P2P lending (also called Peer-to-peer or Crowdlending) started in early 2000 and has slowly transformed the financial landscape. It is quite popular among investors as it provides a fantastic opportunity to earn enormous returns and diversify the portfolio. In this guide, we will discuss the best P2P lending platforms in the US.

To learn more about p2p lending in details, you can check our article Crowdlending Guide.

If you are looking for p2p lending platforms, then you can read this article: Best Crowdlending Platforms in Europre.

Comparison of the best P2P lending platforms

The table below compares the best peer-to-peer lending platforms in the United States.

Rank | Name | APY | Min invest | Term | Type loans | For who |

1 | ? | $1 | 2-7 years | Personal, Auto, Home, Student | US citizen | |

2 | 5.6% | $25 | 3-5 years | Personal | US citizen 80-85K income | |

3 | 5-7% | $25 | 3-5 years | Personal | US citizen Accredited investor | |

4 | 4.5-6.5% | $500 | 6 months - 5 years | Business, Real Estate | US citizen Accredited investor | |

5 | 7% | $100 | 3-5 years | Personal | US citizen Accredited investor | |

6 | 5% | $25 | 3 months - 3 years | Business | US citizen Accredited investor | |

7 | 6-9% | $100 | 6-24 months | Real Estate | US citizen Accredited investor |

Figure: Comparison of the Best Peer-to-Peer Lending Platform in the U.S.

Details of the Best P2P Lending Platforms

SoFi

SoFi or Social Finance is one of the best P2P lending platforms in the United States. The company was founded in 2011 by four Stanford Graduate School of Business students in San Francisco.

Types of Loans offered by SoFi

Investors can invest in the following types of loans offered by SoFi.

- Personal loans

- Home improvement loans

- Family planning loans

- Travel loans

- Wedding loans

- Student Loan Refinancing

- Credit card consolidation loans

SoFi allows diversifying portfolio by investing in various options.

How much investors can earn by investing in SoFi loans?

It is not publicly disclosed by SoFi, how much an investor can earn by investing in SoFi loans.

Who is eligible to invest in SoFi loans?

To become an investor on SoFi, one must be a citizen or permanent U.S resident.

Fees

In most cases, neither the borrower nor the investor has to pay fees to the platform.

How to start investing on SoFi?

Investors can visit the platform to refinance the loan of their choice. SoFi allows refinancing federal & private student loans and personal loans.

SoFi is an all-in-one platform that allows investors to invest in active trading, automated investing, and retirement accounts. With Automated (Robo account), investing is done automatically; investors will only pick the portfolio. With Active (Self-Directed account), the investor will play the role of an active investor, manually picking out stocks ETFs and placing the trade.

What are the risks associated with investing in SoFi loans?

The following are risks associated with investing in SoFi loans.

Federal Loan Refinancing

The platform recommends being careful in the case of federal loans because these loans come with certain protections that SoFi does not support.

Prosper

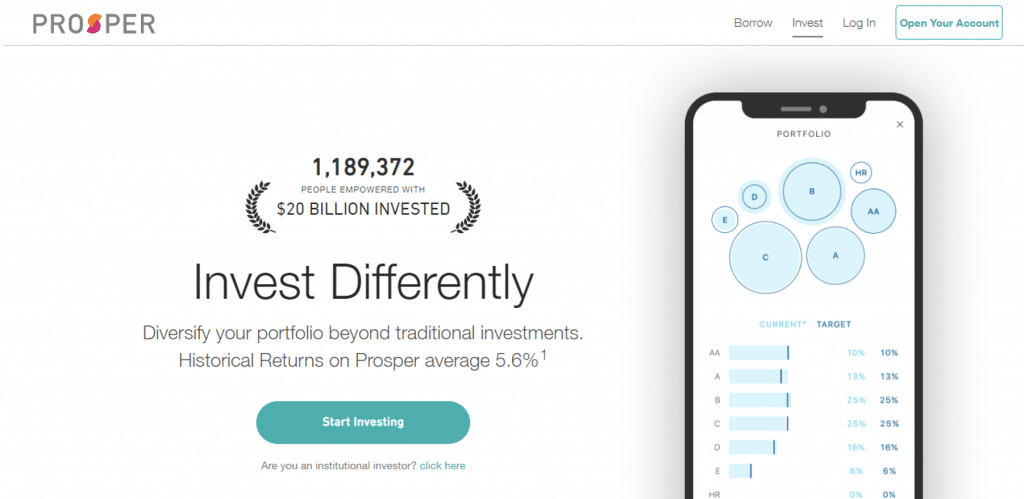

Prosper is one of the world’s first-ever peer-to-peer lending platforms, founded in 2005 in the U.S. More than 1 million people have been empowered with loans worth $20 billion. Prosper offers a fantastic opportunity for investors to invest in loans at the platform.

