If you are looking for growth opportunities that are equivalent to getting into Bitcoin in its early days, perhaps you should invest in the metaverse. The latter is believed to be the next biggest growth segment driven by blockchain technology, after the NFT market. However, it is always a good idea to learn as much as you can about a potential opportunity before you invest your money into it. More knowledge will help you determine whether it is a good fit, and help you understand the associated risks that may lead to financial loss.

What is the Metaverse?

The metaverse is the collective term used to describe digital platforms that facilitate social interactions, the exchange of digital property and the development of digital products and services. All these offerings can be accessed and enjoyed within the metaverse in a decentralized way through blockchain technology. This means you can invest in the metaverse by owning some of those products and services, as well as the digital infrastructure.

Here’s some perspective that will help you understand why there is so much potential value which you can tap into, if you invest in the metaverse. Facebook became a multi-billion empire in a few years after its launch. It achieved that incredible feat by creating a platform that grabbed people’s attention, and it capitalized on its unique position through advertising.

The metaverse aims to do the same, but without selling user data. Instead, the economics of metaverse projects will be built into the products and services within those projects and services through tokenization.

Facebook is also interested in the metaverse and it even rebranded into Meta. However, this is a centralized company, which means most of the value that will be generated on its platform belongs to the parent company. In contrast, blockchain-based metaverse projects provide an opportunity for individual ownership, while strongly supporting a community-based approach.

What is driving the sudden interest in the metaverse?

Lockdown measures during the pandemic meant people had to stay indoors. This was detrimental to physical social interactions. As a result, people flocked to online platforms for entertainment and to keep in touch with family and friends. This migration into online platforms highlighted the potential opportunities that are possible through the metaverse.

It is during the lockdown period that it became clear that blockchain, tokenization and NFT technology have the potential for worldwide disruption in an entirely new way. A decentralized approach that would not only enable participation, but also create opportunities for the average person to participate in building the metaverse.

Some of the earliest metaverse projects have performed exceptionally well. For example, Axie Infinity became the first play-to-earn game that achieved global recognition thanks to its unique approach. Such projects provided investors with a glimpse of the potential waiting to be realized if they invest in the metaverse.

The metaverse is interesting to developers and investors because it is a chance to conquer new frontiers. Metaverse properties such as land are finite and this contributes to their high value. For example, a metaverse platform called Decentraland currently holds the record for the most expensive piece of digital land sold, at $2.43 million. The perceived value is because the buyers can develop that land and transform it into a source of more revenue in the future.

A digital city can be built on that land, containing useful offerings such a virtual concert hall, a library with content that is not found anywhere else, an online school and much more. The possibilities are limitless, as long as the developers can implement in-built economics that ensure a flow of value.

