The metaverse is the next evolution of the internet. Consequently, investing in the best metaverse ETF is similar to taking a stake in a new market opportunity worth $800 billion by 2024, as per Bloomberg data.

Metaverses incorporate social networking, virtual and augmented reality, and live sporting and entertainment features. Their components include NFTs, virtual work and fun spaces, digital currencies and e-commerce opportunities.

Most tech titans invest billions in virtual 3D worlds making these elements a $1 trillion revenue opportunity. The savvy investor seeking exposure to metaverse stocks should invest in the best metaverse ETF.

They will earn returns from niche specific fintech, technology, gaming and semiconductor companies that are making huge waves in the metaverse sector.

What is an ETF?

An exchange-traded fund (ETF) is a group of securities tradable in the stock market. Metaverse ETFs are therefore themed funds that invest in the top-performing metaverse companies and related stocks available on the stock exchange. Below are the best metaverse ETFs and details of their top holdings.

Best metaverse ETFs summary

Metaverse ETF Name | Roundhill | Evolve | Horizon | Fount | Amplify |

Ticker | METV | MESH | MTAV | MTVR | BLOK |

Index | Ball Metaverse | N/A | Solactive Global metaverse | Fount Metaverse Index | N/A |

Founding date | January 31, 2022 | November 24, 2021 | November 26, 2021 | October 27, 2021 | January, 17, 2018 |

Holdings | 40 | 25 | 10+ | 49 | 46 |

Currency | USD | CAD | CAD | USD | USD |

AUM(in millions) | $762 | $6.653 | $4.8 | $8.65 | $8.653 |

Exchange | NYSE Arca | Toronto Stock Exchange | Toronto Stock Exchange | NYSE Arca | NYSE Arca |

Roundhill Ball Metaverse ETF (NYSE: METV)

Roundhill METV, a product of Roundhill investments, is one of the first metaverse specific ETFs to hit the market. It, therefore, has first-mover advantages such as large market size and Assets Under Management (AUM) volume.

The Roundhill Ball Metaverse ETF trades on the New York stock exchange and offers customers thematic and sector-specific investing options. In addition, it monitors the “Ball Metaverse Index” by Matthew Ball. Mathew Ball is a venture capitalist and analyst.

He also is the CEO of the corporate advisory firm Epyllion Industries. More so, Mathew has worked as the Amazon Studios Head of Strategy and has a keen interest in the metaverse and its developments. His investment tagline is, “Day by day; it is becoming easier to envision and participate in the next phase of the Internet.”

Therefore, the Roundhill Ball metaverse index showcases the performance of world-listed equity securities of firms that are building the rail tracks that the metaverse will run on. It tracks the performance of 43 businesses.

80% of the holdings are US-based, and the rest are based in Asia. This ETF also represents metaverse interests in payments, virtual platforms, networking, and computing. In addition, it also reflects the performance of a wide range of content creators and digital payment getway firms that contribute to the advancement of the metaverse concept.

The METV will, for instance, expose you to price movement of prominent metaverse focused shares like Microsoft, Apple and securities from V.R. hardware providers. It is the best metaverse ETF for investors looking for in-depth exposure to ROBLOX Corporation and Nvidia. These two firms carry 20% of the metaverse ETF’s weight.

ROBLOX is a robust user-generated content based virtual world where avatars socialize, play games, and participate in the digital economy. Nvidia is a chip manufacturer and a leading metaverse infrastructure developer.

The Roundhill Ball Metaverse ETF top 10 holdings include;

