One common topic of discussion on crypto social media and forums are crypto arbitrage bots. What are they? How do they work, and are they profitable?

Cryptocurrency investors with a risk appetite that pushes them beyond pure HODLing, often wonder whether crypto arbitrage is a meaningful passive income generation process. Well, arbitrage is an old concept, and it has survived the test of time due to its profitability.

Arbitrageurs travelled up and down the Silk Road for over a millennium, exporting silk from China. They then sold it at a higher price to their wealthy European patrons. An arbitrageur is a trader that seeks profit from market inefficiencies.

Arbitrage opportunities lie in every market. For example, import cheap goods from Alibaba, sell them on Amazon at a higher price, and you have just practised arbitrage.

What is crypto arbitrage?

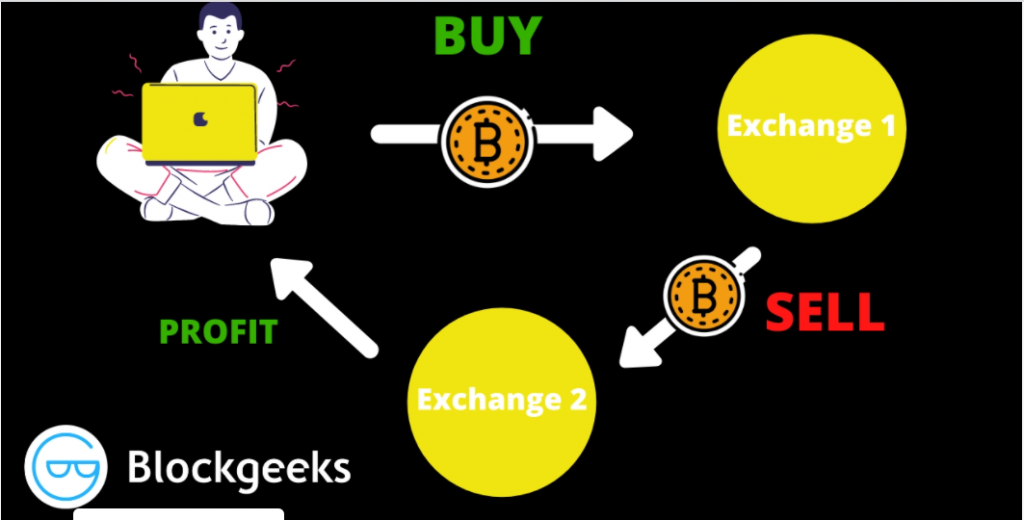

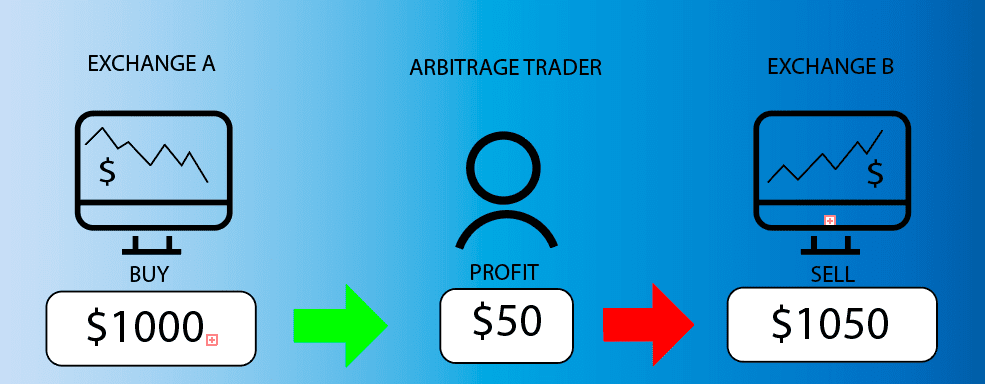

Crypto arbitrage trading is the side-by-side purchase and sale of crypto assets in multiple exchanges. Traders perform this practice to make a profit from crypto-asset price differences. Buy an asset low in one exchange and sell at a higher price elsewhere.