Metaverse market size and growth forecast

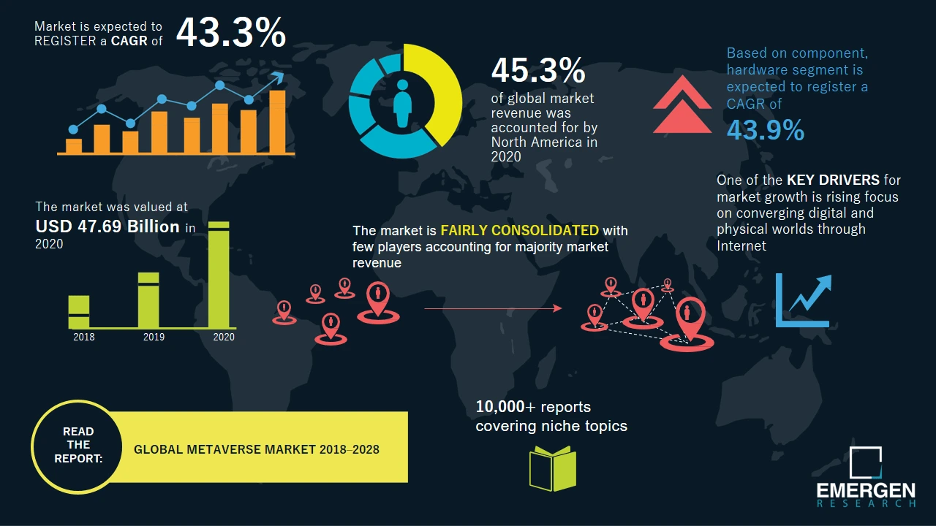

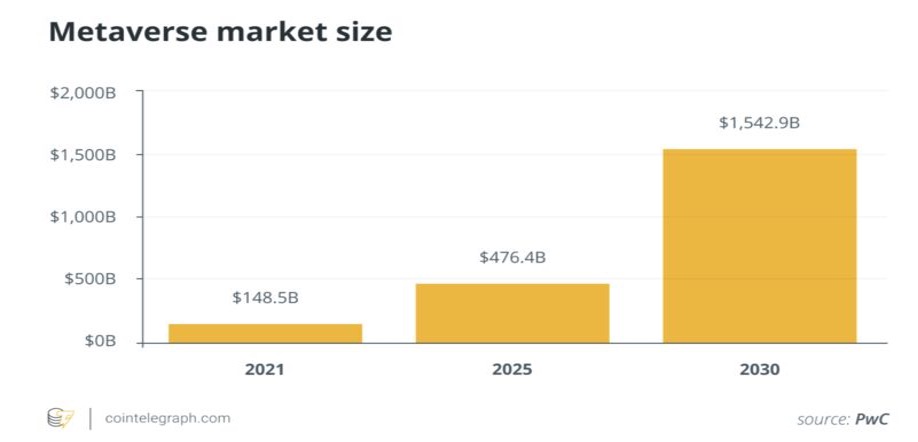

It is important to understand the factors driving growth in specific investment opportunities and valuations are just as essential. It is important to understand some market performance data so you can decide whether to invest in the metaverse. The global metaverse market was valued at $47.69 billion in 2020, with a 43.3% compound annual growth rate at the time.

These forecasts are based on the following factors:

- More demand for metaverse-based digital assets which people can pay for using cryptocurrencies.

- A convergence of the physical world and virtual worlds through the internet.

- The pursuit of business and revenue-generating opportunities in the blockchain realm.

North America is expected to lead in the race for metaverse adoption, followed by the Asia-Pacific region and Europe, with the rest of the world closely following. This is largely due to concentration of developers and early adopters in those regions.

Although decentralized metaverse projects are currently more appealing to investors, centralized companies will also make significant contributions to the metaverse. Some of those companies include Facebook, Unity Technologies and Nvidia, among others. Their contributions include the development of hardware and software that will power the metaverse. Let’s explore some of the different ways of investing in the metaverse.

Metaverse stocks

The race for AI has seen many companies venture into the space and something similar is happening for the metaverse. Some of the key players in the software and technology segment have so far revealed that they will invest in metaverse-related developments. The companies that are related to the metaverse will mainly be in the following segment.

- Those developing the hardware necessary to run the core infrastructure.

- The companies that will make the hardware and software that will allow people to experience the metaverse through video games, virtual reality and augmented reality).

- The companies creating the networks, including social networks in the metaverse.

Let’s look at some of the top companies or stocks that you should consider if you want to invest in the metaverse through this route.

NVIDIA Corp. (NASDAQ: NVDA)

The Nvidia empire is mostly known for its contributions to the gaming industry through cutting-edge GPU offerings. However, it has been expanding its scope in recent years, in search for more growth opportunities in different segments. It is currently working on its metaverse virtual platform called Omniverse which will traverse multiple industries.

Roblox Corp. (NYSE: RBLX)

This is one of the companies that have been pushing into the metaverse through gaming. People can socialize and play 3D games on the Roblox platform and this makes it quite an attractive stock to Wall Street. It already has a good head-start and has the potential to become one of the best metaverse stocks to buy.

Meta Platforms Inc. (NASDAQ: FB)

Facebook has had great success as a social media company since it came into the limelight in 2004. However, the company recently rebranded into Meta and revealed that it is venturing into the metaverse. It has the financial power to fuel its rapid development and rise into one of the biggest players in the meterverse, hence making it an attractive metaverse stock. Meta plans to invest $10 billion in its efforts. Such a massive investment is an indicator that the company is confident that the Metaverse grow into a massive industry in the future.

