About Bondora Portfolio Manager

Portfolio Manager is a semi-automated service. You don’t need any financial knowledge or other previous experience since it does everything for you. It’s a service which manages everything to do with your investments, which makes it perfect for people who are new to investing in P2P, who are unsure of how to get started, who want to spend as little time as possible managing it and who want to have everything set up quickly.

How to configure Bondora Portfolio Manager

Step 1: Open the Portfolio Manager configuration panel

|

Step 2: Chose your risk profile

|

Here are the potential returns advertised by Bondora based on each risk profile

Riks profile |

Minimum return |

Ultra-conservative |

10.42% |

Conservative |

12.31% |

Balanced |

14.66% |

Progressive |

15.84% |

Most opportunistic |

21.51% |

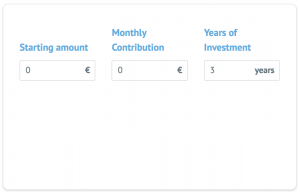

Step 3: Understand and configure the expected return

The module is used to estimate the result of your investment in the long run. The result of the estimation is presented on the left of the risk profile selector. Follow the steps below to do the result estimation.

|

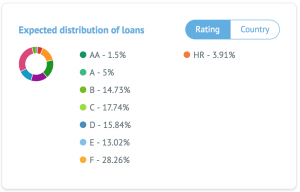

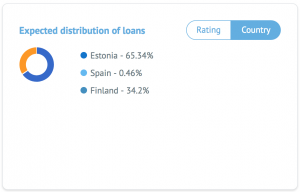

Step 4: Understand the loans ratings and countries of your configure portfolio

The loans rating of your selected portfolio can be viewed. The percentages represent the amount of each loan rating category in your portfolio.

The loans countries of your selected portfolio can be viewed.

I wish this explanation was usefull for you, and enjoy investment with Mintos.

| Please read my summarized review of Bondora to start investing with Bondora

(earn 5 EUR when you open your account) |