Have you ever lent money to someone? If yes, how was the process of getting it back? Did you finally get all your money back?

Lending money to friends and family is usually not a wise thing to do. It can ruin your relationship and you risk not getting back your money.

But did you know that with p2p lending you can lend money and make some passive income in the process?

If you are looking to invest, p2p lending investment is one of the most attractive options currently.

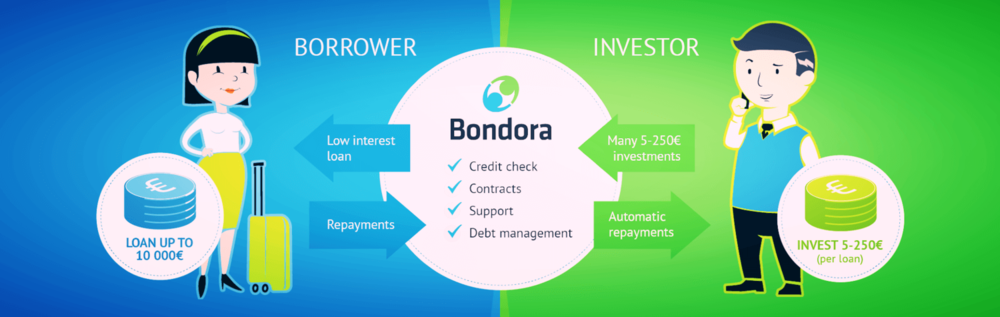

P2P lending is simply social lending where borrowers are matched with lenders via an online platform without using traditional financial institutions as middlemen.

In this guide today, I am going to provide you with a step process to make your first p2p lending investment.

