The cryptocurrency market is expanding, and its value in the global economy increases every day. Investors are also always looking for new, low-risk, and profitable options to profit from. As one of the profit tools for investors, lending systems have provided good opportunities for them. In this article we will talk to you about Ethereum lending.

But there are several blockchains for investors to lend, each with advantages and disadvantages. Interest rates, taxes paid, and investment risk is among the criteria that help investors choose lending blockchains.

In general, investors are looking for blockchains whose capital is not taxed and not controlled. Ethereum offers investors a variety of options that meet their criteria.

In this article, while expressing the trend of investments made in cryptocurrency lending, Ethereum lending networks are introduced and are prioritized according to interest rates and risk.

The trend of the lending marketplace

Lending in the cryptocurrency market is a good option for investors looking to profit from their digital assets. In recent years, the lending trend in the crypto marketplace has increased significantly from $ 10 billion in 2020 to more than $ 50 billion in mid-2021. The chart below shows the growing trend of investors’ general interest in lending.

According to the above chart findings, in November 2021, the USD equivalent of cryptocurrencies locked in the lending market in all blockchains was more than $ 50 billion. Since then, the decline in the crypto market value has dropped to nearly $ 40 billion.

The chart above shows that from 2018 to 2022, the lending market has been experiencing a significant increase every year. But before taking any action of lending in the crypto market, we invite you to check all its rules and conditions to maximize profits and reduce losses.

Lending networks in Ethereum Blockchain

Different blockchains offer investors a variety of tools, but one of the best is Ethereum. The chart below shows the trend of lending expansion on the Ethereum blockchain.

This diagram shows that the volume of Ethers locked in Ethereum lending networks has already reached several peaks. Nearly 6 million Ethers are currently locked up on lending blockchains.

But if you are looking to lend on the Ethereum blockchain, you have two options: centralized and decentralized lending. In this section, we examine both of these.

Ethereum Lending in centralized exchanges

Centralized exchanges such as Nexus and BlockFi must follow specific rules. You need to create your account and then go through the KYC process. These networks generally have protocols to secure your collaterals and are protected by insurance or cold storage.

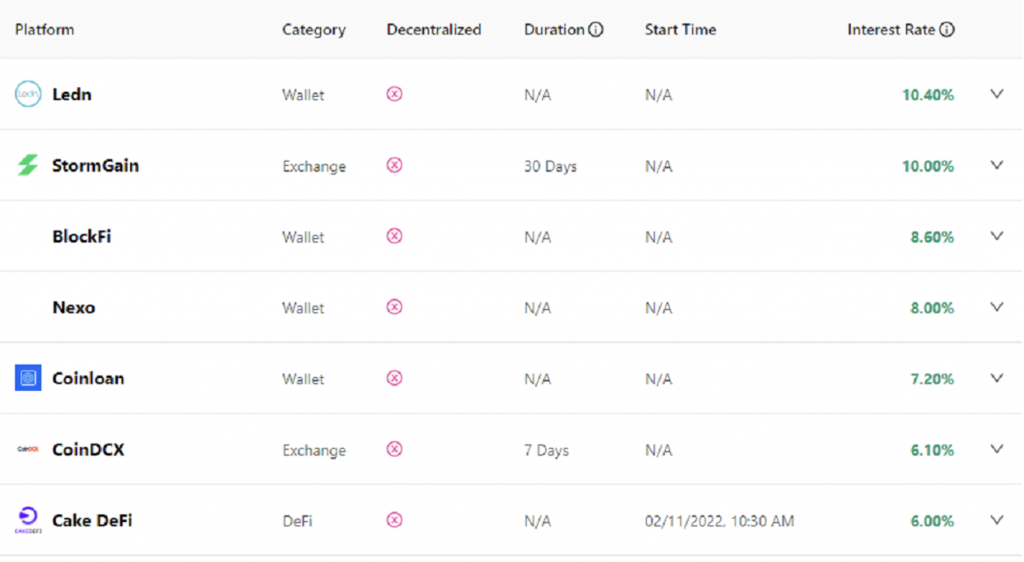

Centralized exchanges use blockchain technology to store prepayments and withdrawals. They offer a great way to get more interest than Bitcoin, other cryptocurrencies and Stablecoins. The following figure shows some of the most critical exchanges focused on the Ethereum blockchain.