Company Weightage

- Nvidia Corporation (NVDA) 10.79%

- Roblox Corp (RBLX) 9.95%

- Microsoft (MSFT) 7.75%

- Meta Platforms (F.B.) 6.22%

- Unity Software (U) 4.84%

- Apple (AAPL) 4.18%

- Amazon (AMZN) 4.08%

- Qualcomm (QCOM) 3.89%

- Autodesk (ASDK) 3.86%

- Tencent Holdings (700 HK) 3.92%

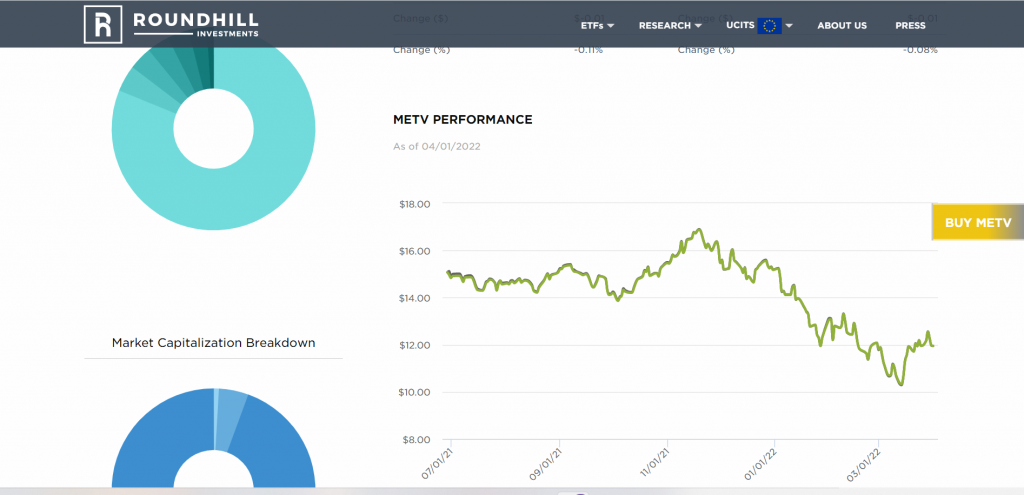

Roundhill METV ETF Performance

Roundhill was established on June 30, 2021. Its opening price was $14.62, but prices surged by 20% when Facebook changed its name to Meta in late 2021. The ETF is an excellent investment because it features stable large-cap firms.

Where to buy the Roundhill metaverse ETF?

You can buy METV ETF in single slots from one-discount brokers like Tiger Brokers and Moomoo. Alternatively, purchase them from online brokers like Interactive Brokers, FSMOne, and T.D. Ameritrade. If your existing brokerage has access to the NYSE Arca exchange, you can also purchase the METV there.

Evolve Metaverse ETF (TSX: MESH.TO)

The Evolve Metaverse ETF by the Evolve Funds Group Inc is Canada’s best metaverse ETF. It is also the country’s first metaverse ETF and trades on the Toronto Stock Exchange (“TSX”).

Evolve MESH is a Canadian ETF that exposes investors to an actively managed diversified portfolio of firms that have stakes in the metaverse ecosystem. Evolve is actively managed; hence, it does not monitor any index.

Instead, it pursues long-term capital appreciation by investing in firms involved in Metaverse advancement. An ETF can adopt a passive investment or an actively managed strategy. The latter has a team or manager that makes decisions that actively affect portfolio allocation.

Therefore, the Evolve Metaverse ETF is one of the best metaverse ETFs for investors that seek funds that adapt to changing metaverse market conditions.

