About Minto Auto-invest functionality

Mintos offers a super developed auto-invest functionality, which I believe is one of the best on the market between all the platforms. You will be able to configure:

- Return rate

- Loan duration

- Payback guarantee

- Country of loan originator

- Loan originator and the associated risk

- Type of loan

- …

With Mintos auto-invest functionality you should also be able to configure a portfolio which should be able to generate +11% of return per year.

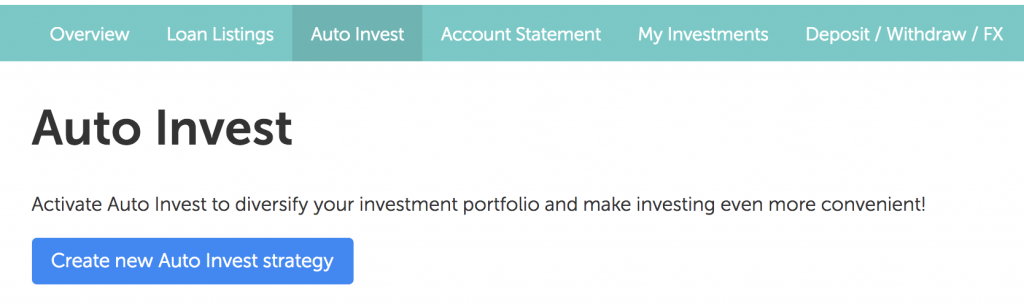

How to configure Mintos Auto-invest

Step 1: Open the Auto-invest configuration panel

|

Step 2: Mintos Investment strategy vs custom strategy

Mintos offers you to chose between to Auto-Invest solutions:

- To select a Mintos Investment Strategy which has been preconfigured: this solution is easy to configure but returns will be lower than the custom strategy as Mintos also build this preconfigured strategy to push people to invest in less interesting loans

- To configure a Custom Strategy: this solution will give you higher returns and you have a lot of flexibility in deciding what to invest in

I will continue the explanation on the configuration fo the Custom Strategy as the returns are the highest between all choices.

|

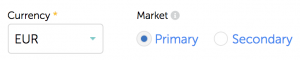

Step 3: Select to currency to invest in

At first, you need to select in which currency you want to invest and if you want to invest in new or resold loans

|

Step 4: Select the loan originators

|

Step 5: Configure interest rate and loan term

|

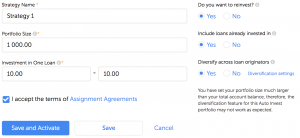

Step 6: Configure portfolio general information

|

Step 7: Last advice

Since it is sometimes difficult to find loans at 12% return rate, I advice you to create 3 different auto-invest portfolgio, as you see in the picture below

In this case, if Minos cannot find loans at 12%, he will then try to find loans at 11.5% and if he don’t manage , he will search to invest in loans at 11%.

The more money you want to invest and the more difficult it will be to invest it at a higher return. In this case you will have two possibilities:

- Create more auto-invest portfolios with lower rate following the above: 10.5%, 10%, etc …

- Increate the size of the “Investment in one loan” to a number bigger than 10 EUR

I wish this explanation was usefull for you, and enjoy investment with Mintos.

| Please read my summarized review of Mintos to start investing with Mintos

(earn additional 0.75% of your investment amount the first 90 days) |