Crypto arbitrage is relatively a low-risk strategy. It, therefore, has many takers. Traders can make low-risk returns by simply capitalising on the most minute of price disparities across exchanges or assets.

Consequently, crypto arbitrage has a lower entry barrier than day trading. Day traders have to make in-depth technical analyses before trade execution. On the other hand, crypto arbitrageurs only need to spot differences between digital assets then make their move.

Then, the cryptocurrency market has high volatility levels. So it follows that arbitrage opportunities here are significantly higher than you would find in other financial markets.

In theory, arbitrage is a low-risk process that does not require professional crypto investment skills. However, in practice, it is anything but. Why is this?

How crypto arbitrage bots make a profit?

While easier to master and less risky than day trading and swing trading, crypto arbitrage profits are bound to speed of trade execution. First, this is because cryptocurrency exchanges are high-speed electronic trading platforms. Second, they have diverse sellers and buyers seeking to profit from arbitrage opportunities.

Consequently, the arbitrage trader is highly vulnerable to execution and slippage risks. To illustrate this point, let’s say trader A manually submits his order to an exchange. First, manual trading is not as fast as automated crypto arbitrage bots trading is.

Then, the cryptocurrency market asset prices fluctuate significantly and rapidly over short periods. This phenomenon occurs across hundreds of exchanges, 24/7 generating massive arbitrage opportunities.

Consequently, the manual arbitrage trader’s slow execution speed could cause loss of opportunity due to slippage. Slippage is the difference between the sale price of an asset and its value at arbitrage trade execution time.

If you performed your trade at low speeds, you could find that opportunity gone. On top of that, you might have very tight margins that present little or no profit. In addition, losses can creep in when you consider costs of exchange and network transactions.

On the other hand, arbitrageurs that trade low volume altcoins could encounter higher slippage. Consequently, they could sell at unfavourable prices due to execution risks. Throw in exchange lag times, and the manual arbitrage trader will often trade in the red.

It follows then that price volatility acts as a double-edged sword. Volatility presents a massive arbitrage opportunities. Yet, it does not favour the slow human trader or slow trading systems. To this end, speed is everything in crypto arbitrage.

For this reason, crypto arbitrage bots are some of the most sought-after crypto trading bots. It is safe to say that you cannot profit without the aid of crypto arbitrage bots.

The cryptocurrency market’s opportunities attract well-heeled players. These big league players leverage technology to ensure that the scales are leaning in their favour. As an illustration, deep pocked CEX arbitragers run their crypto arbitrage bots on the same cloud service as popular cryptocurrency exchanges.

Centralised vs decentralised exchange arbitrage trading

Centralised exchanges (CeXs) leverage the order book system. Consequently, the bid-ask process determines the pricing of assets. As a result, the exchange order book’s most recent buy or ask bids set their asset’s real time price.

If a seller matches a 50ETH order at $2500 per coin, that becomes the exchange’s ETH latest price. A subsequent matched order will determine the next price of ether on that exchange. Consequently, CeXs have a continual but dynamic price recovery process. These prices vary across CeXs due to demand and supply forces from investors.

Decentralised exchanges (DeXs), on the other hand, leverage the automated market maker (AMM) process. The DeX, therefore, does not match trader orders to an order book. Instead, their smart contract protocols create liquidity pools from their liquidity provider’s crypto assets.

Each crypto asset trading pair has its unique liquidity pool. In the absence of a bid/ask matching process, the users can execute their trade instantaneously at all times due to easy liquidity access. Liquidity pools run as a pre-set algorithm or formula.

The formula keeps crypto-assets in the pool at a balance. For example, if borrowers wish to borrow ether from an ETH/MATIC pool, they would have to deposit MATIC in the pool to access ETH. This trade will cause an imbalance to the 50/50 ETH/MATIC balance lowering MATIC prices and increasing ETH prices.

Crypto arbitrage traders will then step in and purchase the cheap MATIC. They will, in turn, add more ETH to create a 50/50 balance between the trading pair. Consequently, the arbitrage opportunity will realign ETH and MATIC prices with the larger market. The AMM system is therefore highly dependent on crypto arbitrage traders.

