NFTs are a craze that gained momentum at the start of 2021, and the industry generated over $23 billion in trading volume in 2021. With many people coming into this sector, it is broadening, providing more facilities to its users. After the crypto loans of the crypto industry, the NFT market is now offering NFT loans. The NFTs owners can borrow money using their NFTs as collateral. This concept concept is new but is rapidly gaining popularity.

You may have heard about NFT loans for the first time or have some confusion. Therefore, we have prepared a detailed guide for you on NFT loans and how to borrow money using NFTs as collateral.

So, let’s break into it!

What are NFT loans?

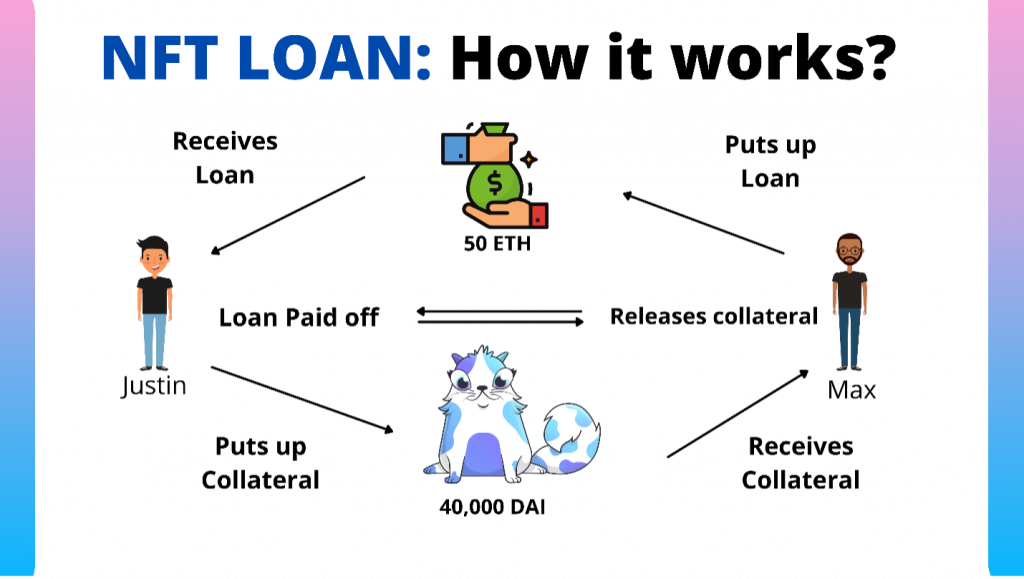

NFT loans are almost similar to any secure loan in which the borrower offers something as collateral to borrow money, and if he fails to pay back the loan, his collateral is seized. The same concept applies to NFT loans, with little difference.

In NFT loans, the NFT owner offers his NFT as collateral to borrow money. He can receive the loan in ERC20 tokens, stablecoins, cryptocurrencies, or fiat currencies. NFT loans are somehow a solution to the illiquidity of NFT.

But if the borrower fails to pay back the loan, he will lose ownership of his NFT. The NFT will be transferred to the lender, who becomes the new owner. The borrower defaulting in this case, can prove very advantageous for the lender. Because it makes the lender receive an NFT for a cheaper price than its original value.

The borrowing terms and conditions vary from platform to platform. However, currently, there are not many platforms offering this service. But, as the trend of NFT loans is growing, many well-known platforms are jumping into it. The number of NFT collateralized loans has been increasing over the past few months, as more people are becoming familiar with it.

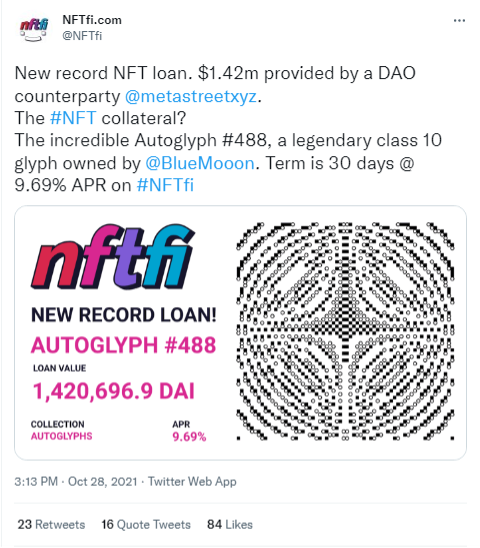

NFT was used as collateral for a $1.4 million loan

Though NFT loans are new, some examples have made headlines. One of those examples is as follows.

On October 28, 2021, a user named KrypToniK took $1.4 million in DAI stable coin from the NFTfi platform as an NFT loan. The NFT collateralized was Autoglyph #488, a JPEG, a kind of 10 Autoglyph, the most uncommon. The terms of the loan were 30 days at 9.69% APR. This was the largest NFT-backed loan ever.

MetaStreet DAO provided the loan. The company has an objective to offer loans to people offering NFT as collateral.

How to borrow with NFT loans?

