issuers to legal, financial institutions.

However, the Federal Reserve has its eyes set on stablecoin regulation rather than the supervision of the entire crypto-assets sector. Therefore, it is possible that in the future of cryptocurrency, fiat backed stablecoins will undergo full regulation.

These regulations will alter stablecoins P2P features through KYC processes. Decentralisation die-hards may opt to build decentralised autonomous organisations (DAOs) to evade sector regulation.

DAOs distribute governance power amongst disparate members and can lower the risk of regulation. To illustrate this point, Wyoming allows DAOs to hold limited liability company status.

Wider adoption of CBDCs and stablecoins

The reign of cash as king is ending, accelerated by the pandemic era shift to contactless and digital payments. As an illustration, the U.S. Mint has asked the public to use coins in payments to lower cash circulation challenges.

Over 51% of the population now makes contactless payments, a 100% increase year over year, as per Visa data. As the era of cash comes to an end, stablecoins and CBDCs will take over, as per professor Eswar Prasad, a Brookings Institution senior fellow and former IMF head of the China division.

CBDCs or central bank digital currencies have high levels of regulation and could challenge the dominance of the stablecoin market. The U.S. Federal Reserve has not kicked off its CBDC development, but China, Japan, Sweden, and Nigeria are on their CBDC trials.

The Bank of England and the European Central Bank have set up processes for their CBDC development. The Bahamas has rolled out the world’s first CBDC, the Sand dollar, while China has over $5 billion in digital yuan in distribution.

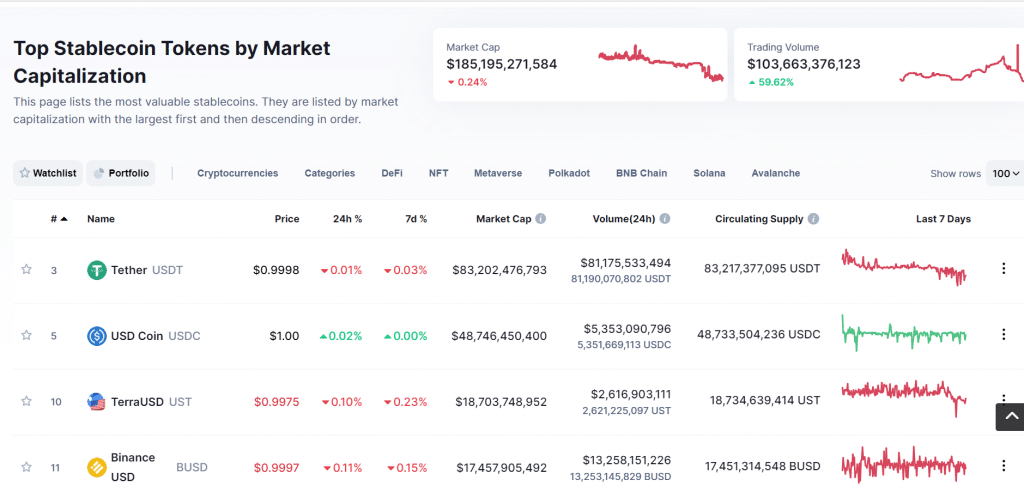

The stablecoin use case in the decentralised finance sector gives them leverage over CBDCs in the future. As an illustration, the Terra stablecoin network is highly scalable and can handle 10,000 TPS, offering its users low transaction.

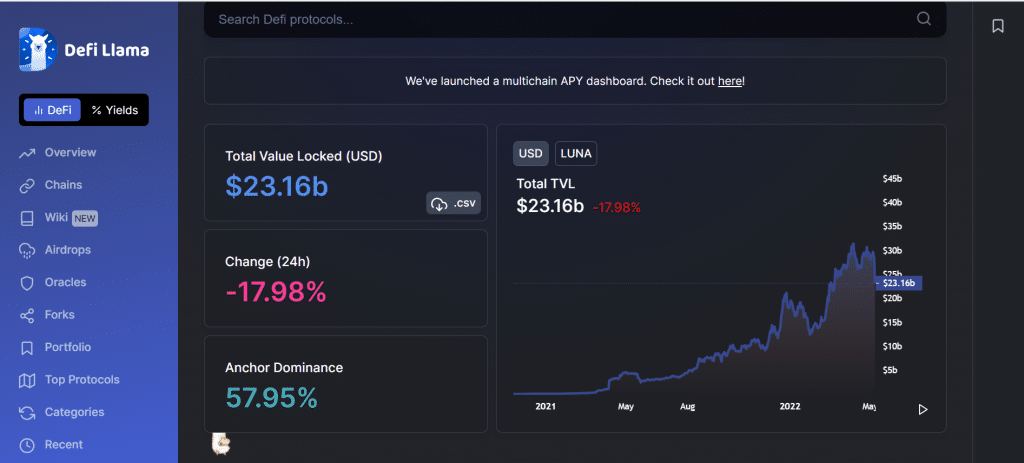

Terra’s DeFi ecosystem runs on Cosmos blockchain. It is now the second-largest DeFi ecosystem in the sector, boasting a total value locked (TVL) of $23 billion. Terra’s decentralised finance applications are slowly gaining on the popular Ethereum based Curve, MakerDAO or Aave network with a $102 TVL.

Terra’s Anchor network pays interest to investors that lend stablecoins. You could, for instance, earn a 19.5% annual percentage yield (APY) by lending TerraUSD (UST) on Anchor. This yield rate is much higher than the 0.06% yield rate in an average bank savings account.