Types of crypto arbitrage strategies

Simple cross-exchange arbitrage

A trader will, for instance, purchase Bitcoin at Coinbase at $30,000. They will then sell it in another exchange, say Binance, at $30,005. Their profit will be $5.

Spatial arbitrage

Spatial arbitrage is a cross exchange arbitrage strategy. Its practitioners, however, pursue arbitrage opportunities across exchanges in disparate regions. As an illustration, you could exploit the price difference between North American BTC sellers and South Korean “kimchi premium” BTC buyers.

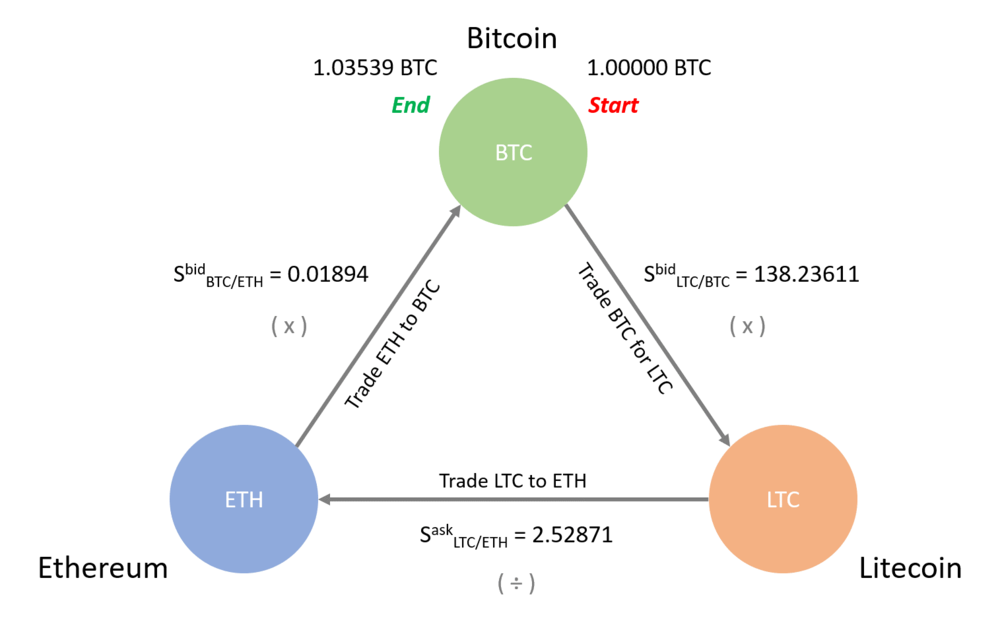

Triangular arbitrage

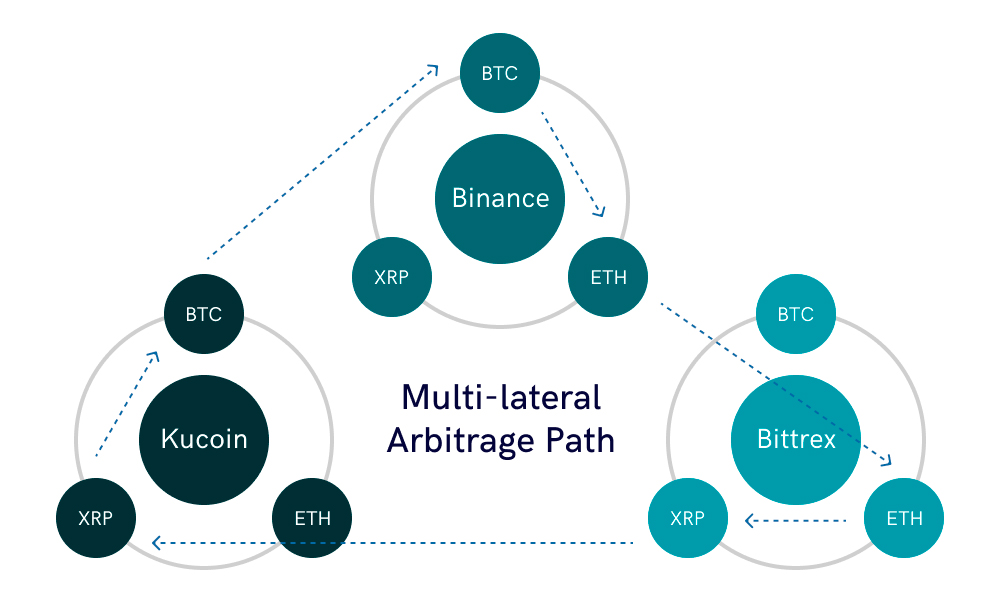

A crypto triangular arbitrage strategy exploits the arbitrage opportunity between three different crypto assets. Triangular arbitrage takes place on one exchange.

To paint a clear picture, let’s say that your choice of three arbitrage assets is the stablecoin USDT, then MATIC and ETH. Trade your USDT/ETH pair, then purchase an ETH/MATIC pair. Afterwards, trade a MATIC/USDT pair, and you could have more USDT at the end of the trade.

Decentralised arbitrage

Arbitrage traders profit on AMMs by purchasing lowly priced cryptocurrencies from liquidity pools. They will then replace them with higher priced assets to create price and asset balance in liquidity pools.

Algorithmic arbitrage

This strategy leverages crypto arbitrage bot’s computational and statistical. It is, therefore, a high-frequency trading strategy that traders enact to maximise arbitrage profits.

How to use crypto arbitrage bots

Most cryptocurrency exchanges support crypto arbitrage bots. There is a wide range of arbitrage bot platforms, but they often charge a subscription fee.

Crypto trading bots connect to exchanges via an API. They will then automatically track numerous markets and buy or sell crypto assets per pre-set strategies. To use crypto arbitrage bots, first fund your preferred cryptocurrency exchange accounts.

Funds ensure that your bot will execute your trades on different exchanges instantaneously and simultaneously. A well-funded account lowers fund transfer fees and execution risks.

You will not suffer execution risks if you are performing DEX crypto arbitrage. DEX functions as per their underlying blockchain’s block time and speed. Therefore, your downside with DEX crypto arbitrage trading is gas fees. A DeX’s network block times level the playing field between arbitrageurs.