BlockFi, Nexo, and CoinDCX wallets are among the most important Ethereum lending networks focused on the Ethereum blockchain.

Ethereum Lending in a decentralized exchange

In these networks, transactions are done by code. In services such as Aave and Compound, smart contracts use algorithms and protocols to automate loan payments. Anyone can use the protocol on the DeFi network. As a result, nothing is hidden in the blockchain. Unlike a centralized exchange, there is no one to set up finances and intermediaries.

Users of decentralized networks can obtain loans in any amount without third-party authentication. Loans are available in Stablecoins or cryptocurrencies such as Ethereum and Bitcoin. Compound, Aave, and MakerDAO are among the most prominent decentralized networks in the Ethereum blockchain.

The difference between the two lending Ethereum methods is who manages the lending and borrowing process. The management business runs the lending Ethereum systems, or a protocol does the job.

Pros and cons of borrowing from DeFi

| Pros |

| Investors can act as lenders in the system and make a profit. |

| The need for mediation and authentication is not strict. |

| Any cryptocurrencies can be offered to the applicant for lending Ethereum. |

| One of the advantages of digital loans is their availability—no need to spend a certain amount of time. |

| There are quite flexible rules for lenders and borrowers. Determining the interest on loans is also important for the borrower. |

| If a person has already taken out a loan and has a late payment history, there will be no special restrictions on getting a new loan. |

| Cons |

| Working with these networks requires skill. Suppose you make a mistake or enter a wrong number in one of the steps of Ethereum lending or borrowing from DeFi, in which case if your request is registered in the smart contract, there is no way back. |

| The need to pledge capital. This means that when you ask for more money for a loan, you have to pledge more money. |

| Another threat to lending Ethereum is the high volatility of cryptocurrencies. |

Comparison of lending networks

There are several factors to consider when getting a loan. Factors such as interest rate (depending on the loan amount), loan duration (is it fixed or not?), Deposit limit (minimum amount that should be in the borrower’s account), amount of collateral (amount of collateral compared to the amount of the loan) and commissions are among the factors that influence the choice of the best Ethereum lending networks (or exchanges).

- Some networks do not require a minimum deposit (e.g., Celsius Network, BlockFi)

- Some networks focus on getting the maximum return on cryptocurrencies, and some focus on Stablecoin.

- Some networks are proprietary, and you can choose them depending on the type of asset (for example, they only work with Bitcoin)

- Some networks can select the loan repayment time. (E.g. Celsius, YouHodler, BlockFi)

