Every new trader is searching for the hidden key to quick success. However, there is no secret formula to instant crypto trading success. You can only attain digital currency success through a combination of strategy, tools, and some luck. One of the most effective crypto trading tools is crypto trading bots.

Crypto trading bots are automated computer programs that buy and sell digital assets on a trader’s behalf. They automatically execute trades as per pre-set conditions to ensure that you maximize returns.

Why using a crypto trading bot?

Digital currencies are extremely volatile, and their prices can shift drastically in seconds. Therefore, traders need to react swiftly to their positions to maximize their profits in this roller-coaster market.

Bots react to the market’s movements while you are asleep and close that deal right on time without any human assistance. Unlike humans, crypto trading bots make fewer errors. For example, they will not react to FOMO or FUD-driven emotional trading like humans do.

Professional traders leverage them to make risk-adjusted returns. Crypto risk-adjusted returns calculate profitability in the context of the risk involved in the purchase or investment decisions. Higher stakes should offer higher returns and vice versa.

Bots generate profit at a higher risk-adjusted ratio than simple HODLing or holding crypto assets in your wallet for future profits. On top of that, digital currency trading bots consider risks such as volatility.

They will make investments in a downturn and offload risk in an upturn. Consequently, with the aid of a bot, market volatility will work in your favor. In addition, they will offer consistent minute risk-adjusted profits, ensuring that you generate compounded returns.

Types of crypto trading bots

There are four main crypto trading bot sources in the market.

Type of bot | Cost | Skill level | Examples |

Open-source scripts | Free | Professional | Zenbot, Gecko |

Free trading bots | Freemium | Beginner | Pionex, Cryptohopper,Trality |

Paid trading bots | Premium | All levels | Bitsgap, Cryptohopper |

Quant funds | High fund minimum | Professional | Pantera Capital, Coin Capita. |

Open-source scripts

If you are tech-savvy, visit code repositories such as Github and download open-source bot code such as Zenbot or Gecko. Then, compile it, integrate your wallet, and trade. Open-source bots are simple. They may only have a few core components such as an algorithm, storage, web server, and an interface development tool.

Zenbot is one of the most popular open-source bots since it has full Binance, Gemini, Kraken, and eight other popular crypto exchange support. In addition, Zenbot provides technical analysis and has a backtesting simulator.

You will need to have some JavaScript skills to run open-source bot code. On top of that, open-source trading bots are command-based, so you will not access a user interface.

Free trading platform bots

There are automated trading platforms that offer high utility, free, and easy-to-use trading bots. These bots have an intuitive user interface, and some even boast of their homegrown cryptocurrency exchange liquidity.

They are also safer and more reliable than most open-source bots. As an illustration, the Pionex platform has 16 free retail investors bots. The beauty of such bots is the ease of access to liquidity, low trading fees, and advanced inbuilt trading features and strategies.

Premium trading bots

Join a platform such as Bitsgap and use their premium bots. These platforms offer diverse crypto trading bots with trading charts and crypto pairs analysis.

On top of that, they integrate with most crypto exchanges and supply lots of trading indicators for strategy development. They also have pre-trade test settings, wallet security, and an easy bot strategy setup process.

Use Quant funds

Quant funds leverage the power of bots and data scientists to analyze and predict market movements. They, however, have a high fund minimum that makes them unsuitable for regular crypto traders. Some good examples of crypto hedge funds include Pantera Capital and Coin Capital.

How do crypto trading bots work?

Crypto trading bots automate trading strategies. Their algorithms blend smart technologies such as machine learning and artificial intelligence with techniques such as coin lending, arbitrage, margin trading, market maker, or leveraged trading.

These bots then connect to cryptocurrency exchanges and analyze market data while predicting risk. Then they will buy and sell crypto assets as per their algorithms when all market conditions are just right.

When a bot connects to a crypto exchange, it will watch for specific events then send you a signal when it is time to make a trading decision. Some traders may automate decision-making so that their bots buy or sell on their behalf.

Crypto trading bots function via three main processes.

Signal generator

The signal generator makes predictions. Crypto trading bots scan raw data from various sources and choose whether to sell or buy. First, they will input data into the signal generator. Some bots allow users to customize the type of data that the signal generator has access to for refined results. After inputting data, a buy or sell signal pops out from the other side.

Risk allocation

The risk allocation process will aid the crypto bot in weighing trading decision risks. The risk allocation protocol then takes the buy or sell signal and determines the volume of assets that it will purchase. In addition, this protocol will stipulate the volume of capital it will allocate for a specific trade.