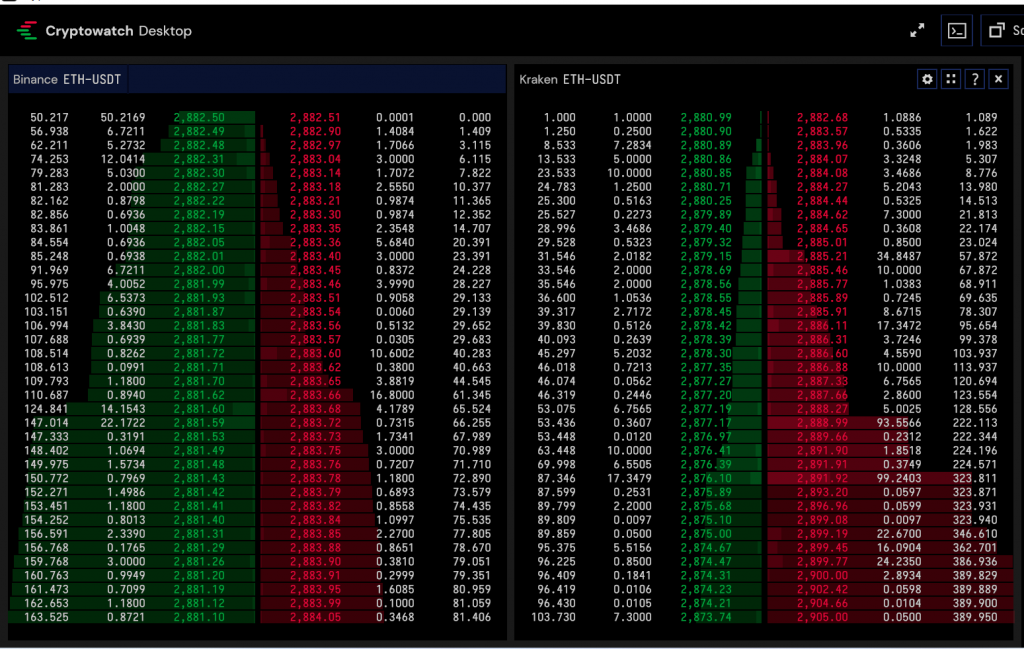

Use case: Kraken and Binance

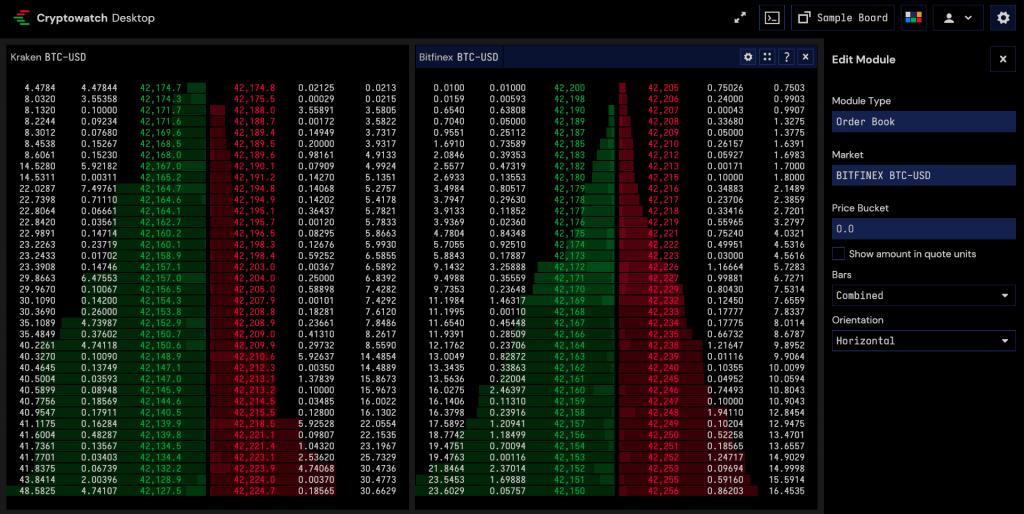

You will find crypto arbitrage opportunities on an exchange’s order books. So, if the best available bid on one exchange is higher than the best available ask price on another exchange, you could leverage this as an earning opportunity.

The image above illustrates an arbitrage opportunity on the ETH/USDT pair on Kraken and Binance. Each of these exchanges’ buy/sell orders is presented in three columns. The bid price on each exchange is highlighted in green. The ask price is in red.

On the Binance exchange order book, for instance, the top order on the green column shows an ETH bid price of $2,880.50. You can therefore buy ETH on Binance and sell it on Kraken for $2,888.68. You will make a minute profit of $8.18 on the 1.0086 ETH order.

To determine just how much ETH volume you can trade at Kraken, simply match the price of $2,888.68 to the Kraken sell order book. A high-volume crypto arbitrage bot trader could, for instance, take up Kraken’s 11th order of 34.8487 ETH for $2,885.21. It will buy cheap ETH on Binance for as low as $2,881.59 to perform arbitrage on Kraken.

The only catch is that you cannot execute this trade manually because the trading opportunity between those exchanges opens and closes at the speeding of light. However, an excellent crypto arbitrage bot will spot, make all necessary computations and execute this arbitrage opportunity.

Tips for Crypto Arbitrage Trading

Crypto arbitrage bot’s algorithms will spot short-living arbitrage opportunities and present them to individual investors that seek to mint profits alongside the big boys. Automation and software will conduct and execute arbitrage on your behalf per your pre-set limits and rules. Use the tips below to perform profitable crypto arbitrage trades.