Metaverse ETFs

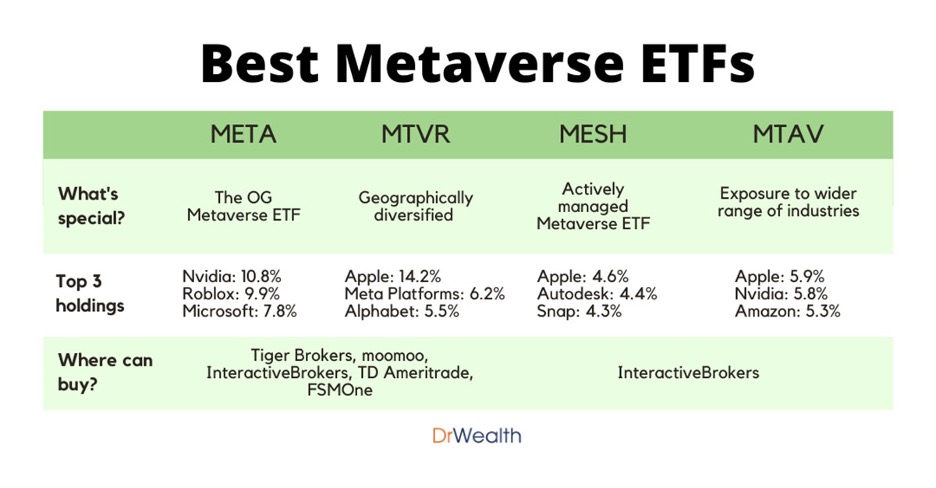

Exchange Traded Funds or ETFs are common in the securities market and are a great way for investors to gain exposure to various markets. They track the prices of the underlying assets, giving investors the flexibility of investing without having to own those assets. This flexibility extends to the ability to execute short positions. Funds that investors put in an ETF are pooled and invested in various fields, such as the metaverse where they can be invested in securities or assets.

The goal is to provide an avenue for investors to diversify their investments with ease. ETF managers research the market and determine where to invest the pooled funds. It is difficult to determine which stocks will be successful but if you invest in a metaverse ETF that is well diversified and managed, then the risk is well spread-out. The managers pick out the stocks that have the most potential, while also adding or removing stocks based on performance and development metrics. Here are some of the metaverse ETFs currently available:

Evolve Metaverse ETF (TSX: MESH)

The Evolve Metamaske ETF is traded on the Toronto Stock Exchange (TSX) under the ticker symbol MESH. It is actively managed and has a diverse portfolio of 25 metaverse stocks from a different part of the world. Most of the companies in this MESH ETF are based in the U.S while the rest are listed in Japan, China and Singapore.

Simplify Volt Equity Web3 ETF (NYSEARCA: WIII)

This ETF is the first to focus sorely on WEB3, a segment that will be deeply integrated with the metaverse. It therefore consists of stocks whose operations traverse the two segments and its goal is to take advantage of the emerging growth opportunities. This ETF is more suited for investors that are willing to take on more risk. The companies in its portfolio are venturing into a new segment that was previously unchartered, hence it is still unclear whether they will be successful in their approach. The Simplify Web3 ETF invests 10% of its funds into Grayscale’s Bitcoin trust, thus providing exposure to BTC.

Roundhill Ball Metaverse ETF (NYSEArca: META)

This is the first metaverse ETF committed to tracking the Ball Metaverse index which consists of 40 companies. The latter are businesses that are involved in metaverse-related developments, thus providing investors with exposure to the segment. Roughly 80% of them are based in the U.S while the rest are in Asia. This ETF also invests in some of the top tech companies globally, such as Apple and Microsoft. These are some of the largest companies in the world and they have the resources to steer safely into the metaverse.