Execution

The execution module leverages platform APIs to execute trades strategically. The execution phase is what makes the open-source bot a bad idea. Say you have found a profitable open-source crypto bot. Then 1000 other traders find it as well. The bot will execute all your trades using the same algorithm. It will optimize all 1001 trades using the same risk allocation processes, causing unfavorable pricing.

What are the characteristics of a safe crypto trading bot?

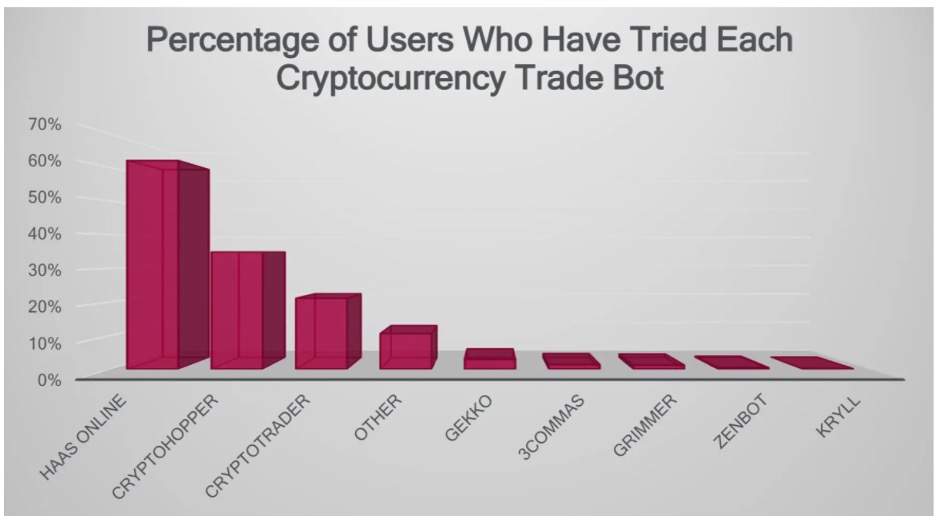

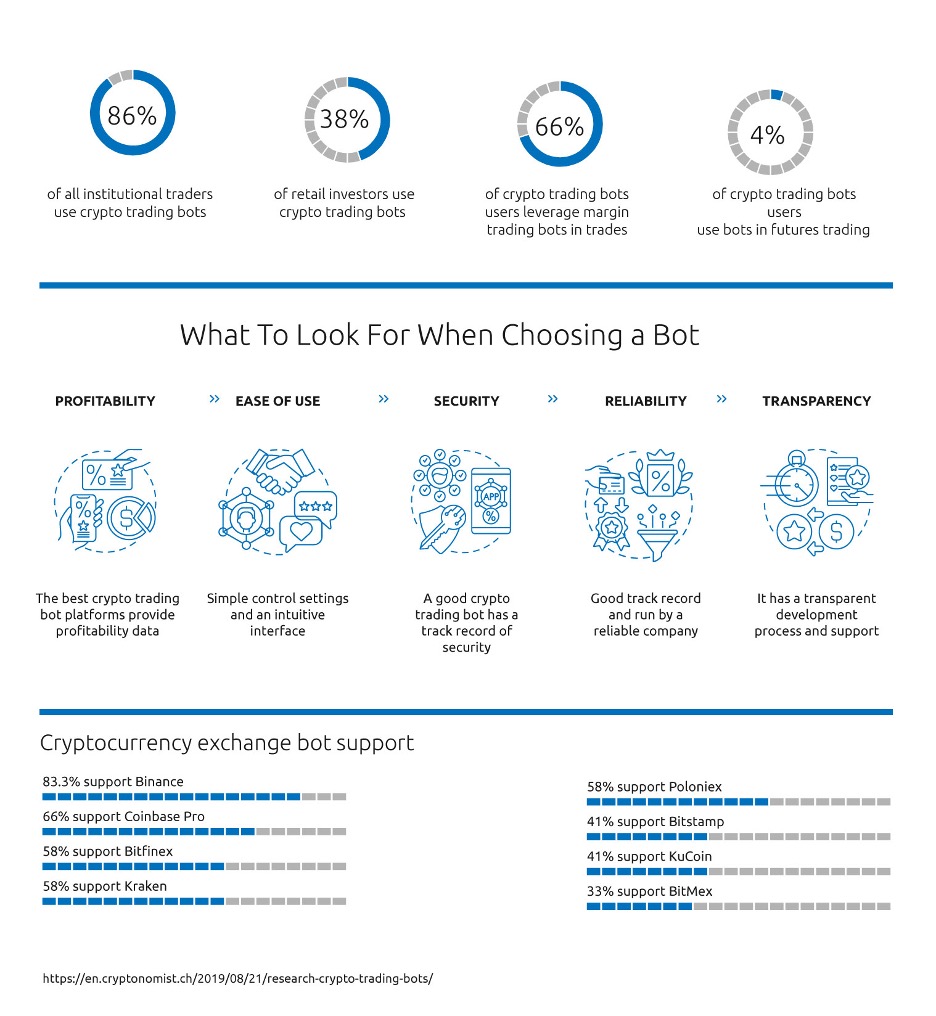

Research shows that over 86% of all institutional traders use a crypto trading bot in their day-to-day trading. In contrast, 38% of retail investors use trading bots to automate a trading strategy.

There is a lower bot use amongst retail retailers due to a lack of trust. In addition, most crypto bots access user private keys, placing investor capital at risk. Retail users also avoid bots due to software-related programming errors that cause massive losses.

Has backtesting features

You should back-test your crypto trading bot of choice against historical trading data. Backtesting is a process that displays just how well a model would function in a real-world scenario. Use genuine slippage, latency, and trading fee high-quality data via crypto exchange APIs to test your bot.

Has strategy implementation

Your bot should have a robust trading strategy to guide its operations. Back-test your design as well to test its performance.

Real-time execution simulation features

Your bot should easily convert your strategy to an API request that any cryptocurrency exchange can decode. The best bots simulate your trading strategy in real-time but with fake crypto assets.

Job scheduler

This feature supports real-world testing of trading strategies. In addition, it will fully automate your trading strategy and set up a scheduler that executes it.

Exchange support

The best bots integrate with a wide variety of exchanges. Binance has the highest crypto trading bot support of all cryptocurrency exchanges. Over 83% of all bots support the Binance exchange, while 66% and 58% of automated crypto trading bots support Bitfinex, Kranex, and Poloniex.

Over 66% of crypto trading bots users leverage margin trading bots in trades. In addition, 4% of them use bots in futures trading. Market maker strategy bots such as Cryptohopper are the gateway to crypto bot trading.

Best applications for crypto trading bots

- When you have repetitive trading tasks such as hourly portfolio rebalancing