The following steps are involved in borrowing money using NFT as collateral.

- Suppose a borrower wants a loan on his NFT. He visits a platform offering NFT loans. The lenders on the platforms will propose different offers with varying payment terms. The borrower can select the offer that best meets his demands.

- Meanwhile, the borrower submits his NFT as collateral. The NFT gets transferred to the platform’s smart contract when he receives the funds. No one on the forum can access it.

- Once the borrower pays back the loan plus the interest to the lender, the NFT is returned to his wallet.

- If the borrower does not repay the loan during the allocated time, the asset gets transferred to the lender. The lender becomes the new owner of that NFT.

Before providing a loan for any NFT collateral, it is first determined if the NFT is worth a loan or not. Generally, the loans are roughly up to 50% of the NFT value.

Let’s consider an example for better understanding.

Suppose you have an NFT worth $24,000 when you need to borrow some money. For this NFT, you will receive $12,000 as a loan if the LTV rate (Loan-to-value) is 50%. The interest rates vary depending upon the lender’s offer you chose. Once you receive funds, your NFT is locked in a smart contract until you pay back the loan amount and APR (Annual percentage rate), let’s say 5%. If you don’t pay in time, the lender will become the owner of the NFT.

Which NFT collections are supported for loans?

You can use any of your NFT as collateral for borrowing loan depending upon the collection supported by the platform you are using or on the preference of the lender. For example, NFTfi supports any ERC-721 tokens. The NFTs related to these tokens include Super Rare, Bored Ape Yacht Club, Crypto Punks, Autoglyphs, Meebits, etc.

How much can you borrow using your NFT?

The following two parameters can help you understand how much you can borrow using your NFT as collateral.

NFT Valuation for loan

The value of NFTs changes constantly depending upon their market demand. This is why NFTs have different prices, and people tend to pay different prices for the same thing. It means different lenders will lend you differently. Therefore, you as a borrower will have to dig to find the correct value, which will follow some trial and error.

To find the fair value of NFT, you can post his NFT as collateral. The lenders will start bidding on the amount they are willing to lend for this NFT. Here you can compare multiple offers and decide the fair value of the piece. It will ultimately help you understand how much you can borrow using you NFT. You may also need to dialogue with the lender for a reasonable price.

LTV rate (Loan-to-Value)

LTV rate is also a criterion to determine how much you can borrow on your NFT. It refers to the amount of loan and the collateral’s value. For example, the NFT you are offering as collateral worth $20,000 and the loan you are receiving is $10,000. It means, the LTV rate is 50%.

Let’s consider another example. If you offer an NFT of worth $20,000 as collateral to borrow a loan and the LTV rate is 40%. In this case you will receive a loan of $8,000.

You can calculate the amount you will receive as loan by using the following method.

Loan amount = Market value of collateral x LTV rate (%)LTV rate usually ranges between 10% to 50%. It is determined by the platform you are using, or you can also mention it in the loan terms, if option is available.

Pros and Cons of NFT loans

Pros

The following are the pros of NFT loans.

- NFT loans are decentralized and automated through smart contracts.

- Borrowers can borrow money immediately through these loans.

- NFT loans allow NFT holders to make use of their idle NFTs collections.

- Borrowers can use the money to borrow new NFTs or other digital assets.

Cons

The following are the cons of NFT loans.

- The biggest drawback of NFT loans is if the borrower fails to pay back the loan, he will lose ownership of his asset.

A borrower took out a loan of 3.5 ETH, offering his NFT, the Elevated Deconstructions NFT, as collateral. At the time of the loan, the NFT was worth 11ETH. But he failed to back pay back the loan. Resultantly, the lender became the new owner of the NFT. The lowest price of the NFT on the market is now 95 ETH.

- NFTs are volatile; their prices can change during borrowing duration. If the cost of NFT increases during the loan duration, the lender can ask the borrower to pay more for getting back his collateral.

To avoid this situation, borrowers can dialogue before borrowing the loan. They can mention it in the terms and conditions of the loan.

- The interest rate on NFT loans can be slightly higher.

Top NFT loans marketplaces

There are not many marketplaces offering NFT loans but realizing its trend, many platforms have started offering this service.

