Investors [09.2021] | Investments [09.2021] | Founded | Country |

5’500+ | € 100M+ | End 2019 |  Ireland |

About Lendermarket

Thank you for joining this Lendermarket Review! Lendermarket is a marketplace for investors willing to invest in Buyback Guaranteed consumer loans issued in Europe. The loans are originated by their partner Creditstar Group – an international consumer finance company, based in Estonia, Tallinn.

As of 09.2021, the platform has originated a total of € 100M+ investments and has 5’500+ registered users.

Investments are available across multiple countries (Czech, Finland, Poland, Spain, Estonia, Denmark, Sweden), in euros and the platform accepts investors from the European Economic Area (EEA) and Switzerland (and few other countries). Investors from the US are not accepted.

Below you’ll find an interesting view of the evolution and main events of Lendermarket from 2019 to 2021.

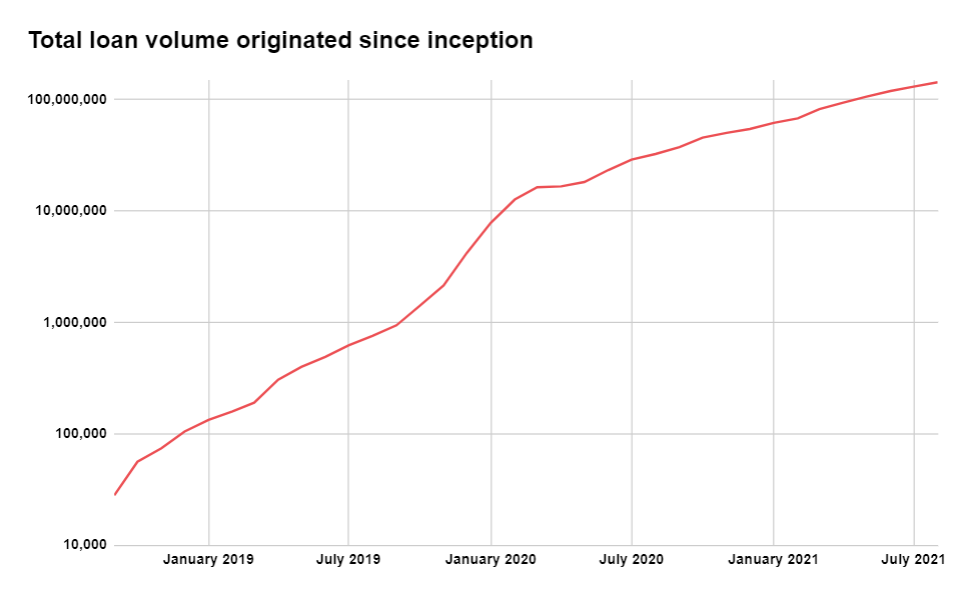

The figure below shows the evolution of the total amount of loans that were originated since the inception of Lendermarket till July 2021

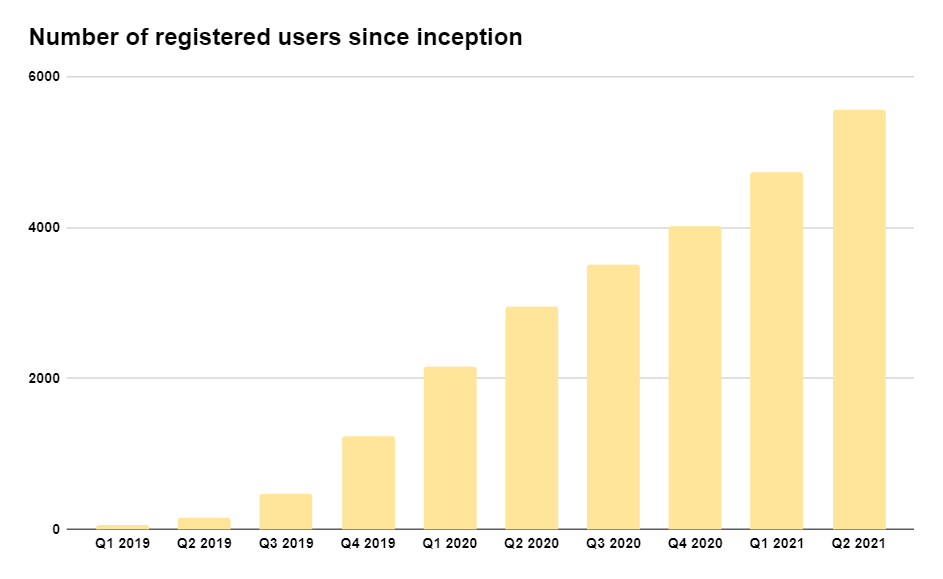

While in this other figure below you can see the evolution of the number of registered users since the inception of Lendermarket.

Start lending with Lendermarket to earn yearly interests of 14% to 15%

How works Lendermarket?

- Borrowers apply for a loan to Lendermarket‘s partner Creditstar

- This loan originators evaluates each application, and if it follows their requirements in theirs of safety and return, they make the loan available for investment

- Available loans can be seen by investors on the Lendermarket website with the following information: country of borrower, issuing date, the total and available amount, the term and the interest rate per year

- Investors select the loan they want to invest in and select the investment amount

- The platform provides monthly interests to the investor and returns the invested amount to the investor at loan term

Remember that when withdrawing your funds from the platform you won’t have any fees, but a minimum withdrawal of 50 EUR is required.