- When you need to execute trades with accuracy at the right window.

- When you do not have adequate time for 24/7 trading and want to keep trading during your personal down time.

- When you need to simplify complex trading strategies such as “smart order routing.”

What strategies do crypto trading bots use to auto-invest?

Crypto trading bots can automate and accelerate the trading process by utilizing algorithmic trading. They will process complex mathematical formulas and consider a carefully reviewed strategy when executing trades.

To this end, a trader that has excellent trading skills and experience will make the most profits when using crypto trading bots. Below are some algorithmic trading strategies that bots utilize during the risk allocation and execution phase.

Trend following strategy

This is the simplest strategy as the bot only reacts to direct changes in the market price. This approach does not use sophisticated algorithms, analysis, or complex AI.

Algorithmic trading bots

Algo trading bots such as Traility leverage statistics, math, and other data to automate a complex trading strategy. Use algo bots to execute advanced buy and sell trades that leverage market signals.

Market making bots

Market-making crypto trading bots such as the HaasBot or Cryptohopper can place quick buy and sell orders for a quick profit. This strategy allows traders to earn from the spread by trading large volumes of assets.

Arbitrage

An arbitrage bot compares prices on different crypto exchanges around the world. Naturally, prices will vary from one exchange to another. Although it is not a sure bet, traders can utilise arbitrage bots to simultaneously purchase cheaply on one exchange and sell on another at a higher price. Blackbird Bitcoin Arbitrage is an example of an open-source C++ arbitrage bot.

Coin lending bots

These bots will lend your crypto assets to other traders as credit. You will, in turn, earn yield from the loan’s interest rate payments.

Technical Trading Bots

Technical Trading Bots such as the 3Commas bot are the most popular crypto trading bots. They study market signals, analyze indicators, and predict cryptocurrency future price movements.

Market correction strategies

You can adopt and design diverse strategies with a crypto trading bot during a market correction. A correction occurs when there are drastic asset price decreases. Corrections are a great way for investors to buy assets ‘on sale.’ However, it is challenging to predict when the next market correction will occur.