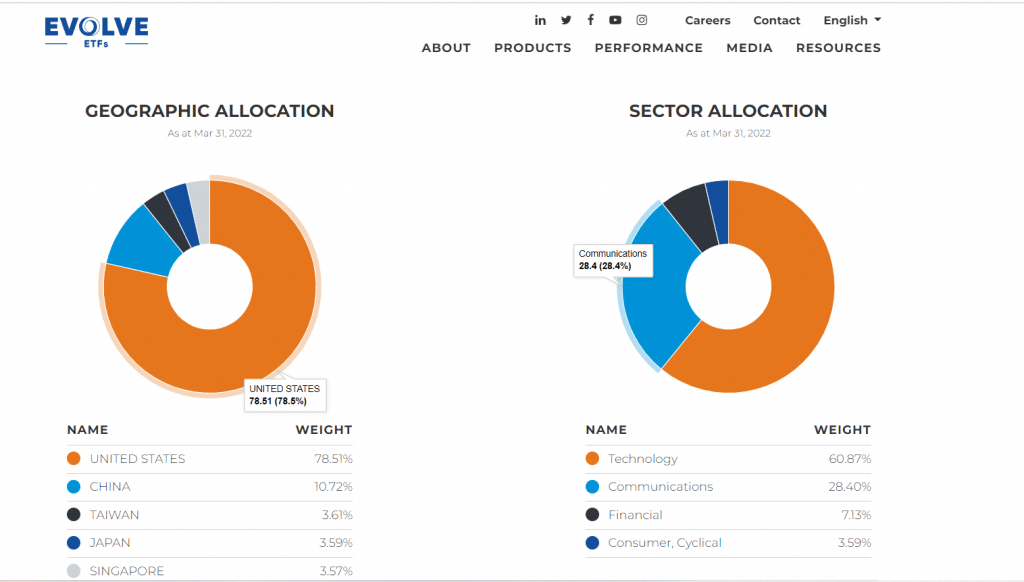

The Evolve MESH comprises 25 stocks and manages assets worth $13.362 million. It will expose you to significant-tech, fintech and social media firms from the U.S., Taiwan, Singapore, China, and Japan.

That said, 90% of this metaverse ETF weight is from the information technology, and communication sector and 70% of its holdings are American firms.

Unlike the Roundhill Ball Metaverse ETF that gives prominence to Roblox and Nvidia shares, the Evolve MESH has an equal distribution of all its components. Consequently, the performance of an individual stock will not drastically affect the fund’s performance. Its large-cap stocks are Meta, Autodesk, Walt Disney and Tencent Holdings.

Tencent Holdings Ltd is China’s largest entertainment and multinational technology firm. It is a top-selling game publisher and a large investor in significant gaming studios globally. In addition, the firm is purchasing Black Shark, a gaming handset maker, to kick off its AR/VR headsets development. This move will enlarge Tencent’s stakes in the metaverse.

Below are the top Evolve holdings

Firm Weighting

- Apple (AAPL) 4.58%

- Autodesk Inc (ADSK) 4.35%

- Snap Inc (SNAP) 4.32%

- Qualcomm (QCOM) 4.26 %

- Intel Corp (INTC) 4.26%

- Walt Disney (DIS) 4.25%

- TSM US 4.20%

- Sony Group Corp (SONY) 4.16%

- Microsoft Corp (MSFT) 4.13%

- Tencent (TCEHY US) 4.13%

Evolve MESH ETF performance

Evolve ETF launched in November 2021. It is currently trading at 8.15 CAD. Its starting price was 10.16 CAD, but the fund encountered a few price drops in January 2022. However, the fund values are on the road to recovery, passing their lowest price of 6.81 on March 14. Evolve MESH has a 0.60% management fee and has an annual distribution frequency.

Where to buy evolve metaverse ETF?

You can purchase MESH VIA Canadian Toronto Stock Exchange (“TSX”) brokerage firms or top stock trading apps like Questrade and Wealthsimple Trade. Questrade offers free ETF purchases. In addition, you will get $50 in free trade credits after funding your investment account with at least $1,000.

Wealthsimple Trade does not charge trading commissions when you trade ETFs and stocks. Instead, new users get a $50 cash bonus after trading $150 worth of stocks or ETFs.

Horizons Global Metaverse Index (TSX: MTAV.TO)

Horizons Global Metaverse Index ETF (MTAV) got off the ground just about the same time as the Evolve MESH ETF. Like Evolve, Horizon is a Canadian-based ETF and earned its spot on the Toronto Stock Exchange on November 26, 2021.

The MTAV ETF tracks the performance of the Solactive global Metaverse index, a function of the Solactive Global Equity Index ETF tracker. The Solactive Global SuperDividend Index tracks the value of 100 equally weighted firms that produce the highest dividend ratios in the equity securities sector.

The Solactive Global Metaverse index leverages proprietary A.I. in the screening and identifying global leaders in the Metaverse. Its proprietary A.I., ARTIS screens publicly available information like news, business profiles, and publications to identify companies with high investment potential.

Unlike the Evolve MESH ETF, which distributes its share weight across all its components, at least 25% of the MTAV share fund targets the tech sector. But, like the Evolve MESH ETF, it favours American tech firms. As a result, it is the best metaverse ETF for investors looking for low-risk ETF investments.