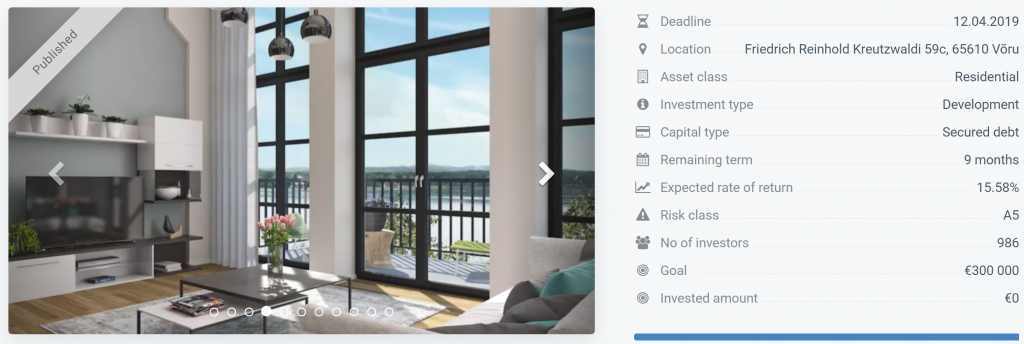

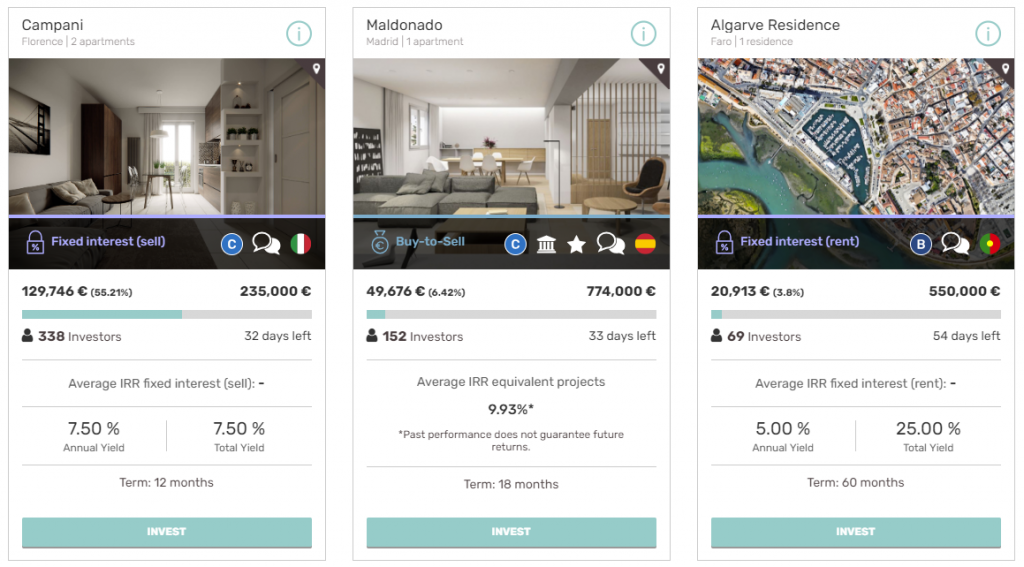

First, you want to shop around for the best platform you feel will offer you better rates. Besides the rates, you should also check the types of loans offered since not all p2p lending platforms offer the same kinds of loans.

After you have settled on the platform to invest, follow the steps below:

Step #1: Register with the platform by providing basic information. You will also be requested to provide proof of identity as well as proof of address.

Step #2: Create an investor account after signing up to start any financial transaction and deposit your money that you would like to invest.

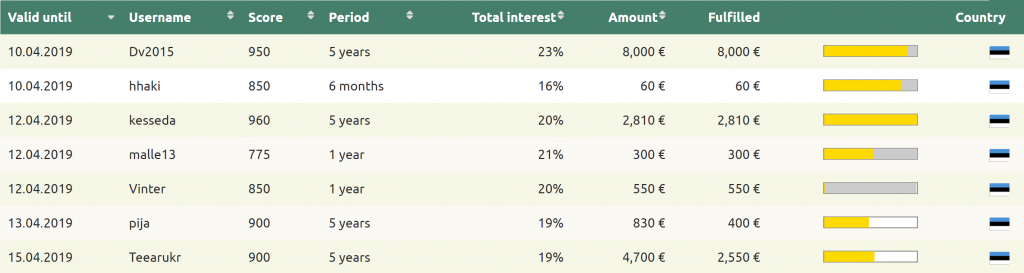

Step #3: Once you have been verified, your investor profile will now be listed online on the platform along with your investment preference.

Step #4: Start investing by browsing loan proposals by borrowers. The rate and terms of the loans (ROI, duration, early exit, etc…) are determined by the platform using their own credit scoring system. Some platforms have a minimum and maximum amount to invest, so make sure you check it first.

Step #5: Once you have made a commitment, you as an investor, will be provided by documents uploaded by the borrower.

Step #6: You and the borrower will then sign a loan agreement (digital process automatically managed by the p2p lending platform) – a legally binding document that is enforceable in the court of law.

Step #7: The loan is disbursed to the borrower, and the investor will start earning their interest starting usually from the following month or sometimes only at the loan term (from 1 month to 3 years). And that is it; you have just earned your first p2p income!

Right now, the most logical question to ask yourself is how much should I invest?

That is a good question. But as far as p2p investment is concerned, there is no harm in starting small so you can get a feel of it. Most platforms have a minimum investment of 10 euros, which is pretty much small and less risky.

On the other hand, the nature of compound interest is that the greater the investment the greater the return. And in p2p lending, this is made even less risky by the fact that you can diversify your large capital investments across a number of loans.

So to answer your logical question, I recommend investing as much as you are willing to, provided you diversify across multiple loans and even platforms. This is the greatest way to minimize your risk and ensure that you end up with the best rewards.

The next question you may ask after how much you should invest is how much control do you have over your investment?

This is also an important question, especially seeing that you are just starting off on p2p lending investments.

Unlike in stocks and shares, you will have some levels of control over your investment in p2p lending. For instance, some platforms will allow you to take a regular income from your monthly income, which means you don’t have to wait until the end of the term for you to get the rewards you so much deserve.

Perhaps before investing in p2p lending, check first to ensure that the site allows you to withdraw your investment income whenever you wish. There are many economic eventualities, so you need to access your money whenever the need arises.

You can find out about this by asking the customer service desk questions like:

- Can I withdraw my income early if I need to?

- Is there a cost associated with early withdrawal?

Last but not least, you must check the transparency of the p2p lending platform before investing. This is very important since credibility has been the riskier aspect of p2p lending more than loan defaults.