Types of Loans offered by Prosper

Investors can invest in the following types of loans offered by Prosper.

- Debt Consolidation

- Home Improvement

- Auto and vehicle loans

- Small business loans

- Medical and Dental loans

- Special occasion loans include weddings, vacations, baby & adoption, etc.

They can invest in fractions of loans.

How much investors can earn by investing in Prosper loans?

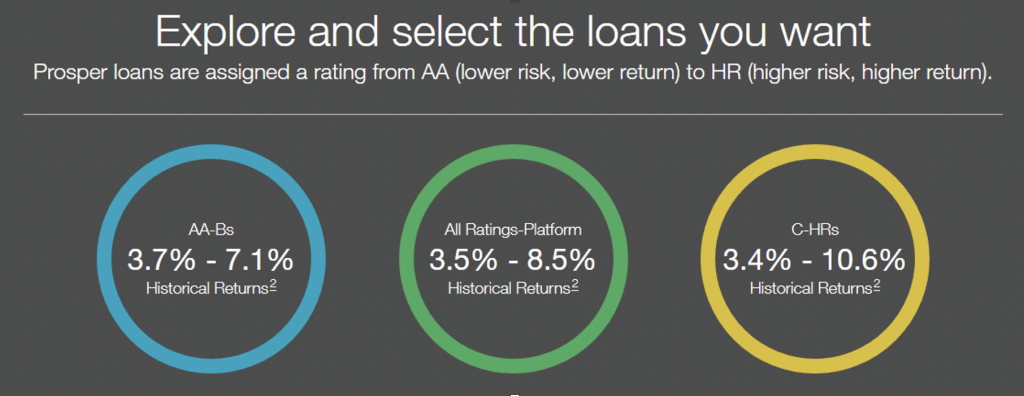

Prosper offers average historical returns of 5.6%. However, the amount investor can earn depends on the risks he will take, the amount he has invested, and how well he has diversified his investment portfolio. According to Prosper, around 84% of all investors on the platform meet or exceed their expected returns on their investments.

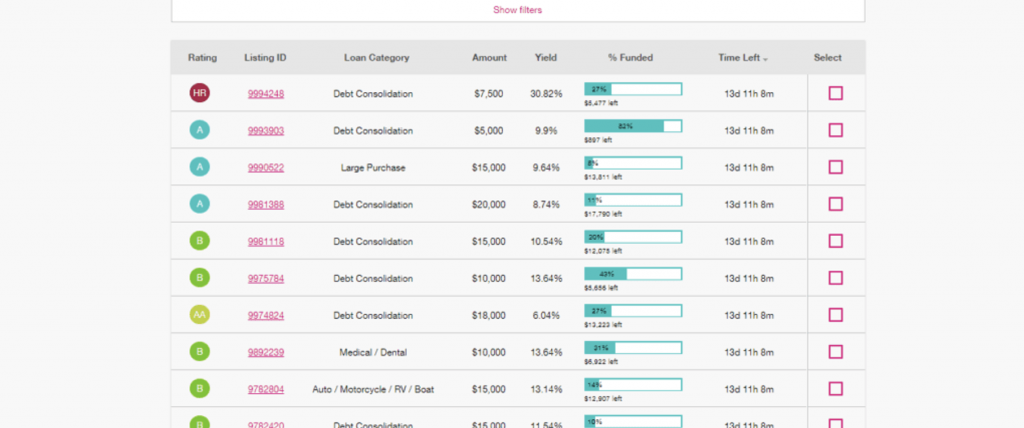

The following figure shows the historical returns on loans with risk grades, among which investors can choose to invest.

Historical Returns are based on actual payments (other than principal) received by the investor net of fees and losses (including from charged-off loans). AAA-Bs (Lowest risks), C-HRs (Higher Risks)

Who is eligible to invest in Prosper loans?

To become an investor on Prosper, one must:

- Be a citizen or permanent resident of the US.

- Be above 18 years of age.

- For residents of California, the investor must have a gross income of at least $85,000 in the last year and expect the same in the current year. Or have a net worth of $200,000.

- For residents of Washington, Nevada, New Hampshire, Virginia, Idaho, and Maine, the investor must have an annual gross income and net worth of at least $80,000, excluding home, furnishings, and vehicles. Or a net worth of at least $280,000.