The MTAV has diversity in sector allocation. Google, Visa, and Amazon are some of its most extensive holdings. Visa Inc. (NYSE: V) is a Fintech and payment firm that began its metaverse foray by purchasing NFTs worth $150,000 in August 2021.

Other prominent shares in its basket include digital marketplaces, infrastructure, payments, creator economies, AR/VR, and gaming.

Below are the 10 top holdings in Horizons Global Metaverse Index ETF.

Company Weightage

- Apple Inc 5.87%

- Nvidia 5.80%

- Amazon 5.27%

- Microsoft 5.22%

- Alphabet Inc 5.14%

- Meta Platforms 5.07%

- Adobe 4.91%

- Tencent 4.88%

- Visa 4.83%

- Walt Disney 4.49%

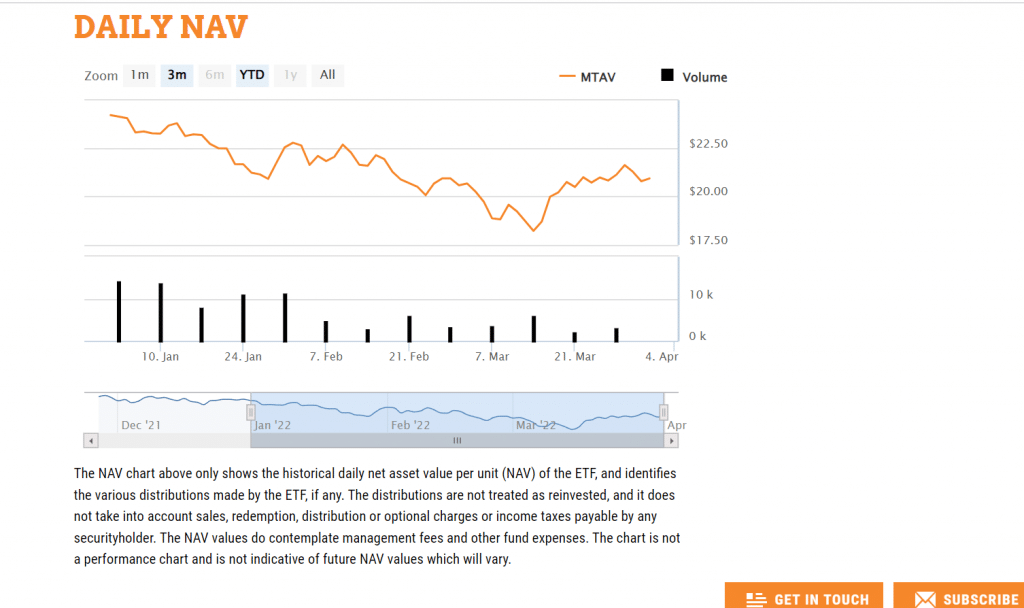

Horizon MTAV ETF performance

This ETF is currently trading at 21.70CAD, a 2.41% increase in value as per Yahoo data. Similar to other metaverse ETFs, the MTAV is also recovering from a start of the year downtrend.

Where to buy horizon metaverse ETF?

You can buy the Horizons Global Metaverse Index ETF via an online discount brokerage account such as Wealthsimple Trade ($50 bonus) and Questrade ($50 free trade credit). CIBC Investor’s Edge and Qtrade brokerage sites are other options. MTAV management fee is 0.55% (plus applicable sales tax).

Fount Metaverse ETF (NYSE: MTVR)

Fount ETF, MTVR, was established on October 27, 2021, and has over $13 million in assets under management (AUM) volume. It tracks an index of 49 metaverse oriented businesses.

The Fount Metaverse ETF (MTVR) exposes investors to gains from businesses that are primed to reap the most returns from the metaverse ecosystem.

The MTVR is managed by the SEI Investments Global Fund, a subsidiary of the SEI Investments Distribution. SEI is a tech and investment firm based in Oaks, Pennsylvania. SEI Investments launched in 1968 and has over $750 billion in assets and $300 worth of investments in private banks, institutional advisors and managers.