Horizons Global Metaverse Index ETF (TSX: MTAV)

This metaverse ETF was created to replicate the Solactive Global Metaverse Index’s performance. It is based in Canada and it is an attractive ETF due to its approach to diversity and fund allocation. It invests roughly 25% of its funds in the technology industry while the rest of the funds are invested in numerous other segments. They include stocks that deal with AR/VR, digital payments and gaming. Some of the companies in MTAV’s portfolio include Visa, Google, and Amazon.

Subversive Metaverse ETF (PUNK:CBOE)

This is the newest kid on the block and it is an actively managed ETF. It has a diversified portfolio which consists of stocks from more than 60 companies in 5 different industries. They include finance, healthcare, consumer discretionary, communication services and information technology. Some of those companies include Roblox, Sony Group Corporation, Nvidia and Block Inc. among others.

Metaverse NFTs

NFT stands for non-fungible tokens, meaning the item is one of a kind there is no other like it. This rarity aspect of NFTs is the reason for their rapid increase in popularity since they can be verified on a blockchain network and sold at markups to any willing buyer. These characteristics make NFTs quite an appealing and many people have so far jumped on the trend.

NFTs are an essential part of the metaverse, and hence an ideal investment opportunity for anyone looking to invest in the metaverse. NFTs that have value and exist in the metaverse include land, digital art, unique pieces of digital furniture, houses and other digital forms of property.

Land has particularly been one of the most lucrative forms of NFTs in the metaverse and investors have been paying millions for it. For example, a plot of land located next to Snoop Dogg’s metaverse property on a metaverse platform called Sandbox recently sold for $450,000. You can buy virtual land and develop it into something that can then generate revenue within the metaverse, as long as it is interesting enough to attract people’s attention.

So far the most valuable NFTs are those developed by a team or organization that is well-established in the market and one that offers access to an exclusive club and associated perks. The Bored Apes Yacht Club is a good example of such a club, and its NFTs are currently among the most valuable.

Buying NFTs an be a great strategy for those that want to invest in the metaverse because they get to own the underlying assets. This means they have full control of the assets which are often fast-paced as far as value is concerned. Some of the NFTS such as land provide an opportunity for investors to be more deeply involved in the metaverse development and value addition.

Metaverse cryptocurrencies

They are cryptocurrencies that are native to metaverse projects running on blockchain networks. They are often used as the unit of value within their ecosystem, hence they have utility. For example, they can be used to purchase items such as land or art within their platform. Metaverse cryptocurrencies often gain value depending on the level of demand they experience at any given time. They can also be traded and exchanged for other cryptocurrencies and stablecoins. Here are some examples of metaverse cryptocurrencies:

Axie Infinity (ASX)

This is the native cryptocurrency on the Axie Infinity decentralized game and functions as the governance token in the platform. However, it might soon be used to buy virtual products and services in the Axie Infinity ecosystem.

Conclusion

The metaverse is turning out to be yet another avenue for blockchain technology to become rooted into our culture, and one that might drastically change the digital landscape as WEB3 unfolds. However, it is still in its early stages of development, which means there is a lot of uncertainty about its future. There are potential mistakes and losses to be made along the way.

If you are a glass-half-full kind of investor, then the metaverse is a place of unlimited opportunities. If you wish to invest in the metaverse, you can select any the aforementioned avenues depending on the type of exposure you want.

These are the main ways of investing in the metaverse.

Metaverse stocks | They are listed companies that are building the metaverse. This approach aims to leverage the growth that those companies will achieve through their offerings.Investors do not own metavese assets.Suited for traditional investors who do not wish to venture into unregulated assets. |

Metaverse ETFs | They provide an avenue for traders to invest in the metaverse through a basket of metaverse-related securities rather than individual stocks.They are ideal for the investor looking to diversify his/her metaverse portfolio while spreading out risk.Metaverse ETFs provide investors with a regulated approach to metaverse securities. |

NFTs | Non-fungible tokens (NFTs) are currently the most direct way to invest in the metaverse.You assume ownership and control of the NFT once acquired.You can invest directly in NFTs that you believe have the most potential.Ownership is decentralized and users decide when to sell the underlying asset. |

Metaverse Cryptos | They are the native tokens of metaverse projects.They are often used to facilitate transactions and governance in their ecosystem.Can be used to buy digital items in the metaverse. |