The continued rise of peer-to-peer lending has empowered retail investors who had otherwise been left unserved or underserved by the formal financial and banking sector. It has brought a massive paradigm shift in the field of investment where investors can be guaranteed of high p2p lending returns than what they would have received from the stock market. Peer-to-peer lending has unlocked a tech-inspired and highly profitable alternative asset class.

Since its inception in the early 2000s, p2p lending has experienced exponential growth that has been a spectacular testament to the shifting investment preferences of the investors.

Today, you can anywhere between 2% and 6% with p2p lending according to Forbes, but it depends on many factors.

If you are currently planning to start investing in p2p lending loans or you are already an investor but looking for tips to increase your earnings, I have prepared for you 10 things you need to keep in mind as you try your luck in this new asset class.

Let’s now have a look at the Top 10 things for high p2p lending returns

You need to choose the right platform

Though this sounds like a non-issue if you don’t choose the right p2p lending platform, you may lose all your capital and potential p2p lending returns.

With that in mind, the first step is looking for the best appropriate platform. Make sure that the platform has a track record of at least three years, a range of safe investment options with high returns, quick access to your portfolio, transparent and inclusive terms and conditions, and an intuitive interface with an auto-invest feature.

A p2p lending platform that fulfills the above criteria can help you earn high returns. If you apply the right strategy, you can earn around 10% interest annually.

Diversification of portfolio

Diversification will ensure that you are not putting all your eggs in one basket, thus helping you avoid some unwanted risk to your investment.

Just like with any other investment, diversifying your p2p lending portfolio keeps components of your investment assets from being too heavily weighted toward one loan type or sector.

With that in mind, make sure you invest in loans from borrowers from across multiple employment categories, regions, credit scores, and income levels to sustainably diversify your investment portfolio.

Top p2p lending sites should be able to provide a feature that allows users to filter through different types of loans based on a variety of borrowers, so make sure the platform you choose comes with this filter function.

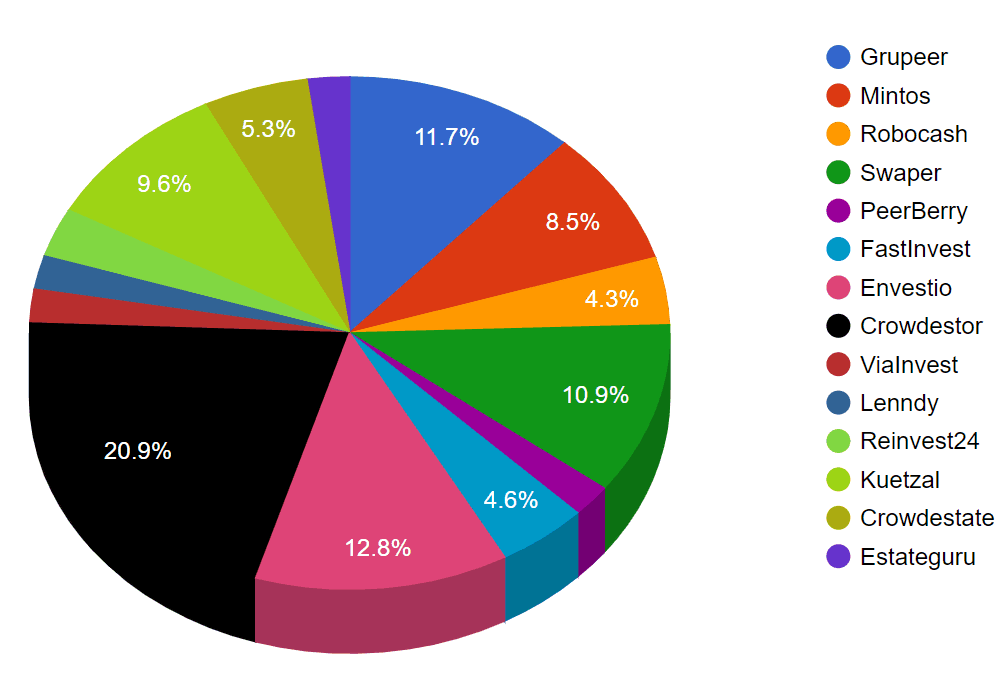

Besides just diversifying your investment based on loans, you can also diversify based on platforms, as shown in the image below:

How to balance risks with gains

If you want to increase your peer-to-peer lending returns, consider learning how to balance risks and gains.

Risks and gains go hand in hand in investing, but only up to a certain limit. For instance, while investing in high-risk loans might get your high returns, it also comes with a higher risk of default.

On the other hand, choosing low-risk loans might not get you desirable returns, but they have low risks of defaults.

Learning is important

Just like any other investment, p2p lending can deliver the best results if you have a reliable flow of relevant information to help with your decision-making method.

The new EU crowdfunding regulation requires platforms to provide sufficient information to non-sophisticated investors so they can have an accurate decision-making process.

Loss of investment

While p2p lending usually provides high returns, sometimes this is never the case. High returns also come with high risks and as an investor, it is important to prepare to lose some of your investment.

Also, with that in mind, make sure the money you put in p2p lending, especially if you are new, is an investible surplus, which you can afford to lose.

If you want to achieve high returns, you need to prepare for a few defaults here and there.

Tax compliance

Another important thing to keep in mind when investing in p2p lending is tax compliance. Depending on your jurisdiction, the interest you receive from monthly payments is taxable according to the taxation law applicable to you.

Time is an important factor

The time value of money is an important consideration for any kind of investment. This concept holds that a dollar on hand today is worth more than a dollar promised in the future, meaning that it is better to have money now than later if all things are being equal.

With that being said, start small and build big, as big returns will only be feasible if you don’t burn your hands along the way.

Cash drag

Some investors are so risk-averse that they would hold money in their accounts as they weigh up their options. While this is not a bad thing, only money invested will be able to earn you interest, while cash deposited into your account will not.

However, one thing you need to keep in mind is the time it takes from investing in a loan to the time your capital starts earning interest. This differs from one platform to another; with some operating based on instant interest accrual while others have delays of a few days.

Secured vs. unsecured loans

Most of the loans listed on p2p platforms are unsecured personal loans unless specified. Business loans can offer no or some form of security while real estate loans can offer first or second charge on the asset as a security.

For your own safety, it is important to finance loans that are attached to an asset as security. But even so, make sure that the property offered is highly liquid and can easily be sold if the loan defaults otherwise you will remain with an un-disposable asset.

Secondary market

Many p2p lending platforms feature a secondary market where investors can sell and buy their investments to and from other willing buyers and sellers.

If you have a knack for creating high-yielding portfolios, you can build a portfolio and sell in the secondary market for marginally high prices.

However, the secondary market does not guarantee that you will be able to liquidate your investment immediately. There must be another investor willing to buy the loan and the loan should be attractive to the potential buyer.

[insert page=’cta-footer-crowdlending’ display=’content’]