The MTVR uses A.I. to predict the 1-year forward revenue of metaverse technology-related services and products. It derives over 50% of its revenue from metaverse-related services. One of its leading stocks is the Meta platform.

Below are the top 10 Fount Metaverse ETF holdings.

Company Weightage

- Apple (AAPL) 14.19%

- Meta Platforms (F.B.) 6.17%

- Alphabet (GOOGL) 5.53%

- Pearlabyss (263750. KS) 2.95%

- Kakao Games (293490. KS) 2.29%

- Roblox Corp (RBLX) 2.61%

- Unity Software (U) 2.35%

- Walt Disney Co (DIS) 2.33%

- Sega Sammy Holdings (6460. J.P.) 2.27%

- Warner Music Group (WMG) 2.02%

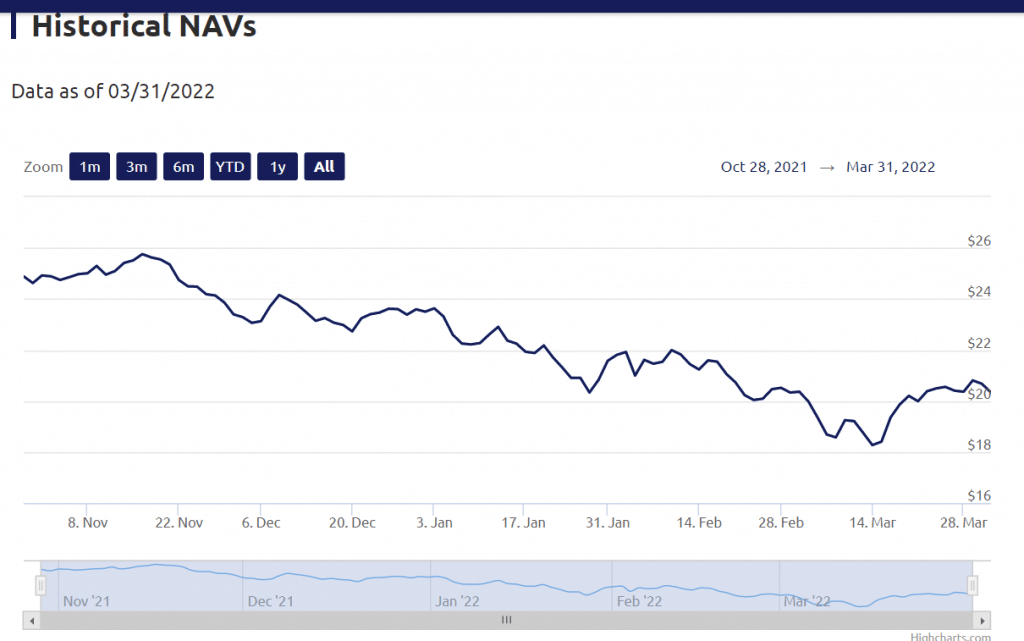

Fount MTVR ETF performance

Fount MTVR ETF is currently trading at $21.01. It kicked off its trading on November 1 2021, at $24.96. Its prices began to plunge a month later, hitting lows of $18.18 on March 14, 2022. Like most metaverse ETFs, the MTVR’s price is rising as the demand for metaverse stocks increases.

Where to buy Fount Metaverse ETFs?

You can buy MTVR single slots on discount brokers like Tiger Brokers and Moomoo. Online brokers options include Interactive Brokers and FSMOne. You may also purchase it on NYSE Arca via your existing brokerage.

Amplify Transformational Data Sharing ETF (NYSE: BLOK)

The Amplify Transformational Data Sharing ETF is an Amplify ETFs product. One of Amplify ETF’s most prominent ETFs is the Amplify CWP Enhanced Dividend Income ETF DIVO which has $1.20B in assets. The BLOK ETF is the best ETF for the investor seeking exposure to businesses that develop and leverage blockchain technology in their functions.

As an illustration, Coinbase, an American crypto exchange platform, is one of the BLOK ETF’s most significant holdings. Like the Evolve Metaverse ETF, the BLOK ETF is actively managed. It is run by portfolio managers who choose securities that join the portfolio. Thus, it doesn’t function by a strict, rules-based procedure for selecting stocks.