Ethereum rates

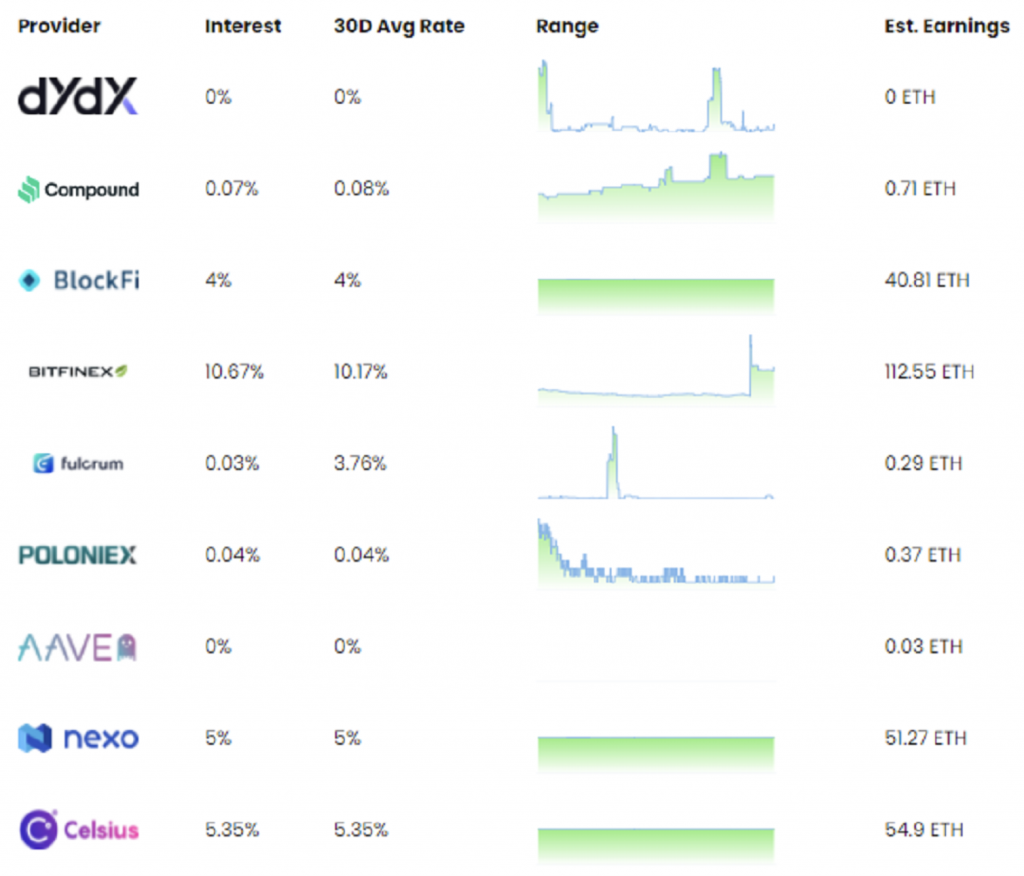

The image below shows the Ethereum lending networks in terms of Ether rates.

According to the findings in this table, the three networks, BlockFi, Nexo, and Celsius, have the highest Ether rates. Compound, dydx, and Aave, on the other hand, have the lowest Ether rates.

Interest rates

In short, the function of lending networks is that the lender chooses the coin he intends to lend in addition to the decentralized network they want to use and attaches their wallet to the network to lend these coins. The lender’s interest will then be sent to the same wallet.

The interest that lenders receive and what borrowers must pay is calculated using the ratio between the tokens lent and borrowed in a given market. It is also worth noting that, depending on each market, the percentage of annual interest of borrowers (Borrow APY) is higher than the percentage of annual interest of lenders (Supply APY). In simpler terms, the interest that the borrower has to pay is greater than the interest that the lender receives.

Loan interest is determined per Ethereum block, and therefore, this amount is generally variable. Users’ interest percentage varies dramatically depending on the demand for a particular token. Of course, today, some protocols, such as Aave, provide a fixed interest rate for the borrower. Therefore, each network may offer different benefits depending on its terms and conditions.

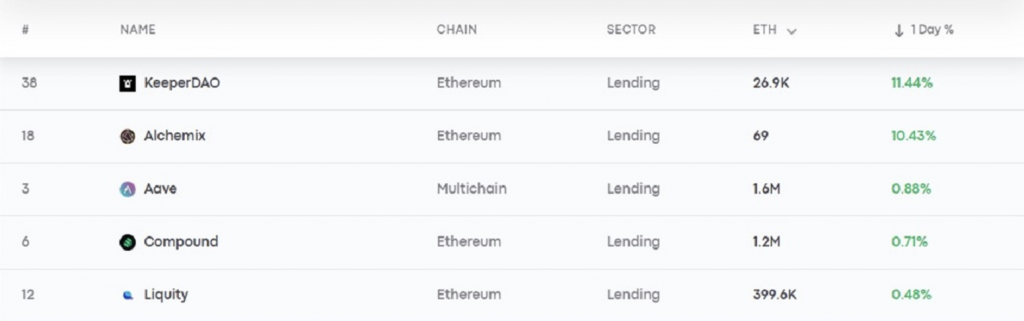

The chart below shows the lending networks in the Ethereum blockchain arranged according to interest rates.

The table above shows that KeeperDAO, Alchemix, and Aave have the highest interest rates compared to other Ethereum lending networks.

Risks of lending networks

Ethereum lending networks, both centralized and decentralized, have risks. However, it should be noted that the risks of decentralized networks are minimal compared to centralized finance. However, like any other financial process, the field of DeFi is not without risk and has its problems.

For example, in 2020, when the yield farming method gained popularity worldwide, borrower interest rates for some cryptocurrencies increased by more than 40%. This may cause novice users who do not follow their loan interest rates daily to repay more interest than they originally expected.