Fees

Prosper charges a 1% annual servicing fee from investors.

What are the risks associated with investing in Prosper loans?

The following risks are associated with investing in Prosper loans.

Borrower default

All financial loan investors face the risk of borrowers not paying back the loan. Prosper does not guarantee the repayment of loans in which investors have invested. The average annual default rate on Prosper is 3% – 4% across all loan grades.

Interest rate risk

Prosper does not penalize borrowers for early repayment of loans. Therefore, it can affect the interest rate earned by investors in the long run.

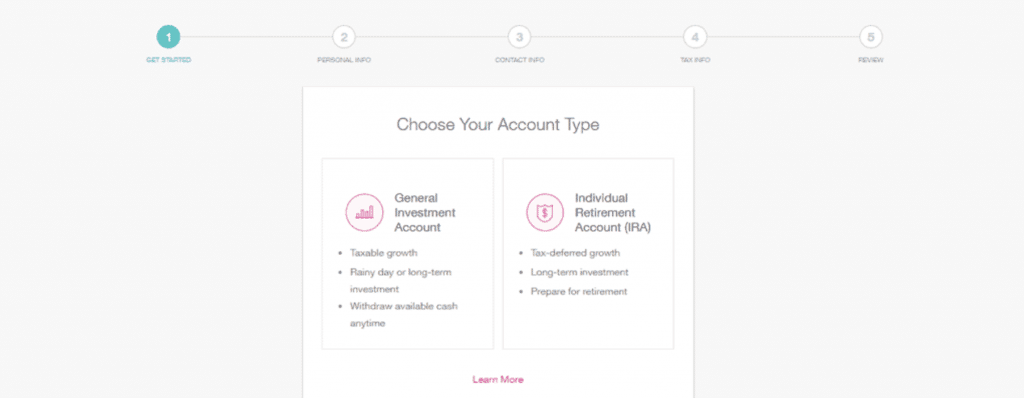

How to start investing on Prosper?

Investors have to set up an account by entering the usual necessary details to start investing on Prosper. The platform offers to choose among three types of accounts: the general investment account, individual retirement account (IRA), and institutional investor’s account.

After setting up the account, investors can select a loan for investment manually or using the auto-invest tool. They can narrow down the search using filters such as loan terms, rates, amount, etc.

Through the auto-invest option, funds are automatically invested into available loans that match the investors’ set criteria. Investors can also set a cash reserve, and the auto-invest tool can only access that cash for investment.

The tool comes with stop, pause, adjust, and restart options. The investors can take any of these actions at any time. However, the auto-invest tool has no option to cancel the investment already placed.

Investors can also use manual and auto-invest tools simultaneously, and there is no fee for using the auto-invest tool.

Peerform

Peerform is another popular peer-to-peer lending platform in the U.S. Peerform was founded by a group of Wall Street executives in 2010. Investors can invest to earn returns and make a difference in the lives of those in need. The platform offers high risk-adjusted returns and a steady monthly cash flow directly deposited into investors’ accounts.

Types of Loans offered by Peerform

Investors can invest in the following types of loans offered by Peerform.

- Debt Consolidation

- Home Improvement

- Vehicle purchases

- Moving Costs

- Medical Expenses

- Installment Loan

- Wedding or similar events expenses

Investors can choose to invest in a whole loan or a fraction of a loan.

How much investors can earn by investing in Peerform loans?

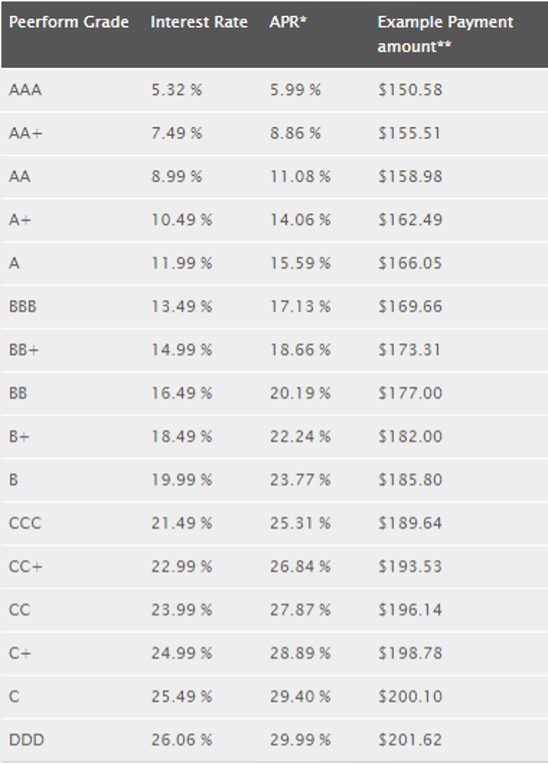

Peerform offers an interest rate between 5.32% to 26.06% depending upon the risk grade. The actual returns are after deducting the origination fee, ranging from 1% to 5% of the loan.

