Understand P2P lending

What are the Peer to Peer lending investors concerns?

Before starting to invest, most future p2p lending investors ask themselves the following questions:

- Is P2P lending safe?

- What are the peer to peer lending risks?

- How to do peer to peer lending risk management?

- How can I choose the safest peer to peer lending platforms?

- How to choose peer to peer lending safe investments?

Understand the P2P lending process

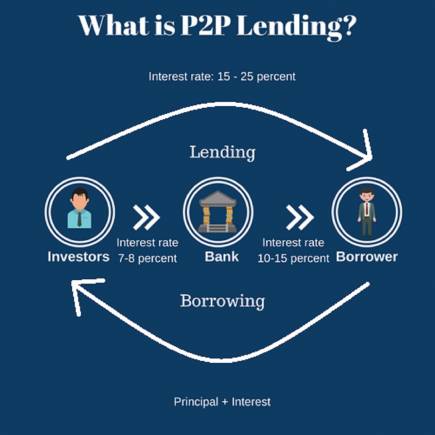

Peer to Peer lending (also called P2P lending, crowdlending or Social lending) is a type of crowdfunding investment where investors co-finance projects by lending money in return for interests. In Europe, it can generate an average ROI of 12-14% per year. Read more…

To understand P2P lending risks and find a safe Peer to Peer lending platform, it’s useful to understand this lending process. It is similar to the one used in banks when a person (or company) applies for a loan. The big difference is that in P2P lending, the risk is put on the shoulders of the private investors instead of a bank or financial institution.

Here are the different steps of the peer to peer lending process:

- The borrower (a private or a company) applies for a loan by providing all his personal and financial information (e.g. income level, dept rate, historical defaults, investment business plan)

- The P2P lending platforms do a profile check of the borrower and estimate his risk profile in order to calculate the interest rate of the loan (which will have an impact on the interest rate you’ll make as an investor on this loan)

- The platform proposes on her website to invest in this loan if the risk profile is good enough to pass the platform criteria

- Private P2P lending investors select a specific amount to invest in the loan project

- Then, in case the borrower doesn’t pay back a borrowed loan:

- if the platform offered a Buyback Guarantee option (which is offered by a majority of them), the platform safety fund will give back the money and usually also the interests to the investor

- if the platform didn’t offer a Buyback Guarantee option, the borrower loses his investment

Good to know:

When investors lend money, they actually lend it to the p2p lending platform. When enough money has been raised for a loan, the p2p lending platform will then use the funding to lend money to the borrower. So the real lender on the contract papers is the peer to peer lending platform and not the private investor.

Why borrowers use P2P lending platforms instead of banks?

There are plenty of reasons for a borrower to use these lending platforms to get a loan. As an investor, it is really difficult to know the reasons, which make peer to peer lending safety variable.

Some borrowers have good reasons:

- Get a lower loan rate than in a bank since there are fewer overhead costs than in a bank (this can’t be always applied)

- Get a loan faster (some lending platforms provide loans value to borrowers in less than 24h

- Advertise their business while asking a loan on platforms than have thousands of daily visitors

Other borrowers don’t:

- The bank didn’t accept to provide them a loan due to their profile or investment risk

- The borrower is already over dept and can’t borrow anymore

Peer to Peer lending risks and regulations

What are the P2P lending risks?

When investing you should be aware of the main Peer to Peer lending risks:

- The borrower makes late interests or principal repayments or doesn’t pay back your loan

- The loan originator (the company managing the borrowers) closes and you cannot recover your investments

- The peer to peer lending platform closes and you cannot recover your investments

Is there an EU regulation for peer-to-peer lending?

At this moment, there is no European legal framework which regulates peer to peer lending (lending-based crowdfunding) when the loan is provided to a business but there is while lending to a consumer which is regulated by the Consumer Credit Directive.

The only European country having a regulation for business peer to peer lending is the UK with the Financial Conduct Authority (FCA) that launched a regulatory framework for p2p lending platforms in April 2014 (reference from UK parliament), which gives also investors the access to the Financial Ombudsman complaints service.

Make P2P lending safe: How to mitigate risks?

There are different actions to make peer to peer lending safe, or at least safer. Before investing in a new platform or project, it is interesting to do the following things:

Assess the risk of the investments you are doing:

- Assess the p2p lending platforms you are using to invest in a safe one

- Assess the projects you are investing in

Diversify your investments (which is easy to do since peer to peer lending platforms allow you to start investing from €10)

- Diversify your investments in many platforms

- Diversify your investments in many projects

- Diversify your investments in many countries and many projects

Invest in safe P2P lending

How to assess if a P2P lending platform is safe?

To evaluate if a peer to peer lending platform is safe you need to analyze:

- The platform team and skills (e.g. to they have a compliance specialist to assess the borrower’s risk profile?)

- The platform financials (e.g. is the platform under financial issues)

- The platform financial authority regulation (e.g. is the platform regulated by an authority?)

- The platform default track record (e.g. what is the platform default rate? This can be a good indicator of their risk assessment process)

- Understand how strictly they assess the investment projects that they publish

- The quality of their contingency fund called also Buyback guarantee fund (to pay back late or defaulted loans)

- Check the Trustpilot score (we included it in all our platforms reviews)

Start to invest in peer to peer lending

If you want to start to invest, we advise you to read our following two articles in the below order for you to get all the information needed to start investing safe in p2p lending:

- Learn about peer to peer (P2P) lending

- Select the best p2p lending platform

- Then read all our platform reviews available on the sidebar on the website to find the safest p2p lending platforms