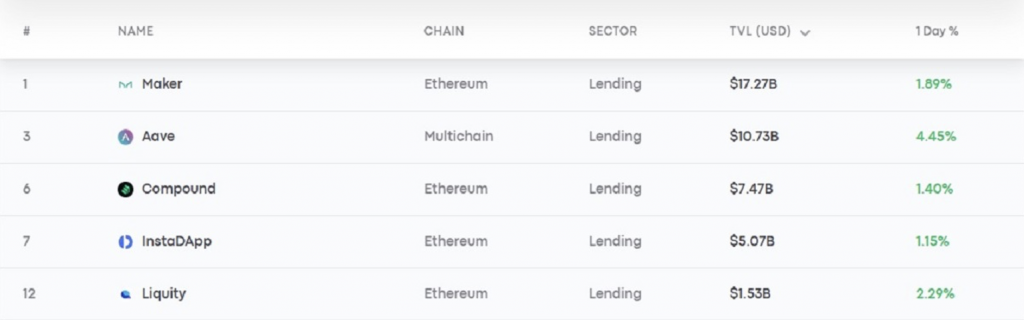

Although the process of lending and borrowing using DeFi networks is not complicated, these networks differ in some details (such as supported wallets and interest rates). The larger the network used and the more liquid it is, the less risk. For example, Maker, Aave, and Compound are the oldest and largest lending networks in Ethereum Blockchain.

In addition, their users should be careful and, when entering their wallet address, make sure that they enter the details and numbers correctly so as not to lose their assets in the end; because then there will be no way to recover these assets.

In general, the three significant lending risks networks in Ethereum blockchain are:

- Smart contract manipulation by a third party

- Loss of collateral due to a sharp drop in price

- Increasing the borrower’s interest rate in a short period

The chart below shows the volume of exchanges made on each Ethereum lending network.

For example, Maker, Aave, and Compound are the oldest and largest lending networks in the Ethereum blockchain. The table below introduces some of the lending networks that operate on Ethereum and presents their strengths and weaknesses.

Comparison of different lending networks on the Ethereum blockchain (Source: Research reviews)

Networks | Pros | Cons |

Compound | compound interest daily; its decentralization | Only be used from the DAI |

Maker | The easy possibility of creating a Collateralized Debt Position (CDP) to receive DAI | It has an above-average interest rate, and only the DAI can be used |

Aave | The existence of floating rate switching and the possibility of using many token | Rates and loan costs are above average. |

Overview of lending networks

In this paper, lending networks on the Ethereum blockchain were introduced, and a comprehensive comparison was attempted.

- After reviewing various networks, we find that Celsius can be ideal for crypto lending, as it supports most Stablecoins and cryptocurrencies. You also do not need to pay to receive interest, and there is a mobile application for crypto lending on this network to make your path to crypto lending smoother.

- However, if you have other special coins, you can use the various features of other networks. For example, if you only have a DAI coin, the Compound may be the best choice for you because its interest rate is high.

- Also, if you have a significant amount of Bitcoin, more than 25 Ethers, or a few other Stablecoins, it is recommended that you use BlockFi; because it has the best Ether interest rate. In this regard, you can also use Celsius to lend Bitcoin and Stablecoin.

- Note that the Dharma Lever blocks your capital for 90 days, and the crypto lending process is not very interesting, and it is recommended that you stay away from this network for crypto lending.

There are slight differences in how each protocol works and the different wallets it supports. There are also significant costs involved in those networks. However, to choose from the available options, you must choose the best option based on factors such as interest rates, risk, and duration.

Conclusion

The advent of lending in decentralized blockchains is a major achievement that has given cryptocurrencies great popularity and led to the influx of large amounts of capital into DeFi. The Ethereum lending process also has several benefits for investors. The use of smart contracts, no restrictions on users, decentralization and no need for long-term deposits are among the most important benefits of lending in Ethereum blockchain.

But lending in the Ethereum blockchain also carries risks, and lending mechanisms in this blockchain also face threats. For example, non-return of transactions in case something goes wrong, the need for large collateral, impermanent loss, and rug pull are among the most important threats to the Ethereum blockchain. So before deciding to borrow at Ethereum Blockchain, do thorough research on the destination network and then take action.