The following figure shows the interest rate offered by Peerform on different risk grades.

Who is eligible to invest in Peerform loans?

Only accredited investors can invest on Peerform. An accredited investor means an investor with either high income or high net worth or both and understands risk. According to the U.S. Security and Exchange Commission, an accredited investor is anyone who:

- Earned income over $2,00,000 (or $3,00,000 together with a spouse) in each of the prior two years and expects the same for the current year.

- OR has a net worth of over $1 million, either alone or together with spouse.

- OR holds Series 7, 65, or 82 licenses in good standing.

Investors from all fifty of the U.S. states can participate in Peerform lending.

Fees

The platform has not publicly disclosed the annual servicing fee.

What are the risks associated with investing in Prosper loans?

The following risks are associated with investing in Prosper loans.

Borrower default

It is one of the most obvious risks of investing in financing loans. Peerform approves the borrower’s application after several security checks. Still, investing in Peerform involves fraud risks leading to loan default. Around 10% of borrowers on Peerform are found to state different income on the registration form, proven by documentation.

Interest rate risk

On Peerform, there are no prepayment penalties on borrowers. Therefore, it can affect the interest rate earned by investors in the long run.

How to start investing on Peerform?

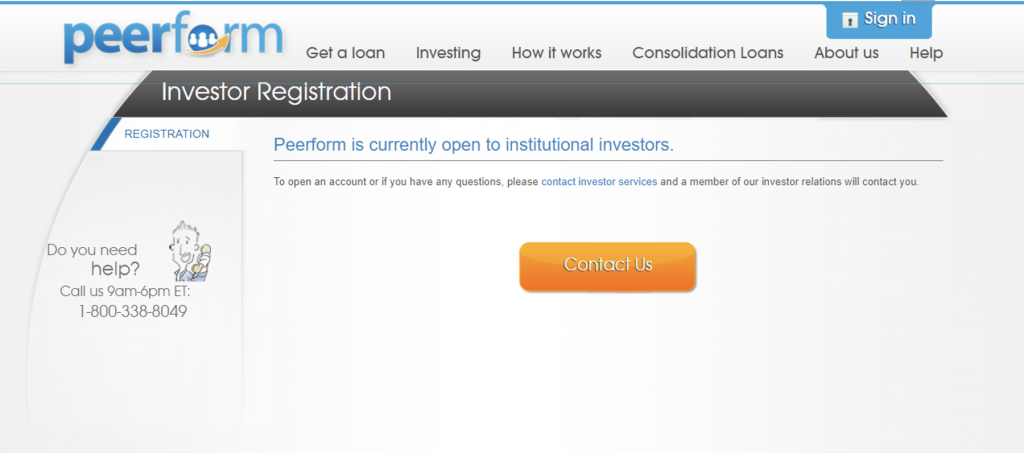

The platform offers two investment options: whole loans or fractional loans. Whole loans- mean buying an entire loan, typically provided to institutions. Fractional loans represent the portion of loans offered to individual investors.

Peerform does not disclose much about how exactly it works for investors.

However, Peerform offers a unique portfolio builder tool to its investors. Investors can customize their investments as they wish. They can build a risk-adjusted profile according to their needs, such as setting a goal. The tool will help them by outlining how to deploy capital to achieve this goal most reliably. Peerform also offers API for whole loan investors for automated investments.

Currently, Peerform is open to institutional investors only.

Funding Circle

Funding Circle is another popular P2P lending platform that operates in small business financing. The platform has lent over £13.1 billion (~$17 billion) to more than 118,000 small businesses globally. By investing with Funding Circle, investors can earn attractive and stable returns.

Types of Loans offered by Funding Circle

Investors can invest in the following types of loans offered by Funding Circle.

- Small to medium-sized business loans such as bakers, butchers, restaurants, shopkeepers, etc., for various purposes such as hiring staff, buying new stock or equipment, opening new premises, etc.

- Property finance loans

Investors can invest in many loan parts.

How much investors can earn by investing in Funding Circle loans?