- Use a clear trading strategy and keep your trading volumes low when dealing with highly volatile pairs to ward off execution and slippage risks.

- Your bot should have access to pricing data from popular aggregators and leading exchange APIs such as Cryptowatch trading terminal by Kraken, Binance API, coin market cap API, Coinbase API for effective arbitrage trading.

- Incorporate a wide range of pairs and trade on multiple exchanges to spread your risks and opportunities. Some crypto arbitrage bots can integrate with tens of exchanges at a go. A crypto arbitrage bot platform that has access to a large number of exchanges can enhance profit generation by 4% to 10%.

- Crypto arbitrage trading is a highly repetitive process, so build your crypto arbitrage bot or use ready to go, programmable software such as Cryptohopper or Bitsgap bots.

- If you are tech-savvy, you can develop your arbitrage trading bot using the open-source bitcoin bot, Blackbird.

- To ensure that the pricing spreads work in your favour, keep your trading fees as minimal as possible. Some crypto exchanges have high withdrawal fees.

- Your profit could also fall prey to high gas fees on congested networks like Ethereum. On the other hand, arbitrage trading on scalable networks is less costly.

- Trade the less popular cryptocurrencies since they have wider price differences between exchanges to make the most out of crypto arbitrage trading.

- Bitcoin and ETH may not earn you as much since they are popular arbitrage opportunities, and their prices between exchanges are barely different. That said, trading in highly liquid markets has its benefits. These crypto-assets have sizable order books and less slippage.

- Last but not least, ensure that you are eligible to trade on your choice of exchange before executing trades. This process will prevent execution risks.

Advantages and disadvantages

Advantages

- Crypto arbitrage bots execute trades in seconds and work more efficiently and faster than human traders.

- They take pressure off the trading process

- They provide quick, consistent profits

- The cryptocurrency market is on 24/7, and bots present opportunities spread over hundreds of exchanges. More so, there are over 4000 crypto assets, each offering a unique arbitrage opportunity.

- The crypto market is naturally volatile and is the perfect crypto arbitrage bot playground.

- The immaturity of the crypto markets sector also creates excellent arbitrage opportunities, especially on new coins.

Disadvantages

- DEX crypto arbitrage bots are susceptible to vices such as front running.

- Constant and high-volume crypto arbitrage bot trading requires large amounts of capital.

- High exchange and network fees can eat into potential profits

- Arbitrageurs are vulnerable to hot wallet risks.

- Less experienced traders may fall for Pump and Dump schemes and purchase illiquid tokens.

- Crypto bot arbitrage is a stressful trading strategy because it requires constant monitoring

Top crypto arbitrage bots

Pionex

Pionex offers its users a free arbitrage bot and prices as low as 0.05% for the premium arbitrage package bot. With these bots, you can execute spot-futures trades between Huobi and Binance.

Spot future trading holds a short position within the perpetual futures market. These bots will hold on to the trade while trading crypto arbitrage with market-neutral positioning. The bot only arbitrages ETH coins.

Coinrule

Coinrule is compatible with the most popular exchanges and has top-notch security and encryption. It is easy to use and offers one on one trading tutorials. In addition, it provides various market indicators, custom rules settings, real-time customer service, among other features.

Cryptohopper

Cryptohopper is a crypto trading platform that allows you to earn profits between various pairs on the same crypto exchange. In addition, these bots can execute complex triangular arbitrage strategies.

You can also earn from cross-exchange arbitrage, which gathers opportunities across exchanges without sending an asset from one exchange to another.

Bitsgap

The Bitsgap platform can integrate with 25 exchanges. It has a demo bot and offers arbitrage opportunities from multiple exchanges in one easy to use interface. However, you will require deposits in these exchanges to keep your high-volume trades profitable.

Final thoughts

Be careful when choosing crypto arbitrage software. Avoid platforms that have unknown developers for the safety of your funds. Additionally, use crypto arbitrage bots platforms compatible with the most popular exchanges like Coinbase, Binance, Kraken or Gemini. A platform that has a reliable and massive community is a huge plus.