Bulkestate Review

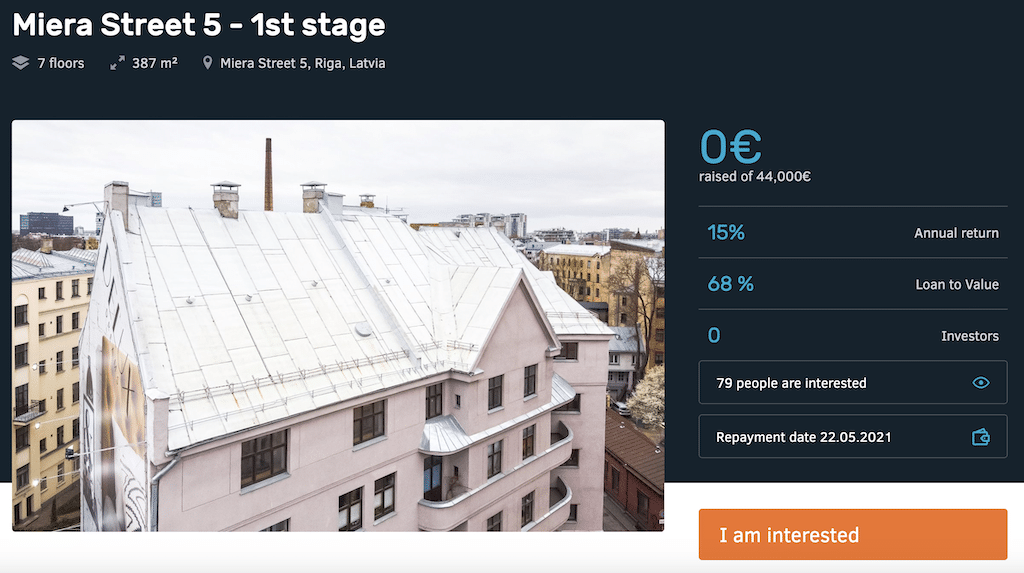

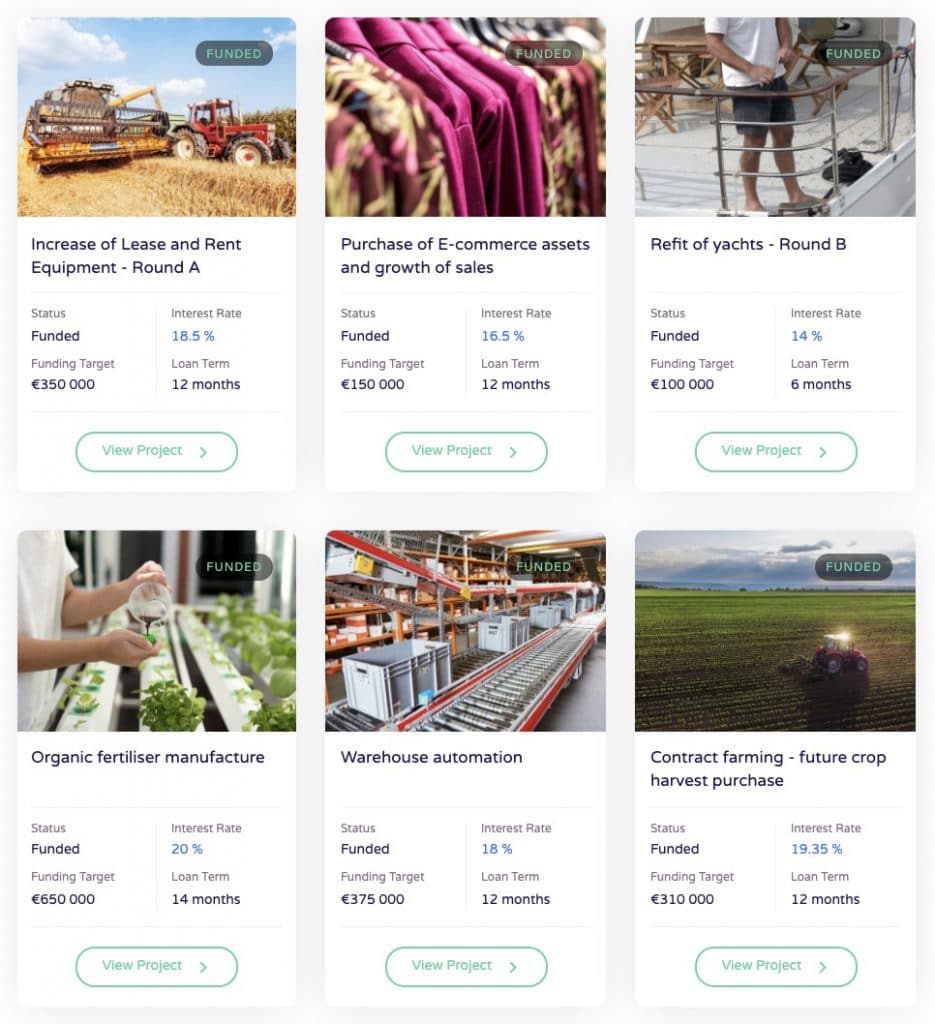

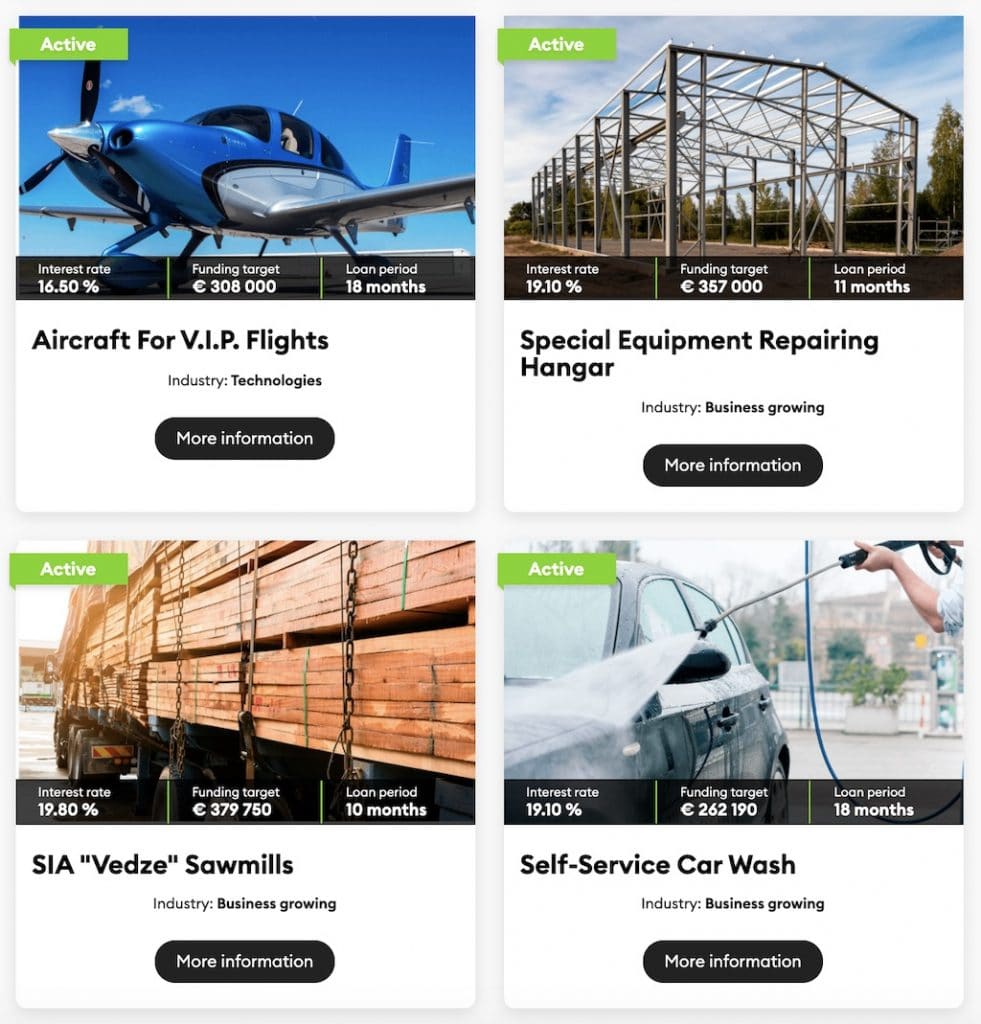

Investors [05.2020] Investments [05.2020] Founded Country ? +23’870 Dec. 2016 Estonia Bulkestate is a European P2P lending platform specialized in Real Estate Crowdlending. The platform operates in a model where it issues loans to borrowers (only companies, no private owners) and then offers them to investors in the marketplace. Bulkestate has a focus on funding new …