Also, PaywithTerra is a payments platform that allows consumers to transact directly with merchants using Terra stablecoins. Merchants only pay $0.05 per transaction, making stablecoins a firm use case in the future of cryptocurrency. In contrast, PayPal charges merchants as high as 3.49% and a fixed fee on transactions.

A rise in bitcoin prices

Bitcoin is the world’s most popular cryptocurrency. It has a market cap of $720 billion, and its volume is nearly 42% of the entire crypto market. In addition, over 2300 US merchants use BTC as a payment method. As per Allied Market Research, the Bitcoin network value could surge by 12.8% by 2030.

Allied Market Research say that bitcoin will remain the highest gainer in the future of cryptocurrency since it has an “untapped potential in emerging economies.”

Then, bitcoin has a limited supply of 21 million tokens. Over 19 million BTC is in circulation. Its price will rally as its next halving event takes place in 2024. The bitcoin mining reward will drop to 3.125 BTC, increasing the demand for freshly mined assets.

The past three halving events in 2012, 2016, and 2020 have positively affected the cryptocurrency’s value. Its price surged by 9,915%, 2,949%, and 665%, respectively, after each successive halving.

The Winklevoss twins are confident that Bitcoin will be worth $500,000 by 2030. Anthony Pompliano, co-founder and partner of Morgan Creek Digital hedge fund, says that Bitcoin will continue to rise in value and cross the $300,000 mark by 2025.

Ryan Gorman, the co-founder of the Trade the Chain app, believes that BTC will go as high as $100,000 by 2030. Professionals such as Ark Invest’s Cathie Wood predict that BTC price will cross the $500,000 mark by 2026.

Cathy is Ark Invest’s CEO and runs the $366.7 million Ark Innovation (ARKK) ETF. Cathy says that one BTC will be worth over $1,000,000 by 2030, a 2000% price increase in eight years. If you wonder whether BTC prices can rise this high, the bitcoin price had a 3,500% price surge in the 2017 bull run.

Other factors that support a 2000% BTC rally are its rising political support. The U.S. Treasury and the SEC have embraced a neutral view of the cryptocurrency market. In her speech at the American University’s Kogod School of Business Centre, the Secretary of the Treasury, Janet L. Yellen, remarks that digital currencies lower reliance on centralised intermediaries.

She also notes that the traditional payments system is slow, expensive and inefficient and is ripe for responsible innovation.

“Estimates suggest Americans spend $15 billion or more each year on (overdraft) fees and services – essentially a tax of about $100 per working American, due mostly to inefficiency and disproportionately borne by people with lower incomes”, Yellen says.

Bitcoin is also enjoying wider mainstream adoption due to innovations such as the Lightning Network for domestic payments. In addition, most BTC investors are ‘hodlers’ using it as a shield against inflation.

DailyFX analyst Tammy Da Costa says that Bitcoin has a significant rival. Ethereum 2.0 will drop the energy intensive proof of work consensus mechanism and adopt an environmentally friendly POS mechanism.

In addition, ether has an unlimited supply and a token burn mechanism that makes it deflationary and gives it higher utility as a medium of exchange.

Be that as it may, BTC will maintain its status as an inflation hedge in the future. Both gold and bitcoin have a relatively low correlation to equities and fixed income. This is because they act as stores of value.

High ether values

Ethereum, Bitcoin’s rival, serves as a record for financial transactions and a smart contracts platform. It is an open-source platform; hence, anyone with coding skills may create decentralised applications like the Uniswap decentralised exchange or online games like Axie Infinity. There are about 203 Ethereum-based Defi-apps and over 2,855 dApps on the platform.

Ethereum will continue to rise since it is the beating heart of the decentralised finance ecosystem. DeFi supports investment and savings without the support of conventional institutions like banks.

Its trustless systems have a $190 billion total value locked, and Ethereum’s DeFi stack is a large part of this massive market that has enormous potential.

Pundits predict that ether’s values could skyrocket to $50,000 by 2030 due to its applications in DeFi. The Ethereum network’s native token will enjoy a 10x price in value since it is also a vital asset in the growing NFT and metaverse sectors.

Then, a network shift to a PoS network will make it scalable, bringing the sector closer to the ‘flippening’. The flippening will occur when ether’s price overtakes BTC prices.

DeFi as the future of cryptocurrency

Decentralised finance is one of the most exciting innovations of the 21st century. DeFi offers its users open, easy to access and transparent investment, lending, borrowing, stablecoin and crypto-asset storage protocols.

Its protocols pose a significant challenge to the legacy financial system since they do not incur the former’s high intermediation costs. Consequently, this sector’s credit is affordable, secure and instantaneous.

More so, DeFi democratises finance and treats all its users equally, lowering inequity. Its systems are the future of cryptocurrency innovations because they could help bank the unbanked.

There are over 1.7 billion unbanked adults globally, and DeFi protocols can financially liberate these masses. Additionally, these platforms can empower the disenfranchised communities through governance and participation incentive protocols.

Data shows that the cryptocurrency market is already breaking down financial barriers that lower financial inclusion. As an illustration, the digital currency market is the only investment sector with higher participation metrics amongst young adult investors than the old.

It also breaks down the racial barriers that disenfranchise minorities. Data shows equal ownership in crypto assets amongst all races in the U.S. The sector is still in its fledgling state but could rise to a formidable industry by 2030, making Defi governance tokens such as COMP or UNI highly valuable holdings.

Conclusion

The future of cryptocurrency is bright as mainstream adoption occurs. As a result, investors that make early stakes in blockchain technology will reap higher returns on investment. That said, thorough research should precede any forays into the sector.