|

|

|

Investors [06.2021] |

Investments [04.2020] |

Founded |

Country |

About Crowdestor

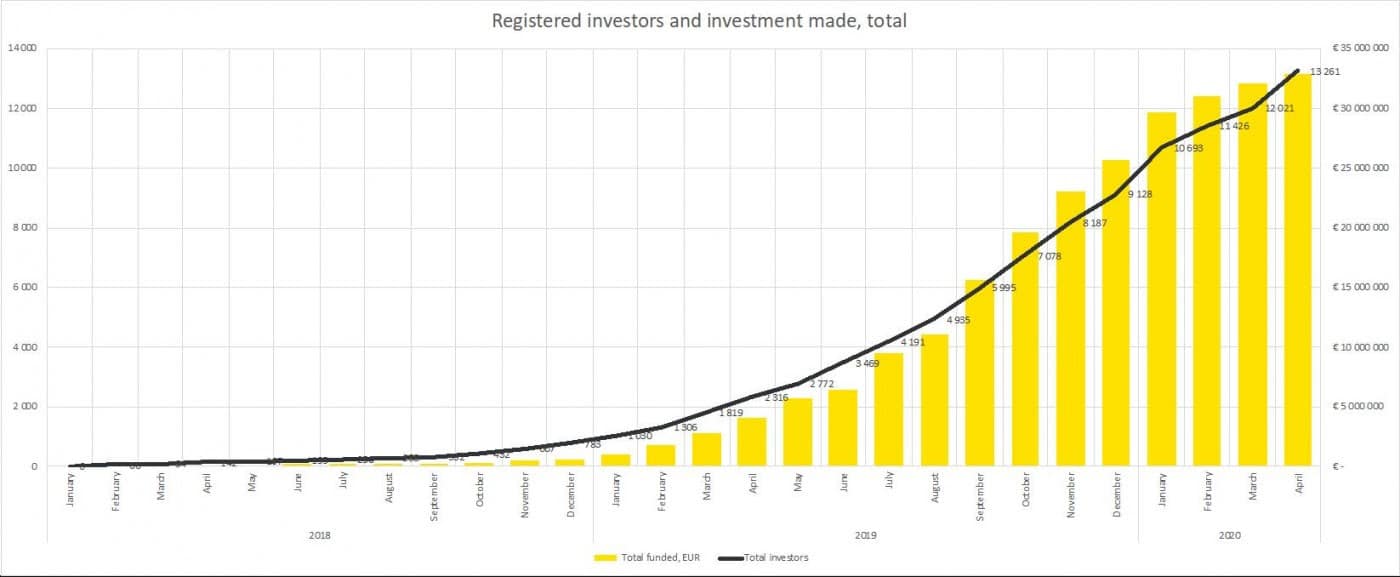

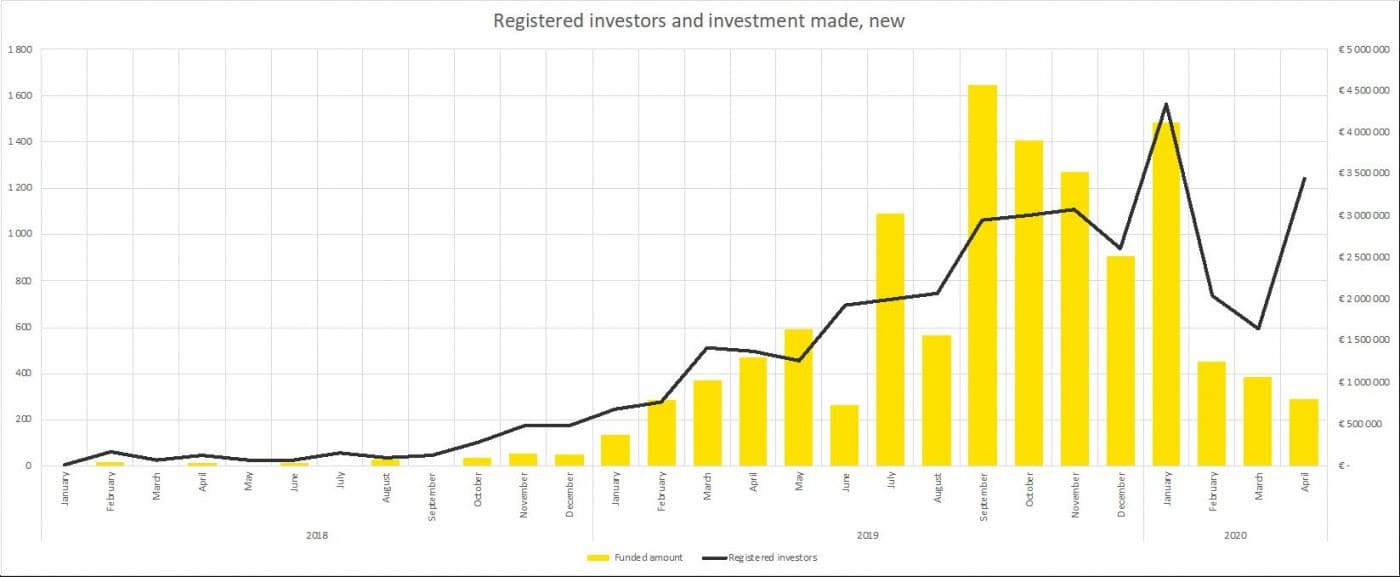

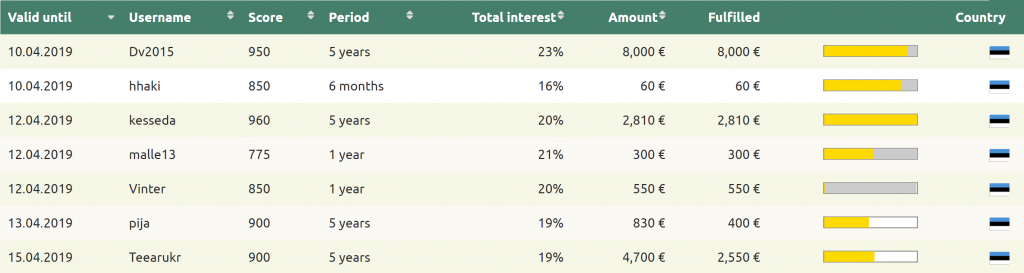

IntroductionCrowdestor is a crowdlending platform focusing on financing real estate and business projects. Theis p2p lending platform proposes interesting and exciting projects such as restaurants, transportation, startups, real estate and cryptocurrency. Concerning the investment location, ~50% of opportunities are based in Latvia and the other 50% are worldwide (UK, Russia, Malaysia, Cambodia, Thailand, Spain, ….). PerformancesCrowdestor has between the highest returns (12-36%) of the European p2p lending market with an average ROI of 18%. Usually, the platform pays monthly interests and investors will receive back the invested amount (principal amount) at the end of the investment term of 6-9 months on average. Investors will receive interest from the moment they invest and not the closing date of the investments project and there are no hidden costs when investing on this platform. EvolutionIn the picture below, you can see the positive evolution of Crowdestor in terms of registered investors and investment amounts made.

Figure: Cumulated registered investors (black) and cumulated investments made (yellow)

Figure: Monthly registered investors (black) and monthly invested amount (yellow) SafetyThe platform was founded in 2018 and has a shorter track record than others. You can also sense it as they don’t display their platform statistics publicly on their homepage (e.g. number of investors, invested amount) Nevertheless, they are now improving and promoting the safety of their investments. To do so, the platform created a Crowdestor BuyBack fund to give back money to investors in case borrowers default to pay. This is how works their BuyBack program:

A second important point is Crowdestor skin in the game. They are always investing between 2-10% on each project amount to take part in the risk and prove accountability. You should diversify your investments portfolio with this platform if you want to add slightly riskier/high return investments to it. TeamThanks to the popularity of Crowdestor, the investment platform is hiring 7 new professionals to strengthen the team. Those people are focusing in 4 areas: Business development for SMEs investments, Internalisation of the IT development (previously outsources), Financial and risk analysis, Customer and investors support. You can see the information below on the people:

This gives us also a sense of security, knowing that the platforms in improving in different parts of their business and is hiring physical people. |

Pros & Cons

| Pros | Cons |

| + Highest-interest rates of the market (~18%) + Diversified types of investments (e.g. restaurant, shop, crypto, transportation) + Monthly interest payment (mostly) + Interests calculated from investment date + Super detailed investment information + Short-medium term of investments (from 3 months) + Creation of a BuyBack fund in progress |

– No BuyBack guarantee on loans – Smaller-sized platform (lower track record) – Invested amount (principle) returned at investment term – Small amount of investments (~1x/week) – No cash-back investments (1%) – No Auto-invest available – No secondary market for early withdrawal |

Investment details

| Investment currencies | EUR | |

| Return on investment (ROI) | 18% | |

| Minimum investment | € 50 | |

| Investment period | 3 – 18 months | |

| Default rate | 0% | |

| Investment fees | 0% | |

| BuyBack guarantee | No | |

| Auto-invest | No | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 7.7/10 | (on 27.07.2019) |