Investors can earn 4.5%-6.5% returns on their investments depending on the risk band from A+ to E (where A+ is the lowest risk). The platform has earned $329 million in interest for investors so far.

On Funding Circle, borrowers repay the loan in fixed monthly installments. The platform then distributes it among investors who invested in that loan. Investors can start earning interest after the first month of investment.

Who is eligible to invest in Funding Circle loans?

To become an investor on Funding Circle, one must:

- Be a citizen or permanent resident of the US/UK.

- Be above 18 years of age

- Be an accredited investor

Fees

Funding Circle charges a 1% annual servicing fee from investors.

What are the risks associated with investing in Funding Circle loans?

The following risks are associated with investing in Funding Circle loans.

Bad debt

Funding Circle provides secured loans (collateralized), but there are chances when borrowers fail to pay back the loan. Due to default risks, the platform charges investors an extra percentage into a provision account to help investors offset their losses in case of loan default. In other words, investors have to pay a tax for the risk on the platform.

Interest loss

Funding Circle does not charge a penalty on early repayment of loans. Therefore, the investors may not receive the interest they expected to earn.

How to start investing on Funding Circle?

Through Funding Circle, investors can lend to 200 different businesses. Investors need an account on Funding Circle to start investing.

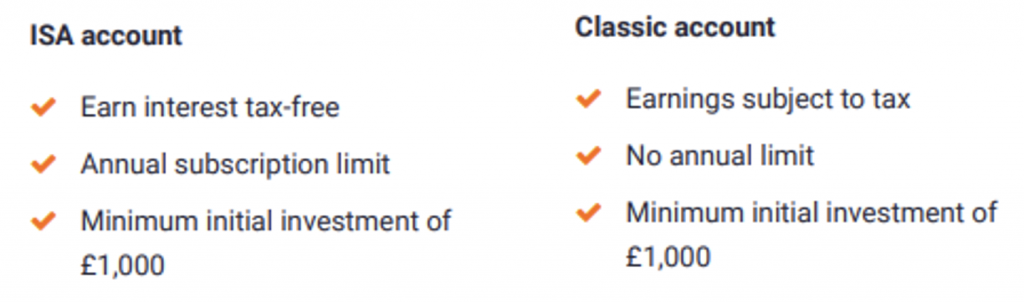

Investors have the option to choose between an ISA account or Classic Account. These accounts work almost in the same way, with some exceptions. The following figure compares the two types of investor accounts offered by Funding Circle.

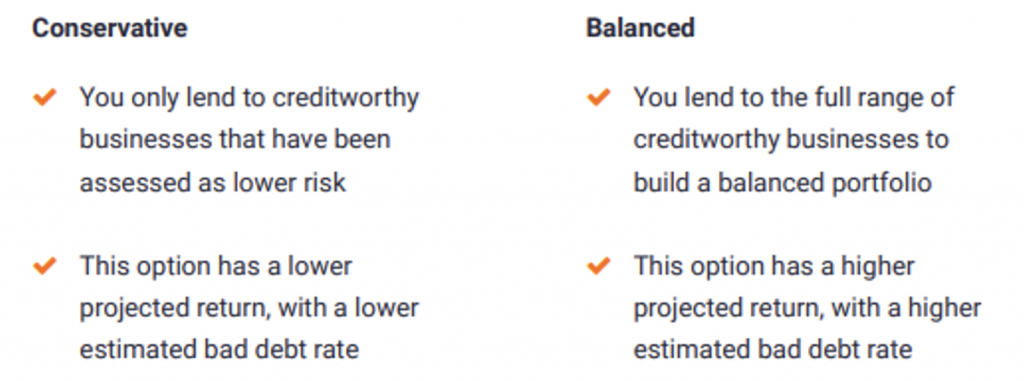

At the time of account creation on Funding Circle, investors can select between two lending options-Conservative or Balanced, to get returns of their choice.

The following figure compares the Conservative and Balanced lending options.

Funding Circle also offers an auto-invest tool enabling investors to quickly lend to hundreds of businesses and build a diversified portfolio.

Note: Funding Circle is not currently accepting new investors.

Final Words

Peer-to-peer lending in the U.S. has been happening for many years but has gained popularity in the past few years. Millions of people have taken loans for university, business, home improvement, etc. The number will keep on increasing as it is a viable source to get funds and start anything if someone lacks money. It means investors have many opportunities waiting for them, if they are accredited, more preferably. P2P lending can also prove to be an excellent alternative to traditional investment. But investors must assess their financial situation, risk tolerance, and financial goals before investing in any P2P lending platform.