|

|

Investors |

Investments |

Founded |

Country |

About Fast Invest

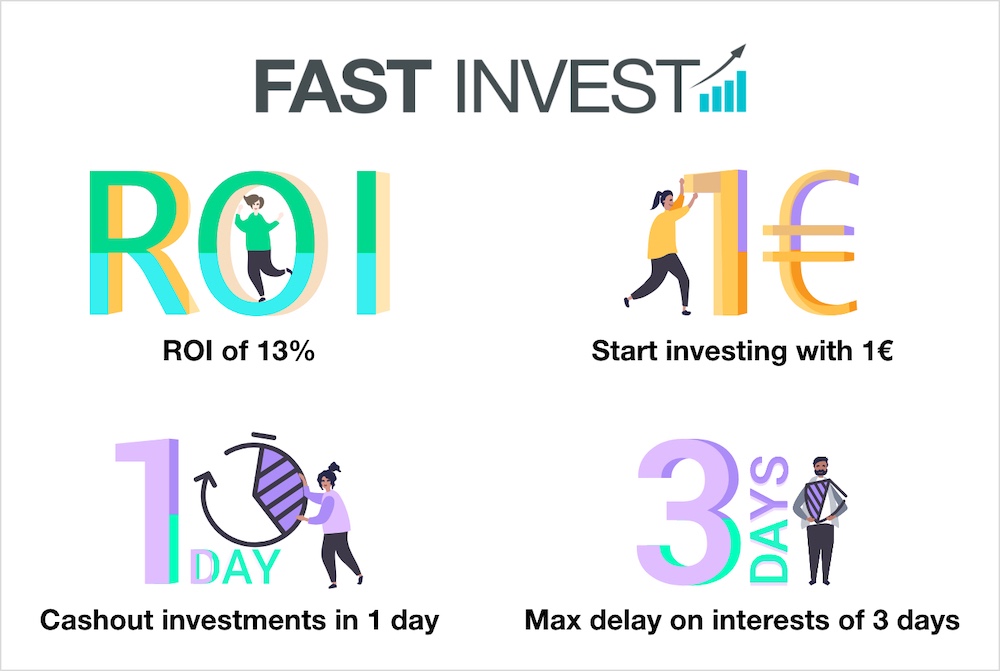

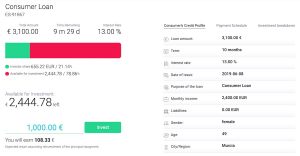

IntroductionFast Invest is a peer to peer lending platform allowing to invest in consumer loans across the European countries Denmark, Spain, Iceland, Russia and Poland. All the loans have BuyBack guarantee that pays the principal investment and the interests if the borrower defaults to pay after minimum 3 days – maximum 60 days (the industry standard is 60 days). The investment term range from 1 to 18 months. When selecting an investment, generic information are provided such as loan details (e.g. ROI, term, amount) and repayment schedule (principal and interests). In addition, the platform offers two unique selling propositions:

How it works

PerformanceInvestments at Fast Invest generate an average ROI of 12.04% with available loans reaching up to 13% of ROI. The interests are pays on a monthly basis and the principal amount is usually amortized multiple times during the investment period. SafetyHere are the different procedures offered by the platform to make it safer:

|

Advice

| Fast Invest is a platform ideal for new crowdfunding investors: It is really simple to use. Investors just need to setup their auto-invest functionality and the platform will take care of investing the money.

Their Auto-invest has a unique feature: you can set-up the end date until when you want your money to be invested. The tool will invest the funds only in the loans that end (including Buyback days) before the set date. It makes sure that on the planned date your money will be in the available funds. The return rate of in the market average (12% ROI) and the loans come with the above-explained BuyBack guarantee and MoneyBack guarantee which makes a great difference compared to the standard secondary market. So you don’t have to care about the loan term and you can get back your invested cash when you want. Another good point of this platform is that they are growing internationally, with offices in the UK and Lithuania. The investments that they offer can be made in the following countries: Spain, Poland, Iceland, Russia and Denmark, which allows a good diversification between different regions of Europe and not only in East Europe as many other platforms do. I thus strongly advise you to add Fast Invest to your portfolio. The downside of this platform is that we don’t have clear visibility and information about some of the loan originators. But the ones that we see on FAST INVEST are offering better Buyback terms here than on other Platforms:

Repayment Guarantee means that in case the borrower is late by 7 days, the lender will pay the late payment in 7 days. |

Pros & Cons

| Pros | Cons |

| + Exit anytime (sell to FastInvest) + High-interest rates (~12%) + Repayment of part of loans before term + Buyback guarantee on all loans + West-Europe investments (e.g. Denmark) + Auto-invest available |

– Medium-sized platform (lower track record) – Small loans information – Only few visible loan originators – No cash-back investments |

Investment details

| Investment currencies | EUR, PLN | |

| Return on investment (ROI) | 12.04% | |

| Minimum investment | € 1 | |

| Investment period | 1 – 18 months | |

| Default rate | 0% | |

| Investment fees | 0% | |

| Skin in the game (of loan originators) | 5-10% | |

| BuyBack guarantee | Yes (3, 7, 15 or 60 days) | |

| Auto-invest | Yes | |

| Secondary market | No (but you can sell back your loans to the platform) | |

| Trustpilot Score (Safety) | 8.6/10 |

Investment types

Investment example

|

Investment result forecast

|

Below you will find the resulting forecast when investing using Fast Invest compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years). By investing €1’000 using Fast Invest for 15 years you might end up with €5’852 (€3’455 more than with the stock market). Chart by Visualizer |

Welcome bonus – affiliate/referral link

| You can register to Fast Invest by clicking the button below. It will be highly appreciated. Thanks! |

Similar platforms

|

|||

| View the list of all the platforms | |||