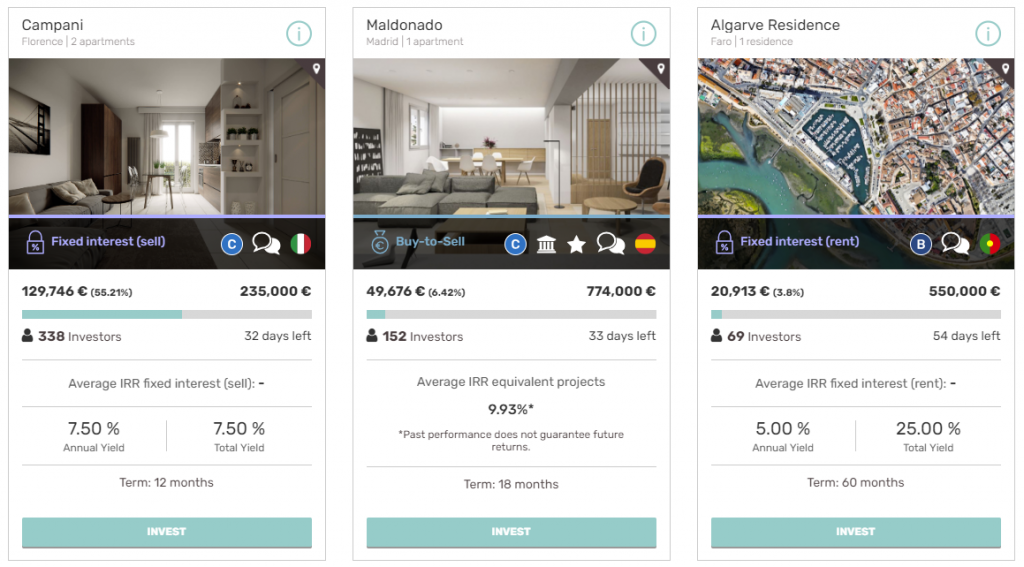

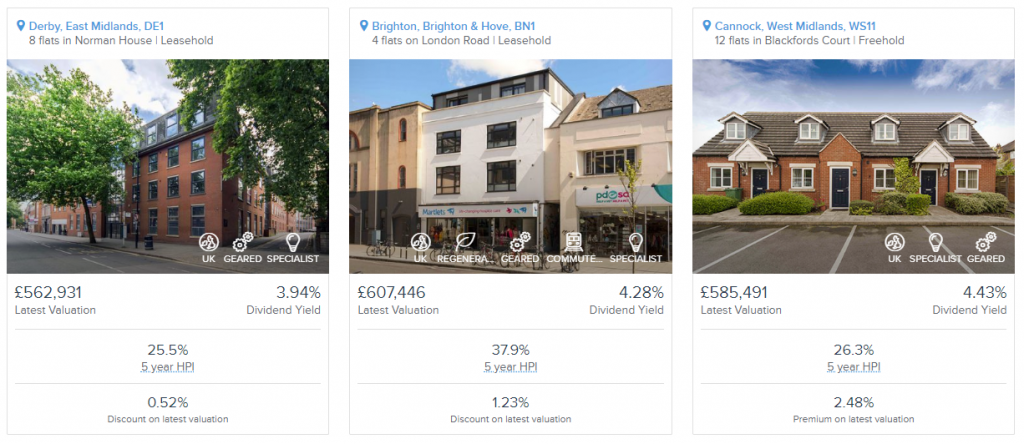

Investment types

Investment example

|

Investment result forecast

| Below you will find the resulting forecast when investing using Crowdestor compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using Crowdestor for 15 years you might end up with €11’974 (€9’577 more than with the stock market). |

Crowdestor promo code (affiliate/referral)

| Register on Crowdestor by clicking the button below to benefit of Crowdestor bonus as a cashback payment.

