|

|

|

Kuetzal Review

Attention: same red flags arose regarding Kuetzal’s safety. I do not recommend investing on this platform at the moment.

Investors |

Investments |

Founded |

Country |

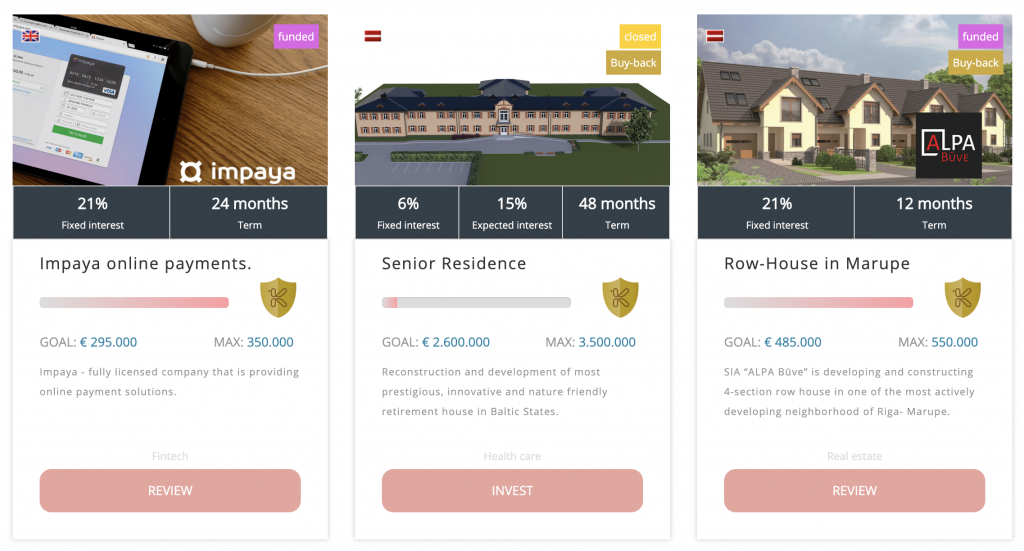

| Kuetzal is a crowdlending platform focusing on financing businesses and real estate projects. You can invest in fun and special projects in the field of crypto-mining, fin-tech, healthcare, transportation, logistics, petrol and real estate.

Location-wise, a projects are usually based in Latvia but you’ll also be able to invest in UK, Spain, Ukraine, Estonia, Poland. Projects usually return monthly interests and the invested amount (principal amount) is returned to the investor at the end of the investment which is often of a 12-24 months term. The €100 minimum investment amount is between the highest of the market (Crowdestate does the same). Performances: The ROI of Kuetzal investments is in the highest range of the market, averaging at 18% ROI and with projects ranging from 6% to 21% return on investments (directly related to risks). Interests start calculating from the day after you made and not when the full project is funded. This is a good practice in the peer to peer lending industry that is not covered by many platforms. Risks: If a project defaults and that it is supported by the BuyBack feature, the platform guarantees to cover 100% of the investment during the 2 months after the default is announced. This time is then used for the legal process of a maximum of 2 months to return the funds (the platform expects to return funds in 1-2 weeks). In this case there are no fees for investors. To BuyBack feature information of a project are displayed in its detail page (click an investment to see this page) in the KPIs box as in the image below.

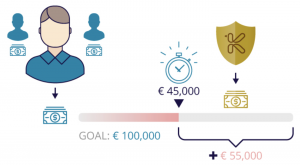

An additional security mark to check on the investment is if they are covered by the Kuetzal Care feature . This feature means that if a project doesn’t reach the fund goal, the platform will involve its own funds (called skin in the game) to cover the gap between the invested and targeted amount. The platform gets these funds through agreements with investment funds, banks, and private investors. This might create an additional warranty since the p2p lending platform is willing to participate in the investment. This action is called having skin in the game. The image below illustrates this process for example for an investment with a goal of 100K, if the amount collected is only of 45K, the platform will add the missing 55K to the investment.

Withdrawal: The minimum withdrawal amount in €15 and it requires you to have 1 investment. In addition, the platform advertises that it is possible to cancel an investment before its term by writing an email to Kuetzal. But it will generate the investor a penalty of 10% of the invested amount. |

Advice

| Kuetzal has between the highest returns (up to 21%) of the European crowdlending market with an average of 18% but has also a short track record with a young team. You should diversify your investments with this platform if you want to add riskier/high return investments to your portfolio. This platform is similar to Crowdestor. |

Pros & Cons

| Pros | Cons |

| + Highest-interest rates of the market (~18%) + Diversified types of investments (e.g. crypto-mining, fintech, healthcare, transport, logistics, petrol) + Monthly interest payment + Interests start from investment date + Creation of a safety fund in progress (of 100K) |

– BuyBack guarantee not on all projects – Large minimum investment amount (€100) – Minimum withdrawal of €15 – Medium-long term investments (>12 months) – Missing detailed projects information – Smaller-sized platform (lower track record) – No Auto-invest available – No secondary market for early withdrawal |

Investment details

| Investment currencies | EUR | |

| Return on investment (ROI) | 18% | |

| Minimum investment | 100 EUR | |

| Investment period | 12 – 48 months | |

| Default rate | 0% | |

| Investment fees | 0% | |

| BuyBack guarantee | Yes | |

| Auto-invest | No | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 7.9/10 |

Investment types

Investment example

|

Investment result forecast

| Below you will find the resulting forecast when investing using Kuetzal compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using Kuetzal for 15 years you might end up with €11’974 (€9’577 more than with the stock market). |

Kuetzal competitors

Useful links

|

||

| Kuetzal Risk Analysis |