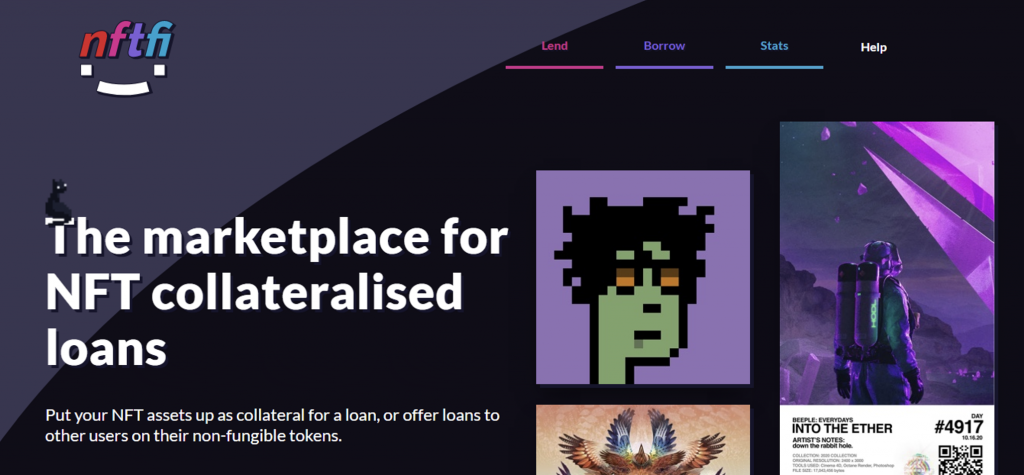

NFTfi

NFTfi is the most famous and considered the best p2p marketplace for NFT collateralized loans where users can borrow money by offering their NFTs as collateral. Stephen Young founded the platform at the beginning of 2020.

Platform | Founded in | Loans offered so far | Borrowing duration (Days) | APR | Volume | Supported Projects | Fee from Borrower | Payback method | Supported Token |

NFTfi | February 2020 | Over 2100 | 7, 14, 30, 90 | Varies | 40 million | Over 100 | Zero | One full payment | All ERC-721 |

Arcade

Arcade, formerly called Pawn. fi is a lending platform that allows users to borrow against NFTs as collateral. The co-founder of Arcade, Robert Masiello, says, “Arcade is for both borrowers and lenders. If you own high-value NFTs, you can borrow against the fair value….”

Arcade utilizes Wrapped NFT technology. This technology allows borrowers to bundle multiple NFT assets and use them to acquire a single loan.

Platform | Founded in | Borrowing duration (Days) | APR | Volume | Fee from Borrowers | Payback method | Supported Token |

Arcade | 2020 but will open for public in 2022 | 30, 90 | Varies | 3.5 million | 2% | Currently One full payment, But will support period payments in future | All ERC-20 |

Stater

Stater is another platform allowing borrowers to borrow ETH by using their NFT as collateral. Stater claims to provide loans without letting borrowers lose ownership.

The borrower can pay back the loan in installments or in one full payment. For each missed installment, he will also have to pay the penalty. Otherwise, the lender becomes the owner of the NFT.

Platform | Founded in | Borrowing duration (Days) | LTV | Supported Projects | Fee from Borrowers | Payback method | Supported Token |

Stater | 2020 | Varies | 60% | N/A | 1% on each installment | Installment and Full payment | NST |

Nexo

In December 2021, Nexo announced the launch of its NFT lending desk. Currently, the platform accepts NFTs from Bored Ape Yacht and CryptoPunk. The company says, in the future, other collections will be added to the list of accepted NFTs.

Nexo says, “no liquidity before maturity, even if the value of your NFT fluctuate during the course of the loan, you won’t get liquidated.”

However, to apply for the loan on NEXO, the value of your NFT must exceed $500K.

Platform | Founded in | Borrowing duration (Days) | LTV | Supported Projects | Borrowing Rates | Payback method |

Nexo | 2021 | Varies | 10%-20% | Currently 2 | 12% to 15% annually | Full payment |

DROPS

Drops allows to put your NFT as collateral and receive instant and trustless loans. If the borrower fails pay back the loan on time, his NFT will be liquidated. The interest rate for borrowing ranges from 1.31% to 30.45%. Darious Kozlovskis, Founder & CEO of Drops says, “we believe that NFT owners can derive more value from their idle assets”.

Platform | Founded in | LTV | Supported Projects | Payback method |

Drops | 2021 | 80% | N/A | Full payment |

Kraken

The co-founder and CEO of Kraken, Jesse Powell, says that Kraken plans to offer NFT-backed loans through its upcoming NFT marketplaces.

Kraken is planning to start supporting NFTs from early 2022, but the platform has not revealed the launch date for its NFTs services yet.

What are NFT flash loans?

NFT flash loans is another use case of NFTs. NFT flash loans are basically designed for developers. They can easily and instantly borrow without offering collateral. But it is must that the liquidity is returned to the pool within a single trading block.

To take a flash loan, the developers need to build a contract that requests a flash loan. This contract will require to execute the instructed steps and pay back the loan + interest and associated fees, all within the same transaction. If liquidity is not returned within one transaction, the whole transaction, and all the actions executed until then are undone.

The first ever NFT flash loan is Hashmasks.

Future of NFT loans

NFT collateralized loans are a technologically advanced sector that is expected to open many potential use cases in the future. The NFTs loan market will grow in the future; more lenders will accept NFTs as collateral, offering loans to more borrowers. It is believed that NFT collateral sector will open a trillion-dollar market. However, being a borrower, you must know the fair value of your asset, accept the loan offer carefully after comparing and analyzing it, take care of the lending duration.

Unarguably, NFT loans have a bright future ahead, just like NFTs. But you need to be careful before borrowing a loan because otherwise, you may end up losing your NFT that may have more value in the future.