BONUS = 0.5% of your invested amount during the first 180 days after signup |

Crowdestor competitors

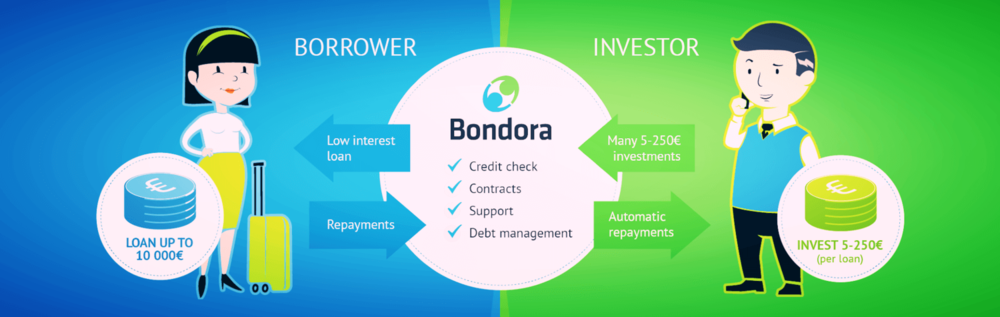

How works Crowdestor

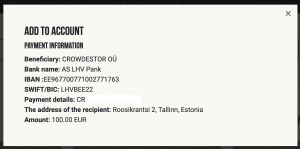

Step 1: Deposit money

Transfer money from your bank account to the platform account. You will have to indicate your platform account ID in your transfer comment (the comment system is supported by all banks.). You must send your deposit from a EURO account. It usually takes 1-2 business days to receive your money. It is advised to first send a small deposit (e.g. €10) to make sure your transfer information is correct, and then to execute the “real” deposit.

Once you click on the “Add” button to deposit funds, you will then enter the amount you want to deposit, and a popup will open showing you the bank transfer information. You will also receive an email with the details.

Step 2: Choose the project to invest

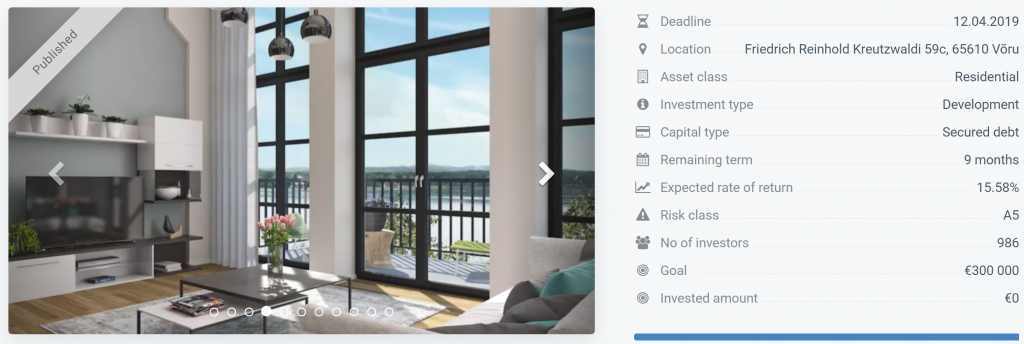

The p2p lending platform displays investment opportunities on its “INVEST” page. Investments are listing chronologically buy the start date. There are no filters on investments since there are not so many. Here is how an investment in previewed on the page:

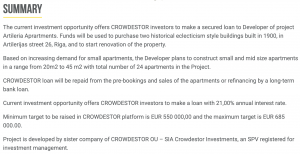

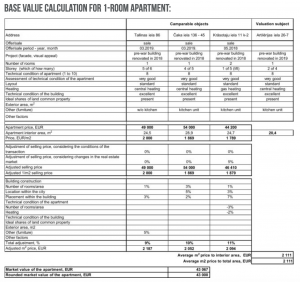

You can then click on “Invest in project” to view a LOT of additional information about it as following:

Investment KPIs

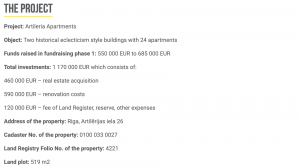

Project summary

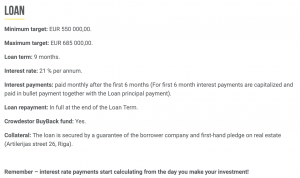

Details of the loan

Calculations and business plan

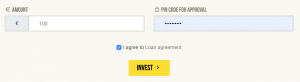

Step 3: Select the investment amount

Once you reviewed your project, decide how much you want to invest. You need to select at minimum €50. You can invest how much you want at the maximum of the loan still available.

Step 4: Invest

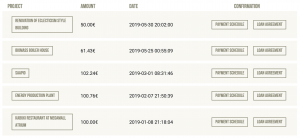

Once you have confirmed your investments, you can view the list of all your investments with the main information such as the amount invested, the date and the payment schedule.

Step 5: Earn interests

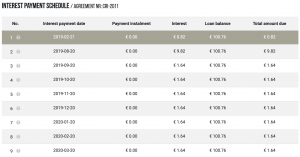

You will receive monthly incomes from your investments. So you can expect to start receiving interests after 30 days after your first investment.

Step 6: Track investment

You can easily follow the results and numbers of your investment activities thanks to the dashboard. It provides simple but useful information such as the money you earned (“Profit”), the money you invested (“Total Invested”), the return “Average Interest Rate” and the available money to invest (“Amount Available”).

Welcome bonus – affiliate/referral link

| Register on Crowdestor by clicking the button below to benefit of Crowdestor bonus as a cashback payment.

BONUS = 0.5% of your invested amount during the first 180 days after signup |