A crypto trading bot that has a robust strategy can take advantage of market corrections. As an illustration, it can utilise the reversion strategy and dollar-cost averaging (DCA) to reap huge rewards from a correction event.

This strategy works by identifying a crypto asset’s upper and lower price limit. Afterward, the algorithm executes orders when the price goes above the normal range. Its users will scoop profits when prices make a new high or low. However, investors should be careful as prices may take a long while to reverse.

Use case of a bot: 3Commas

3Commas is a crypto trading platform that has crypto trading bot features. It has a daily trading volume of $10m, is currently used by over 33,000 traders, and supports 13 exchanges, including Binance, Kraken, Huobi, and Bitmex.

The 3Commas bot allows users to reap the benefits of automated trading irrespective of their knowledge and experience in crypto trading. Furthermore, traders who are hesitant about creating individual trading parameters can copy other traders’ bot setups.

Choose a trader that has an attractive portfolio. Analyze their historical profit and losses data, their choice of trading pairs, and volume. Review their strategy, then copy it via the 3Commas bot.

After connecting 3Commas to your exchange account, utilize its smart trade feature’s TradingView indicators for your technical analysis. Use it also to set up your bot’s trading preferences to match your crypto trading experience.

The trading orders feature, for instance, adjusts a trader’s stop loss and profit-taking automatically by analyzing market conditions. To this end, if you set your trading order to exit a trade when bitcoin goes down by 10%, the smart trade protocol will exit the trade immediately after the price drops by 10%.

However, if the prices surge, contrary to the norm (having a fixed profit take order), the trailing order will adjust your stop-loss parameters.

The 3Commas bot also allows you to execute short orders (sell higher, but lower). For example, you can utilize it on short sale orders if you think a crucial support level will occur at a certain price. Then, your bot will sell your holdings and execute a short order at that price. Consequently, you will earn profits in a bear market.

Additionally, its smart sell feature allows traders to sell assets and buy them later if they speculate that the price of their holdings is about to go on a short-term decline. The 3Commas bot will execute this level of trade on your behalf and automate your dollar-cost averaging strategy as well.

As an illustration, it can purchase a pre-defined amount of the digital currency of your choice every time its price drops.

Factors to consider when choosing a crypto trading bot

- The credibility of its development team. Look at their qualifications and portfolio management history. Other factors that you should study include the source of development funds and bot documentation to ensure that your bot’s development team is accountable and transparent.

- The Bot’s trading strategy should meet your trading automation needs.

- The best crypto trading bots have excellent support teams, continuous updates, and a vibrant user community.

- Paid bots may offer more trading features and better results, but they come at a cost. Weigh your options and risk/ reward ratio before making premium payments.

- Unless you have the technical savvy, choose bots that are easy to use. For example, beginner crypto traders should not start their journey by configuring a bot’s back-end or server.

Pros & Cons

Crypto trading bots’ pros

They are emotionless

Emotional trading can lead to massive crypto trading losses due to misguided decision-making. An emotional trader makes fast and half-cooked decisions due to fear, especially when crypto asset prices fluctuate drastically. In contrast, trading bots are emotionless and will carry out a trade fast when all pre-set conditions of a trade are fully met.

Efficiency

Man is to error. A human is more likely to miss or mess up a profitable opportunity than a trading robot. Also, humans are slow and may scan one exchange for ages, whereas a trading bot will scan several platforms simultaneously. It will then leverage all available opportunities to their advantage.

They are fast and work 24/7

Crypto market prices change drastically within a very short window. Bots work at all times, ensuring you benefit from any arising opportunity.

Crypto trading bots’ cons

Not easy to use

It would be best if you had a level of trading expertise to generate sustained profits from crypto trading bots. Most trading bots require specialized configurations to function at their best and loads of surveillance. These requirements can be challenging for a beginner trader that lacks a robust trading strategy and experience.

Risky

Trading bots communicate with other exchanges via API intermediaries. They are therefore vulnerable and a hotspot for hackers. You can improve your security by hiding your API key and not automating withdrawals. Also, review a bot’s security features before use.

They require monitoring

A trading bot works automatically, but it is crucial to monitor it from time to time. For example, a bot may fail to consider external factors like world events or breaking news that affect the market.

Conclusion

Crypto trading bots are an effective way to make passive income. Go with bots designed by financial analysts with a proven track record when making a crypto trading choice. Ensure that their bot has an ‘edge’ or special characteristic that makes it unique from regular crypto trading bot algorithms. If you feed them a good investment strategy, the best bots will supply constant risk-adjusted profits.