Also, it has several standards and simple parameters for which stocks are eligible to be included in the ETF. For example, its U.S. stocks must have a market cap of at least $75 million. Then, foreign stocks require a market cap of at least $100 million to join the BLOK ETF.

Additionally, its stocks must meet minimum liquidity requirements. Eligible stocks must have an average daily trading volume of $250,000 over six months.

Amplify’s ETF top 10 holdings carry about 47% of its assets. Its top five industries are;

- Software 27.90%

- Capital markets 22%

- It services 19.50%

- Semiconductors and equipment 7.80%

- Banks 7.20%

The North American tech firms carry the enormous slice of 77% of share weight. The Asia Pacific region has 17% while 6% goes to western Europe. BLOK ETF top 10 holdings are;

Company Weightage

- Galaxy Digital Holdings 5.24%

- Silvergate Cap Corp 5.08%

- Nvidia Corporation 4.67%

- Coinbase Global Inc 4.27%

- SBI Holdings Inc 4.17%

- Microstrategy Inc 4.02%

- Riot Blockchain Inc 3.94%

- CME Group Inc 3.88%

- Hive Blockchain Technologies 3.50%

- GMO Internet Inc 3.47%

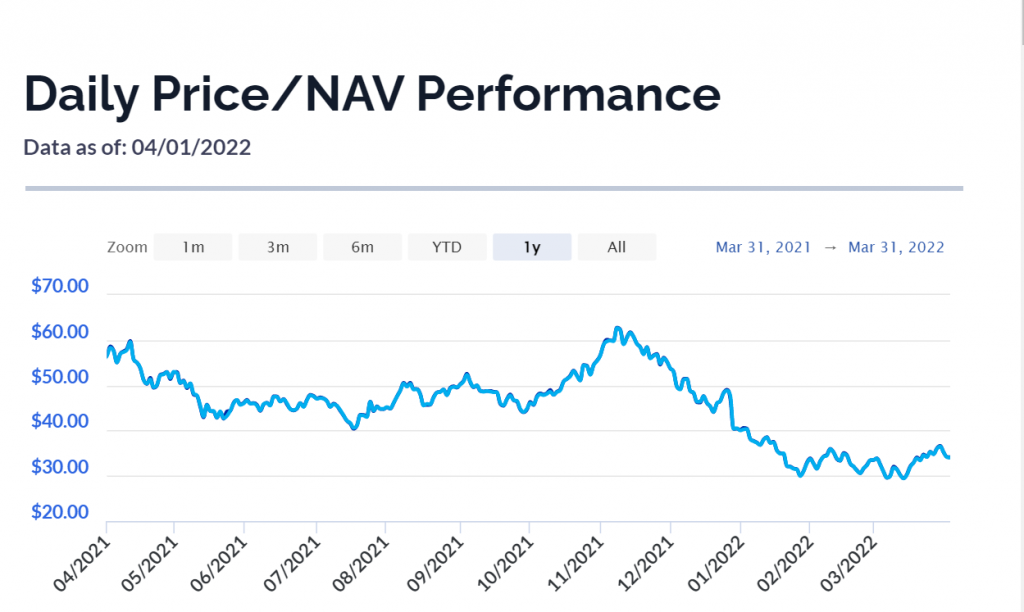

Amplify BLOK ETF Performance

The Amplify Transformational Data Sharing ETF’s inception date is January 2018. Its shares first sold at $19 and have risen over time to the current $34 mark. In October 2021, the share value increased to an all-time high of $55.

Where to buy Amplify Metaverse ETF?

You can buy a share of the BLOK ETF on Stash. Stash is an investment plan that allows you to buy smaller and more affordable investment pieces (fractional pairs). Alternatively, purchase the BLOK ETF shares from professional brokerage platforms like I.G.

Conclusion

Identifying, tracking, and purchasing shares from leading metaverse companies can be challenging. Fortunately, you can partake in the metaverse boom via the best metaverse ETFs listed above. ETFs are an affordable, low-risk investment strategy that builds diversified portfolios at lower expense ratios.