Lendermarket interests rate

In this Lendermarket Review, we want to talk to you also about performances, as it is often the main concern of investors.

This crowdlending platform provides loans generating an average of 14%-15 yearly ROI and proposes investments with a term from 30 days to 4 years.

Usually, if you invest in short-term loans (< 30 days) interests are provided at end of the investment term and if you invest in long-term loans (multiple months) you will receive interests and part of your invested amount (principal amount) every month.

In addition, all loans come with a BuyBack guarantee feature, meaning that the peer-to-peer lending platform will pay back the investment to the investor if the borrower defaults to pay (on this platform it happens after 60 days).

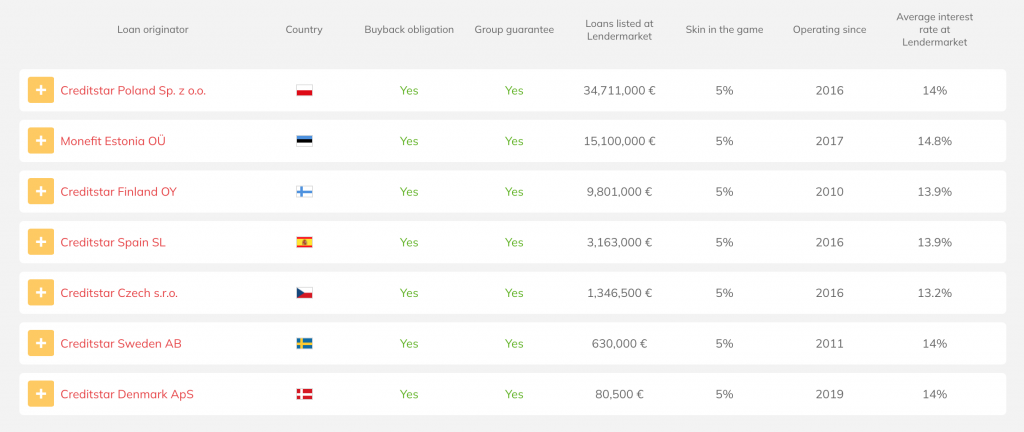

The picture below shows information about the loan originators and their numbers, including the returns.

Is Lendermarket safe?

Here is a summary of what we know about Lendermarket in terms of safety:

- Their loan originator partner, Creditstar Group, is one of Europe’s leading digital consumer finance companies, with more than 12 years of experience, 1M registered customer accounts, 165M EUR assets under management as of 03.2021 and a team of 135 people.

- The bank used to deposit your money is called Fire Financial Services Limited. This bank provides a range of payment services since 2010 and is regulated by the Central Bank of Ireland. Fire helps Lendermarket to manage bank transfers to / from investors in a trustworthy, simple and quick way.

- All loans come with a Buyback guarantee of 60 days

- Lendermarket is not profitable yet, you can find there financial report here, which shows the positive behavior to be transparent

- On the downside, Lendermarket’s loan originators have a skin in the game of 5%, which is slightly lower than competitor that often put 10%

- The platform has a small amount of employees: 7 on LinkedIn as of 09.2021

- Here are the main people in the company’s team:

- Founder: Aaro Sosaar (who is the CEO of Creditstar Group, the main loan originator of Lendermarket)

- Head of Lendermarket: Endrik Eller

- Head of Operations: Omayra Roig

Start to earn interests with Lendermarket

To benefit from lending interests you need first of all to create a Lendermarket account. Good news! With Lendermarket you can earn a bonus when creating the account via our partner link.

| Start lending with Lendermarket to earn yearly interests of 14-15% |

Review of Lendermarket Pros & Cons

Pros | Cons |

+ Returns above (14-15%) + Buyback guarantee on all loans (60 days) + Short term investments (from 30 days) + Simple to use auto-invest | – Younger platform (smaller track record of 5.5k users) – USA investors not accepted |

Lendermarket investments details

| Investment currencies | EUR | |

| Return on investment (ROI) | 14-15% | |

| Minimum investment | € 10 | |

| Investment period | 30 days – 4 years | |

| Default rate | unknown | |

| Investment fees | 0% | |

| BuyBack guarantee | Yes (after 60 days) | |

| Auto-invest | Yes | |

| Secondary market | No | |

| Trustpilot Score (Safety) | 3.7/5 | [09.2021] |

Investment types

Investment example

One more crucial piece of information that we would like to show you in this Lendermarket review is the investments you can make.

Investments made available are consumer loans. As you can see in the table below, you will receive summaries of basic information on them such as:

- the borrower’s country

- the total amount of the loan (often below 1’000 EUR, since it’s consumer lending)

- the available amount still to be invested

- the loan term (which is the duration until maturity/payment of the loan interests)

- the interest rate per year

Investment result forecast

Below you will find the resulting forecast when investing using Lendermarket compared to investing the same amount in the US stock market (US stock market: 6% average yearly growth in the last 30 years).

By investing €1’000 using Lendermarket for 15 years you might end up with €7’137.

Lendermarket bonus and cashback

| Register on Lendermarket by clicking the button below to benefit from the Lendermarket bonus as a cashback payment. BONUS = 1% of your invested amount |

Lendermarket competitors

View the list of all the platforms